Would you invest in a bond that pays the same as a US government bond but with much more risk? That is exactly what is happening today with many Negotiable Obligations (ONs) Argentina.

To understand the context, it is key to remember that Negotiable Obligations (ONs) are bonds issued by companies to finance themselves. These fixed income instruments allow the investor to know in advance when the maturity will be, what coupon it offers and the payment dates, which gives them attractive predictability, especially for conservative profiles.

Without taking into account the last few months, the returns ranged between 8 and 12%. However, in recent weeks, these corporate bonds have been the center of a “tsunami” of dollars that generated certain distortions in their yields.

The main trigger behind the current demand for Negotiable Obligations was the Asset Regularization Regime (laundering). This allowed those who regularized more than US$100,000 to invest in certain assets without paying the 5% penalty rate. Naturally, this attracted many investors.

Dollar deposits rose violently:

ON1.png

As a consequence of the inflow that went to financial investments, the price of many ONs skyrocketed in recent weeks, which impacted a drop in yields.

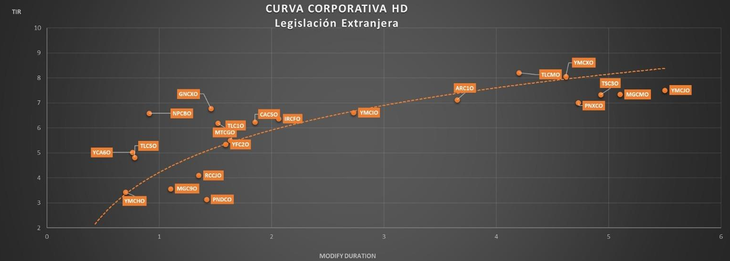

Let’s see how the corporate curve is now, foreign legislation:

ON2.png

The shortest ONs (YPF, Pampa, Telecom, Arcor, Pan American Energy) yield between 3% and 5%. And to obtain more attractive returns (above 7%) you have to go for very long maturities, over 4 years.

Let us also remember that Negotiable Obligations yield very little due to the restrictions imposed by the exchange rate. If market participants had the opportunity to invest in US Treasuries, they would certainly do so, as the yield is not much different and the risk is substantially lower.

So the question that arises is: Why would an investor agree to invest in an Argentine ON that pays the same as a United States Treasury bond, but with much more risk? The answer is simple: it shouldn’t. However, the “compression” of returns caused by money laundering has distorted the market in such a way that current prices do not adequately reflect the risk.

What do companies do in this context?

They take advantage and go out to finance themselves at attractive rates. By issuing negotiable obligations, they access fresh funds, improve their financial structure and extend amortizations.

It is important to understand that this flow of capital is temporary. Once the laundering concludes and money stops entering the system, we will likely see a correction in the prices of these assets.

Is it advisable to invest in ONs TODAY?

Although Notes have been an excellent option in the recent past, today, in many cases, the risk is not justified. It is essential to analyze each issue individually, taking into account the credit quality of the issuing company and comparing the returns with safer alternatives.

For those looking for a medium or long-term investment horizon, the most prudent thing to do is to wait for yields to return to more reasonable levels and the “euphoria” of money laundering to calm down a little more.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.