The economic crises They are points that change the course of history forever. An example of this was the 2008 crisis in the United Stateswhich was considered the worst after the crash of 1929.

However, there was an exceptional case that was able to float in those turbulent waters. It is about Stephen Digglea businessman who, unlike many experts, found a way to make money in one of the most complicated moments in the history of the North American country.

How Stephen Diggle made $2.7 billion in the 2008 crisis

It was all a big gamble. Diggle came to win the incredible figure of 2.7 billion dollars for investors hedge fundafter risking it for the volatility between 2002 and 2009. He had launched Atradis Fund Management with $4 million in 2002.

stephen diggle.gif

In this context, the American real estate bubble burst, the markets collapsed and a global financial crisis occurred, so Atradis decided to close its doors and return all the money of its investors in 2010.

What was the 2008 financial crisis like?

The US government opted for a series of economic measuresamong which the deregulation of markets, the expansion of credit and the reduction of taxes and interests stood out.

On the other hand, disproportionate mortgages prevailed compared to the clients’ ability to pay. However, Home prices within the real estate market rosemillions of people had to stop paying their mortgages and banks lost confidence and gained liquidity problems.

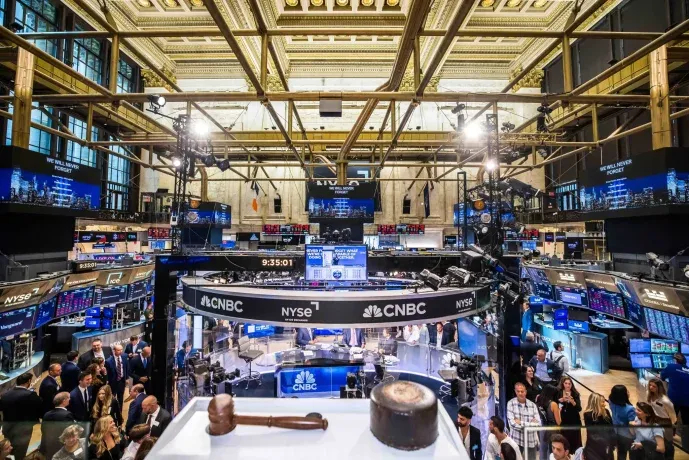

wall street markets NYSE.jpg

NYSE

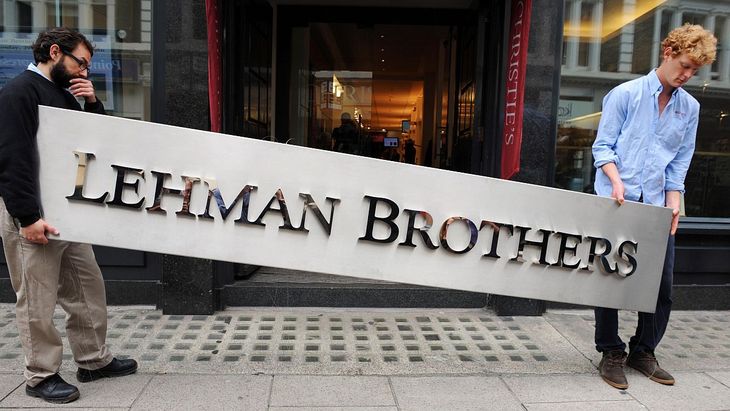

The crisis reached its peak on September 15, 2008when the bank Lehman Brothers officially declared bankruptcy. At times of speculation and collapse of the financial system, stock market indices plummeted, The bank left a debt of 691,000 million dollars and 25,000 employees on the street. This crisis was considered the worst since the Great Depression in 1929.

lehman-brothers.jpg

The solution became interest rate drops and a public debt purchase program to alleviate the costs that the population had to pay, as well as transmit confidence to the financial system. Due to the injection of liquidity to revive the economy, global public debt grew noticeablyand the market managed to stabilize in 2010, although it had repercussions until 2015.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.