Ferro indicates that This phenomenon is largely due to international flows, since the US remains the preferred investment market globally.. This means that, “regardless of the Fed’s decisions and with the increase in rates, the US absorbs savings from the entire planet.” Thus, the American economy did not experience the brake that was expected, except in some specific sectors.

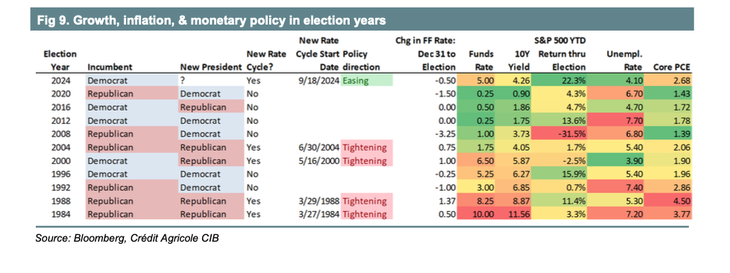

For its part, Nahuel GuevaraResearch analyst at Inviu, analyzes that the US enters the elections with very solid economic activity. The Gross Domestic Product (GDP) remains at a growth of 2.8%. Regarding inflation, despite the difficulties in reducing it linearly to the 2% objective established by the Federal Reserve, the news is generally positive.

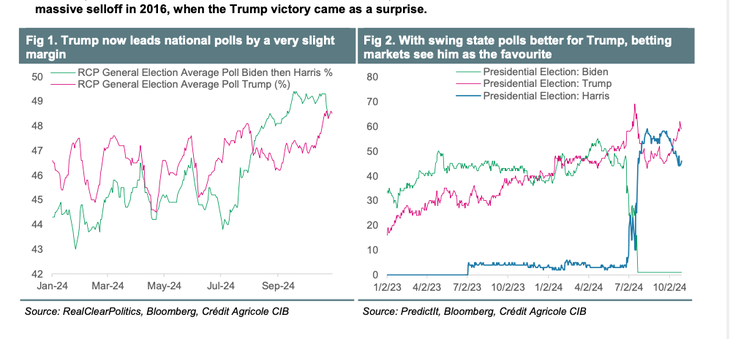

The analyst assures that until this Monday the market adjusted its prices in anticipation of a probable Trump victory, even with Congress in his favor. “This expectation drives the increase in so-called “Trump Trades”, which include assets like Bitcoin and Donald Trump’s social network“. From Inviu’s perspective, “one of the main factors to follow in the future will be the high fiscal deficit facing the US economy.”

Well, it happens that none of the candidates in the elections contemplated measures to improve this situation; in fact, In the case of Trump, “a deepening of the deficit is expected, Strictly speaking, with interest rates growing rapidly due to an interest rate that, despite the aforementioned cut, remains at historically high levels,” says Guevara.

Elections under the market’s magnifying glass

Ferro explains about the elections that one of the few certainties that are handled is that, if Trump wins, it is likely that tariffs will increase. “This could generate tensions in certain sectors, especially in Europe and in countries with high trade surpluses with the US, such as China, Japan, and even Mexico”, he indicates.

A determining factor that Ferro mentions, is the composition of Congress: “Not only does it matter who wins the presidency, but also how divided the parliament is, since that can directly influence the ease of passing significant policies,” he indicates.

In this regard, the latest pre-election report of Crédit Agricole Corporate & Investment Bankthe corporate banking and investment arm of the French group Credit Agricoleposes four scenarios that the election would yield and, in advance, indicates that, “outside of the presidential race, the map of the Senate in this cycle It is very favorable for Republicanswhile the House of Representatives looks very tight and we believe it could lean in the same direction as the presidential race.”

Electoral Scenarios

The four electoral outcome scenarios anticipated by the report are the following:

- a victory for Trump, with a Republican sweep in Congress.

- a victory for Harris, with a Democratic sweep in Congress.

- a victory for Harris, with divided government (Republicans control at least one chamber of Congress).

- a Trump victory, with divided government (Democrats control at least one chamber of Congress).

Republican sweep scenario

The document maintains that it considers the scenario of the Republican sweep as “the most probable, with 40%” of chances, although it does not reach 50%. Unlike a “red wave“Traditionally, the margins in the Senate and House would be close.

In this way, with the control of Congress, Trump would push his agendaespecially in tax cuts, which would include the extension of the Tax Cuts and Jobs Act (TCJA) and possible additional reductions in the corporate rate. “Fiscal discipline would not be a priority and an increase in deficits would be expected with a more generous policy,” warns the bank.

Regarding economic policy, he maintains that Trump could implement new deregulations and stricter immigration measureswhich would include the deportation of undocumented immigrants. Tariffs would be a key tool, “with proposals for general 10% levies on all imports and 60% over those of Chinaalthough its legal scope is uncertain,” he indicates.

Regarding the economic impact, he maintains that Tax cuts and deregulation could benefit US growth“but tariffs and tougher immigration policies would limit it.” He also states that higher tariffs and an expansive fiscal policy “inflationary pressures would increase.”

Elections 1.png

There is much speculation about Trump’s relationship with Jerome Powellpresident of the Federal Reserve (Fed) and the Crédit Agricole Corporate predicts that the US central bank will be forced to apply more restrictive policies due to inflationary pressures. Ferro expresses himself along the same lines, pointing out, in statements to this medium, that the Republican candidate could exert greater pressure on the monetary regulator to adopt more aggressive policies, although he himself promotes more rigid regulation.

“In economic terms, Trump’s management could be marginally favorable, but, ultimately, the effect will depend, to a large extent, on the composition of Congress,” he adds.

Regarding the impact of a Republican sweep in the financial market, the French bank projects an increase in Treasury bond yields, especially 10-year ones, although higher inflation expectations are expected to impact those profit rates.

Harris, with complete Democratic control

According to the bank, given the unfavorable Senate map for Democrats, as of today, “This is the least likely option of the four scenarios.with a probability of only 10%·. This panorama would be known as the “blue wave” and does not generate much attention due to the challenges that the map of the Upper House represents for that political sector.

The document maintains that, in this scenario, Harris would have a supportive Congresswhich would give him more room to advance his proposals. Some tax cuts would also be considered, although of a different nature than those proposed by Trump.

“It is likely that Harris will only seek to extend a portion of the Tax Cuts and Jobs Act (TCJA), specifically for those earning less than $400,000,” and is also considering expanding the child tax credit, among other proposals.

Elections 2.png

In contrast to Trump, Harris would likely raise other taxes“like corporate tax and capital gains.” He has also introduced various measures ranging from support for affordable housing to support for small businesses and an industrial policy focused on the US.

However, again, deficits would remain high, and single-party control of both houses would likely lead to further growth in the deficit. “We believe this scenario would also result in undisciplined fiscal policy, although not to the same degree as under Republican rule, as tax increases could offset other policies to some extent,” the report warns.

Regarding the inflationary impact, the document indicates that the main pressures on prices present in Trump’s plans are largely absent in Harris’ssince no immigration tariffs or restrictions are included in Democratic policies. The fiscal side, with a more relaxed outlook, could add a small boost to inflationary pressures, although that margin would be almost zero.

Trump with divided government

The bank gives the scenario of Trump winning with divided government a 20% chance, making it the second least likely of the four possibilities. Republicans will almost certainly win control of the Senate, so divided government would likely come from narrow Democratic control of the House of Representatives.

“Divided government means stagnation, to some extent. Again, there is room for compromise on certain measures. However, when it comes to tariffs, Trump has some leeway to implement them without Congress, so unlike the previous divided-government scenario, tariffs will likely increase.

Elections 3.png

On the tariffs front, the Crédit Agricole Corporate assume that Trump could face some legal obstacles more (although that is not clear), while other sources of revenue could be more affected by such tariffs, leading to a slowdown in growth without as much counterbalance by other tax cuts in the Republican sweep scenario.

As a result, the document states that Tariff revenues here are less than in the Republican sweep scenario. The end result is an increase in the deficit of $3.1 trillion from 2026 to 2035, also smaller than in any of the sweep scenarios, but slightly higher than in the previous divided government scenario.

Harris, with divided government

This would be the second most likely scenario of the four outlined by the French bankwith a 30% chance. This would imply a Republican Senate, although it is theoretically possible that Harris could win against Republican control of both chambers of Congress.

It is also highlighted that the Senate is the chamber in charge of confirming the executive and judicial nominations of the president, as well as those of the Fed, so, in addition to impacting the legislative agenda, a Republican Senate could act as “a thorn in the rib of Harris by preventing several nominees from being confirmed smoothly.”

- Policy Highlights: Given the opposing agenda of the two parties, any divided government scenario would likely involve a fair amount of gridlock, with little chance of any major fiscal package. This would be more similar to the current status quo, given that Biden faces a Republican-controlled House.

- The scenario may have a limited impact on growth. Extending the TCJA could provide a modest boost, although that would largely be extending the status quo rather than allowing taxes to increase if parts of the TCJA were to expire.

- Impact on inflation: Again, the lack of major legislative packages given the likelihood of congressional gridlock means a limited impact on the inflation outlook in this scenario, and therefore a limited impact on the Fed’s path.

- Impact on the market: We expect the Treasury curve to flatten in a rally, with 10-year yields lower by 10 to 15 basis points. Inflation expectations would tighten, squeezing the EIB. Treasury securities would outperform swaps modestly, widening spreads.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.