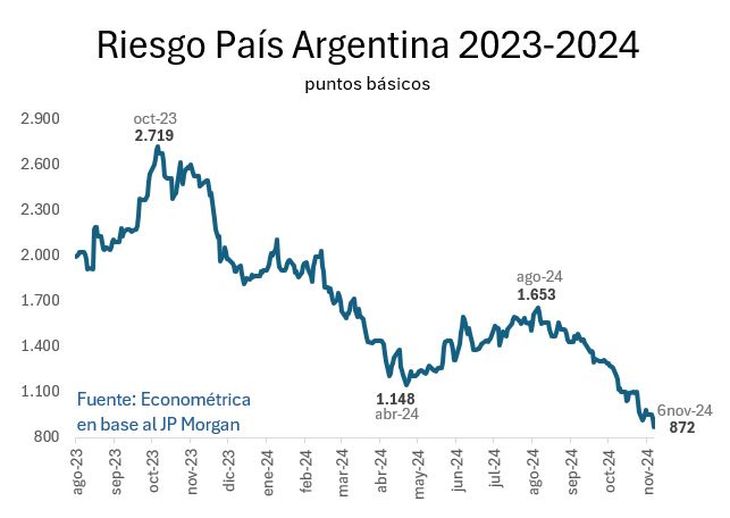

The country risk measured by JPMorgan reached 872 points, a level that had not been seen since August 2019, prior to the PASO that decreed the defeat of Mauricio Macri.

The country risk once again breaks a new symbolic value.

Depositphotos

He country risk from Argentina prepared by JPMorgan collapses this Wednesday below the line of the 900 basis points, the best in more than five years, after Donald Trump’s victory in the United States presidential elections. The country risk measured by the US bank falls 6.5% to 872 basis points.

The content you want to access is exclusive to subscribers.

The figure of 872 points It had not been seen since August 2019, prior to the PASO that decreed the defeat of Mauricio Macri. Along these lines, sovereign bonds in dollars They climb to 2.2% led by AL35, followed by AL29 (1.9%) and AL38 (1.7%).

“The phenomenal drop in country risk today is explained by two factors: the rise in American rates (lower prices of their bonds) and the fall in our rates (due to the rise in the price of our bonds),” explained Franco Tealdi, financial advisor at X.

WhatsApp Image 2024-11-06 at 11.30.32 AM.jpeg

Sergio Gonzalez, Head of Asset Management at Cohen Aliados Financieros, For its part, it focuses on the fact that Trump’s victory brings optimism because the market considers that his victory can bring benefits for the country, in terms of negotiations with the International Monetary Fund (IMF) and trade negotiations.

“LThe rise is surprising, but is possibly due to technical market positions. Perhaps there could be some rise in stocks accompanying what is happening in the US, but not in bonds. Although Milei’s closeness to Trump is very important, it is not going to produce something immediate that can solve the macroeconomic problems,” explained Sebastián Azumendi, Sr Trader at Adcap Grupo Financiero.

For his part, analyst Christian Buteler emphasized that the new president means for the market “more chances that Argentina can get some type of financingwhether from the IMF or some other multilateral organization and in this way the bonds become more payable. But it is an immediate reaction, we have to see how it continues to evolve.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.