The S&P 500 Last Friday it broke the 6,000 point mark for the first time in history. The Dow Jones also crossed 44,000 points, while the Nasdaq Composite rose almost 6%, setting up the best week for stocks of 2024 in Wall Street. In the local square, the S&P Merval cut the upward trend due to profit taking, but the optimistic projection remains, while dollar bonds maintain good performance, so the question that arises is: with the markets at maximums, what strategy should be followed?

Everything indicates that the S&P 500 record mark is a key psychological milestone that may increase investor interest in stocks, since there is still a lot of money in money market funds and Treasury bonds. The broad market index needed just 189 trading days since it first closed above 5,000 points on February 9 to break another record of 1,000 in November.

And, with the markets at maximums, valuations are usually higher and are sometimes driven by optimistic expectationswhich increases vulnerability to setbacks if the results do not meet these projections, so take profits At this time it is a way to mitigate risks in investment portfolios.

“Cash is king” and the strategy recommended by experts

According to a senior market source, “Cash is king” is an expression used to describe the importance of cash flow in the success or failure of a business or investment strategy. And, on many occasions, “Doing nothing may be the best strategy.”, that is, maintaining healthy liquidity is also an option in the face of market volatility.

As well explained Fernando Staropolianalyst at Rava Stock Exchange, in dialogue with Scope, With the rise experienced by the markets, both abroad and locally, many investors are beginning to take profits or are contemplating doing so. In fact, remember that Friday’s trading in the local market went into negative territory, while, in New York, the indices remained in green despite a slight cut in technological assets.

S&P 500.png

And with markets at highs, valuations tend to be higher and are sometimes driven by optimistic expectations.

And since the dollar continues without major variations, “in this context, remaining with liquidity placed at the peso rate (short-term) is a valid alternative while waiting for opportunities,” says Staropoli. It also suggests that other investors who prefer to keep its holding with purchased assetsthey choose to rotate towards instruments with lower volatility and take advantage of those that remained with attractive prices after the ups and downs of the US elections. In that sense, “some technological and mass consumption assets are entering”.

The Argentine bull market

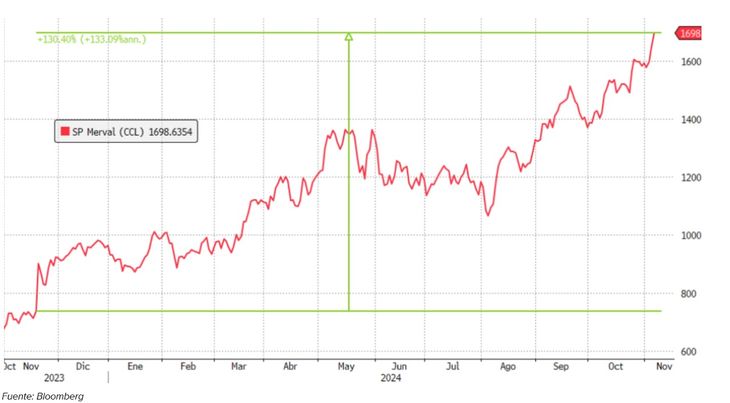

But as explained before, the “bullrun” is not only in the New York square, because as well analyzed Juan Bialetpersonal finance manager, SBS Group in Argentina, Bonds have risen 75% in dollars this yearenergy stocks have doubled and banking stocks have tripled. “Nobody went bankrupt to make profits, the saying goes” he slides.

The analyst highlights that, although the prospects are encouraging, the margins for increases are beginning to become more limited. Prices are no longer given and “it depends on the greed of each investor whether to leave or continue surfing the wave of the Argentine bull market.”

For Bialet, “Unlike bonds, stocks have no ceiling”. Remember that the potential in Vaca Muerta with the energy trade surplus is US$30 billion for 2026 and 2027. “But our history forces us to be cautious. For those who want to start collecting the kite, negotiable obligations (ONs) are a good refuge to make fixed income in dollars with limited risk”recommends.

The impact of Donald Trump’s victory on national equity

Ignacio Sniechowskihead of Equity of the IEB Group, In dialogue with this medium, he slips that the upward trend of the S&P Merval remained firm, “but the triumph of Donald Trump – which gave a strong boost to all financial assets – had a very positive impact on the local equity market“.

“In our strategic vision, the upward potential of the Argentine stock market depends on three key variables,” says the strategist. Although simplified, this approach offers a combination effective clarity and precision to assess the possible extension of the current positive trend.

Merval in CCL.jpeg

It is suggested to remain liquid, since, in times of volatility, doing nothing may be the best strategy.

“We consider that there are solid fundamentals so that the S&P Merval can reach the maximums recorded during the Macri administration (2,200 measured at the CCL and adjusted for inflation in the US). The three key variables to monitor, according to Sniechowski, show a favorable evolution, particularly after the elections in the US. And they are the following:

- Sovereign debt and country risk: Argentine bonds have experienced a significant compression and the country risk was reduced to levels below 900 points, which improves the perception of stability and attractiveness of local assets.

- International context: Donald Trump’s victory strongly boosted equity markets in the US, an effect that spread to other markets, including Argentina, which creates a more favorable global environment.

- “Delivery” factor: For the analyst, this factor is the most difficult to measure and is key to consolidating market expectations. Recent advances in the accumulation of reserves, decrease in inflation, reduction of country risk, rebound in economic activity and improvement in the presidential image suggest a positive environment that will support the upward trend.

Thus, a key week for the markets begins, with data from the North American and national economy that will influence the market trend: in the north, a new report on inflation and retail sales will lead the economic calendar. In the domestic sphere, on Tuesday, the National Institute of Censuses and Statistics (Indec) will report the Consumer Price Index (CPI) corresponding to October. Private analysts agree that the figure would be below 3%.

In that context, the key for investors will be to balance liquidity and exposure in their portfolios, by knowing how to take advantage of the opportunities offered by the market, but also with the aim of protecting themselves against possible corrections in a context of historical highs.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.