Luis Caputo is betting that the dollars that entered the laundering process will be recycled via dollar credit to the private sector, to inflate the supply of foreign currency in the official market and give oxygen to the Central Bank in the most challenging months of the last stretch of the year.. Some of that is already corroborated. Since mid-Augustwhen the regularization of assets and the rally in foreign currency deposits were activated, this type of bank loans to companies expanded by almost US$1 billion. This allowed the BCRA to end September and begin October with a purchasing balance, despite seasonal pressures and the new import payment scheme.

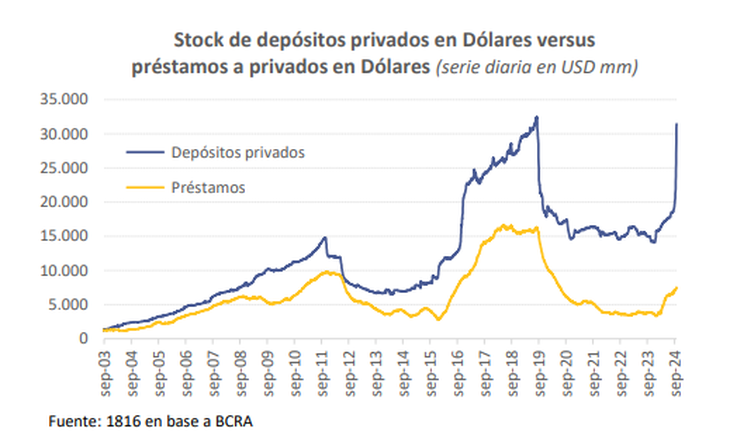

The ceiling of the increase in financing in foreign currency to companies is given by the strong growth in dollar depositswhich since the beginning of laundering has accumulated US$12,839 million. As the banks progressively send those foreign currencies deposited to the BCRA as reserve requirements, the regularized money will shore up the Central Bank’s gross reserves.

But the main obsession of economic agents is the net reserves, today negative by more than US$5,000 million. In this account, laundered dollars do not have a direct impact, except for the portion that is paid as a fine (although the regularization regime offers ample possibilities to avoid the penalty).

image.png

So, as he told Scope, In the city, speculation had begun with possible indirect ways to recycle those currencies. and that help contain the bleeding of net reserves: the impulse of the credit in dollars to companies and/or the possibility that the Government decided to go out issue short-term debt, such as Letes in dollarswhich were placed by Caputo during the Macri administration, contributed to the outbreak of the crisis in 2018 and then ended up being reprofiled by Hernán Lacunza in the same mandate.

Was the Minister of Economy himself who He came out to rule out that second possibility through his social network account We don’t want to do it, because We want those dollars to go to finance the private sectorso that the capital market develops and there is more investment and generation of quality employment.” And he gave as an example Pampa Energía’s placement of a four-year negotiable obligation for US$84 million at a rate of 5.75%.

Credit in dollars and inflated offer

Beyond Caputo’s argument and financing in the capital markets, the truth is that The economic team embraces bank credit to companies in foreign currency as a way to inflate the supply of currency in the official exchange market and give oxygen to the BCRA in challenging months.

This type of loans, by regulation, must be settled by the companies that take them on the official market and add supply to that market.. For the BCRA it represents a relief in the short term since these are months of lower seasonal agricultural settlement, which is combined with the extra demand derived from the overlap of the old import payment scheme in four installments with the new two-installment scheme. Although It is considered that this is an “inflated offer” since, when these credits expire, the companies will ask the Central Bank for the dollars. “When the flow reverses, it hits the reserves”an operator told Ámbito.

Loans, reserves and the performance of the BCRA

However, since mid-August, the credit in dollars to the private sector grew by almost US$1,000 million. Central data shows that As of September 27, it had accumulated an expansion of US$947 million and, apparently, continued to rise during the following rounds. The consulting firm 1816 linked this data with the BCRA purchasing balance in the official market during the last wheels.

According to calculations by Gustavo Quintana, from PR Corredores de Cambio, in September it accumulated purchases for US$373 million. Furthermore, in the first three rounds of November it totaled US$338 million, “a much better result than expected given the seasonality and, above all, the overlap of the old and new import payment scheme,” highlighted 1816.

For the consulting firm, “it is possible that energy exports have played a role, but at least in recent weeks local loans in dollars also seem to have played a relevant role.” And he stated that corporate actors take this type of financing at a lower cost than credit in pesos as a result of the current exchange rate devaluation table of 2% monthly.

image.png

That’s why Caputo promotes this strategy to go through October and November, the most complicated months for the flow of currency. If this process continues, analysts believe that the loss of net reserves expected for the last quarter could be offset (at least partially). The report of 1816 maintained that, given the strong growth of deposits in dollars, It would not be strange if the stock of loans in that currency “grows significantly” in the coming months and he asked himself: “US$5,000 million?” We will have to see how much of that materializes.

Dollar and the risks for 2025

Beyond the short-term bridge, the outlook for next year looks complicated. “Even so, “The dynamics of the external sector continues to be the central risk when we think about a 2025 exchange rate status quo”said the consultant. Without going any further, the Government has just failed to meet the net reserves goal for the third quarter with the IMF by more than US$2,000 million and already in January the large maturities of external debt begin. That is why Caputo seeks to accelerate Repo-type loans with international banks, for which official sources admit that “there is still a lack.”

In fact, both the consulting firm CP and Marina Dal Poggetto (Eco Go director) They agreed that the Government lacks US$20,000 million to sustain the current exchange rate scheme during the next year.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.