This Friday, the Central Bank of the Argentine Republic (BCRA) released the report from the Survey of Market Expectations (REM) carried out in September, where results linked to the inflation and the dollar value. In the first eight months of 2024, the accumulated price increase was 94.8%.

The REM collected the forecasts of 28 local and international consulting firms and research centers and 14 financial entities in Argentina on the main variables of the economy. The survey published this Friday was carried out between September 26 and 30. Over there, Respondents anticipated a continuation of the crawling peg of the official dollar until the end of the year and ratified their GDP fall projections for 2024.

What does the REM predict for inflation?

REM participants predicted monthly inflation of 3.5% for September. This is the same level that they had projected for that month in the last survey. However, it becomes relevant since for August they had forecast a CPI of 3.9% but finally the data published by INDEC surprised upwards by marking 4.2%.

If materializedthis would imply that in the ninth month of the year the 4% floor would have been breached for the first time during the current mandate. Furthermore, it would mean that (after the retrocession of the PAIS tax rate) inflation would have resumed the deceleration process after four months of stagnation.

In any case, the bad data in August had consequences on the city’s expectations. Respondents recalculated their forecast upwards for the annual accumulated: now they expect it to close at 123.6% year-on-year, that is, 0.8 percentage points more than in the previous survey.

For the following months, The forecasts remain far from the path promoted by the Government, which seeks to converge as quickly as possible to the 2% monthly devaluation. The REM predicts that inflation will be 3.4% in October, that it will drop to 3.3% in November, that it will rebound to 3.6% in December and that it will mark 3.4%, 3.3% and 3% in January, February and March, respectively.

REM inflation

This would imply that the CPI oscillates above a floor of 3% for the next six months, which would account for a continuity of inflationary inertia beyond the official adjustment plan. For the next twelve months, the average of those consulted projects a cumulative 41%.

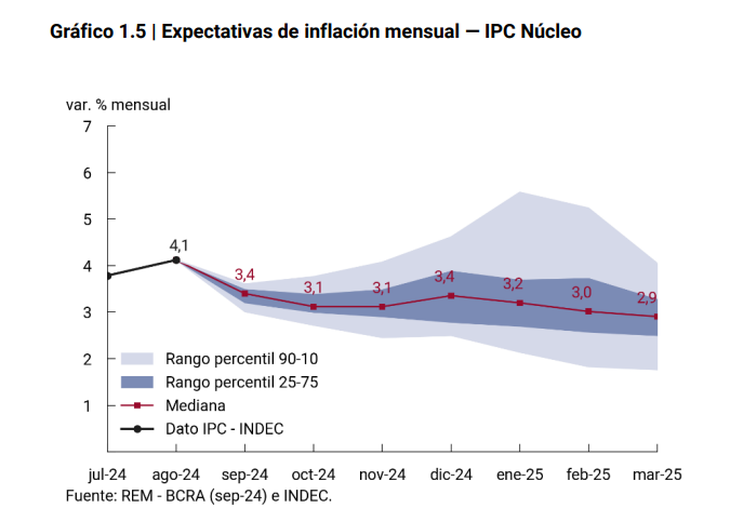

Regarding the core inflation (which excludes seasonal and regulated prices), the REM anticipates 3.4% for September, 3.1% for October and November, 3.4% for December, 3.2% for January, 3% for February and 2 .9% for March.

REM inflation

Market estimates on the dollar

The consulting firms and financial entities that participated in it reduced their devaluation expectations and put a price on the dollar, both for the end of the year and for the next 12 months. The data is known in the midst of an exchange rate calm that has the blue dollar in a tailspin.

According to the median of the estimates, the average December dollar would be in the $1,021.50almost $4 below what was expected in the previous REM. This would imply an increase in 6.2% with respect to the average value of the official exchange rate in September, which was $961.81, a variation that is in line with the monetary authority’s current “crawling peg” strategy.

Likewise, the city’s analysts cut their projections for the price of the wholesale dollar by $51 a year from now, which would be $1,279.20. So, The market expects that the real exchange rate will continue to appreciate since, while an exchange rate jump of 33% is foreseen, the expected inflation is 40.9%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.