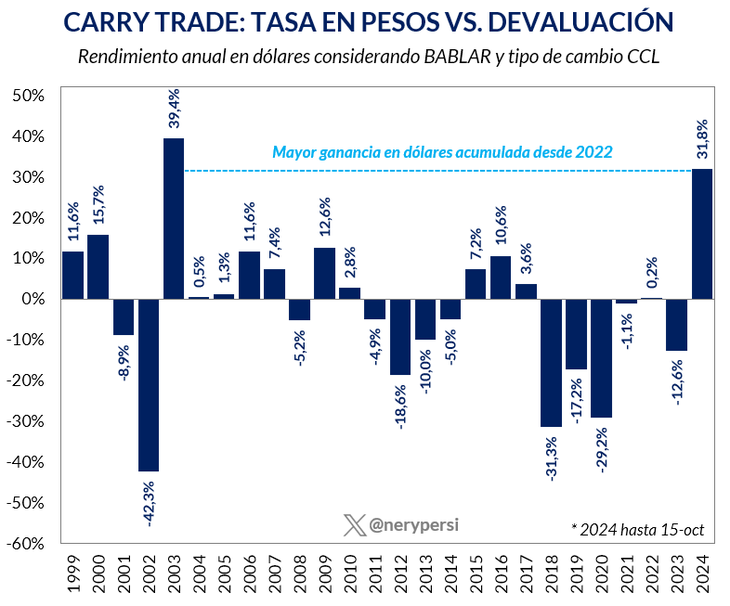

The combination between the rate in pesos, the exchange rate table and the compression of the gap left juicy financial gains. Only in October does it exceed 6%.

The strategy of the Minister of Economy, Luis Caputo, to encourage bets on the “carry trade” provides them juicy profits to those who got on the cycle of the peso rate with the ironed dollar. So much so that the return in dollars obtained by those who entered at the beginning of the year is already close to 32% and It is the highest since 2003.

The content you want to access is exclusive to subscribers.

According to economist calculations Nery Persichini, The annual return on bets on the “carry trade” accumulated until October 15 reached 31.8% if the BADLAR rate is considered (which remunerates deposits of more than $1 million with a term of 30 to 35 days) and the evolution of the dollar counted with settlement (CCL).

The “carry trade” and the Caputo plan

Why does this phenomenon occur? Basically for the incentives generated by the Caputo plan. It is the cocktail between a rate of interest in pesos that gradually stopped being negative in real terms (compared to inflation) and that, as a rule, was above the exchange table (the crawling peg of 2% per month), and a intervened financial dollar due to the additional supply provided by the blend dollar (20% of exports are settled in the CCL).

That is to say, the official and financial exchange rate controlled by the stocks and intervention provides a considerable return to whoever enters the cycle of the rate in pesos. The carry trade consists of sell the dollars, place yourself in some instrument in pesos (fixed term, public securities, mutual funds, etc.) and, finally, switch back to dollars before its price jumps.

“Carry trade” and extraordinary profits

He extraordinary return in dollars was particularly strong in recent monthswithin the framework of the exchange rate peace achieved after the mid-year turbulence. In addition to the official intervention via blend dollar and via sale of reserves, the window opened by the special Personal Assets regime and the tax moratorium also helped to reduce the exchange gap, which contributed to additional demand for pesos.

image.png

In fact, only so far in October the “carry” left a hard currency profit over 6%Persichini estimated. “The streak of recent months is a statistical rarity (it moves away from the average values),” said the economist on his account on the social network X.

When compared to what has happened in recent decades, The 31.8% return in dollars accumulated so far this year is only surpassed by 2003 (39.4%), the year following the exit from convertibility. In the middle, years of much more limited gains are interspersed (12.6% in 2009, the highest), with years of considerable losses (such as 2018, 2019 and 2020, in the midst of the Macrismo crisis, the first two and in the middle of the pandemic the third).

The Government seems embarked on the objective of reinforcing this strategy. But the question looms: with negative net reserves, a dollar that is lagging behind and an election year ahead, how long will it be sustained?

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.