I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.

Menu

Mixed day for Argentine assets: bonds stop rally and country risk exceeds 1,100, but stocks rise

Categories

Most Read

Euro today and Euro blue today: how much they closed at this Tuesday, October 21

October 21, 2025

No Comments

Dollar today: how much it closed at this Tuesday, October 21

October 21, 2025

No Comments

Wall Street closed unevenly, but the Dow Jones reached a new record in a context marked by the shutdown

October 21, 2025

No Comments

Paradigm shift: BlackRock brings Bitcoin closer to large Wall Street investors

October 21, 2025

No Comments

The blue dollar overheated and broke a new record five days after October 26

October 21, 2025

No Comments

Latest Posts

Automotive supplier: Rescue plan for Webasto in the clear

October 22, 2025

No Comments

Auto supplier Rescue plan for Webasto in the clear Copy the current link Add to watchlist The supplier, known for its car roofs and parking

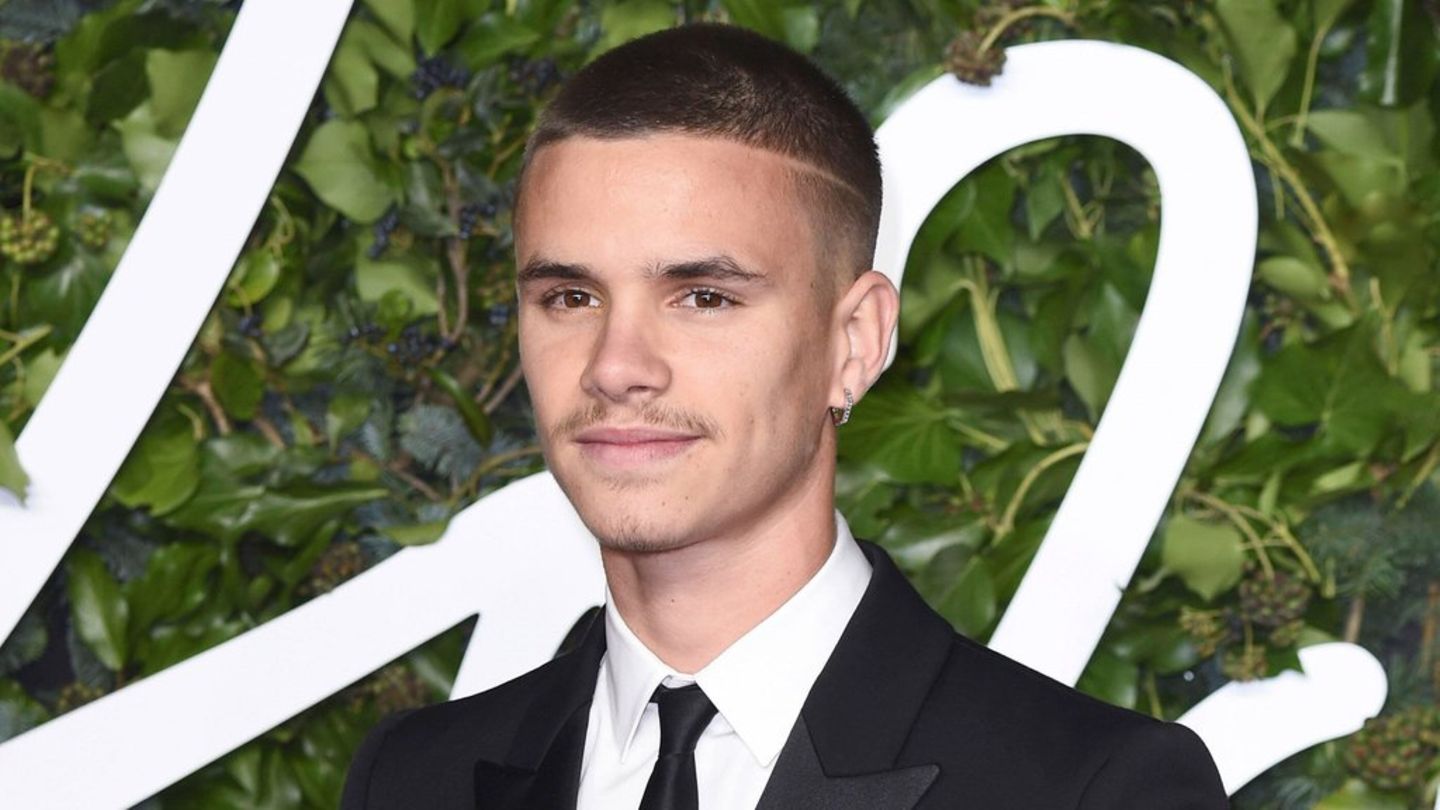

Romeo Beckham: Is he back together with Kim Turnbull?

October 22, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

War against Ukraine: Parts of Ukraine without power after Russian airstrike

October 22, 2025

No Comments

IvanI have been working in the news industry for over 6 years, first as a reporter and now as an editor. I have covered politics

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.