One of the proposed modifications has to do with the tax scheme for metal plates to avoid sudden jumps between similar valuations.

He Government of the City of Buenos Aires presented the project of Budget 2025which includes changes in the calculation of the ABLan increase in security items and an operating surplus of $10 billion. Within this framework, $62 of every $100 pesos will be allocated to Education, Health and Promotion and Social Action.

The content you want to access is exclusive to subscribers.

One of the proposed changes has to do with the patent tax scheme to avoid sudden jumps between similar valuations.

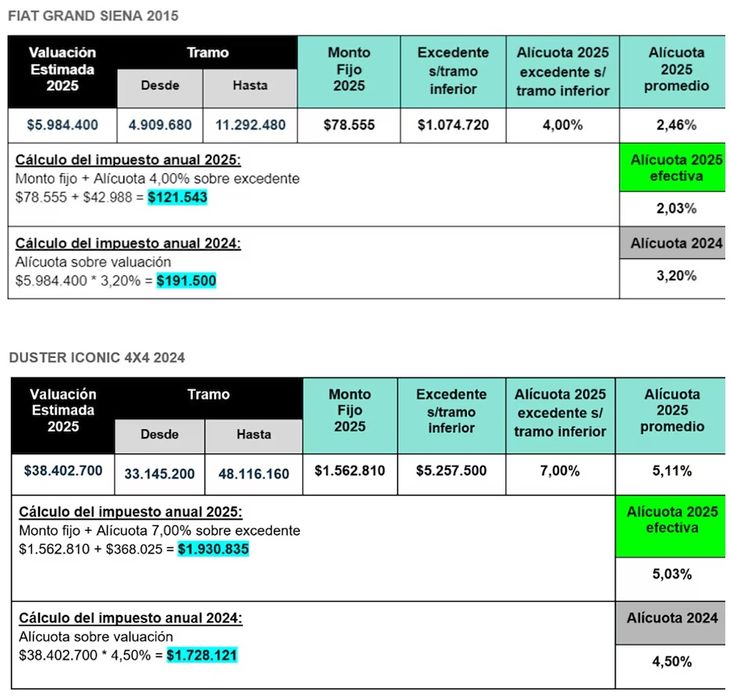

In that sense, the new structure seeks to create a more equitable system by readjusting scales and aliquots, establishing a minimum amount in each scale and an aliquot for the surplus. For example, a Fiat Siena 2015with a valuation of $5,984,400, would see its rate reduced from 3.20% to 2.03%resulting in an annual tax of $121,543.

fiat.jpg

A 2015 Fiat Siena, with a valuation of $5,984,400, would see its rate reduced from 3.20% to 2.03%, resulting in an annual tax of $121,543.

CABA 2025 Budget: changes in patents, with the end of exemptions for electrified vehicles

In contrast, a 4×4 Duster Iconic with a valuation of $38,402,700 would have an increase in the rate from 4.50% to 5.03%, reaching a tax of $1,930,835.

In total, 60% of the vehicles (560,313) would see a reduction in their rate, 15% would maintain the same, and 25% (266,867 vehicles) would experience an increase, according to the information specified by Infobae.

cars-patents.jpg

Number of private cars, according to the new survey.

Patents: tax equity

In search of greater tax equitythe review of particular situations is promoted, so by 2025 it is proposed:

- Hybrid and electric cars: Until today they were exempt from paying the tax. Starting in 2025, this exemption will be eliminated. Only new registrations will maintain the benefit and only during the first fiscal year.

- Buses with low floor: Until today they were exempt from paying the tax. This benefit had been implemented to encourage the installation of these units. Since the adaptation process has already been completed, it is proposed to eliminate the exemption. The rate will be the corresponding one according to the table: 1.15%.

- Pick ups: Until today they paid taxes at a reduced rate. Starting in 2025, it is proposed that they pay taxes as indicated in the valuation payment scheme.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.