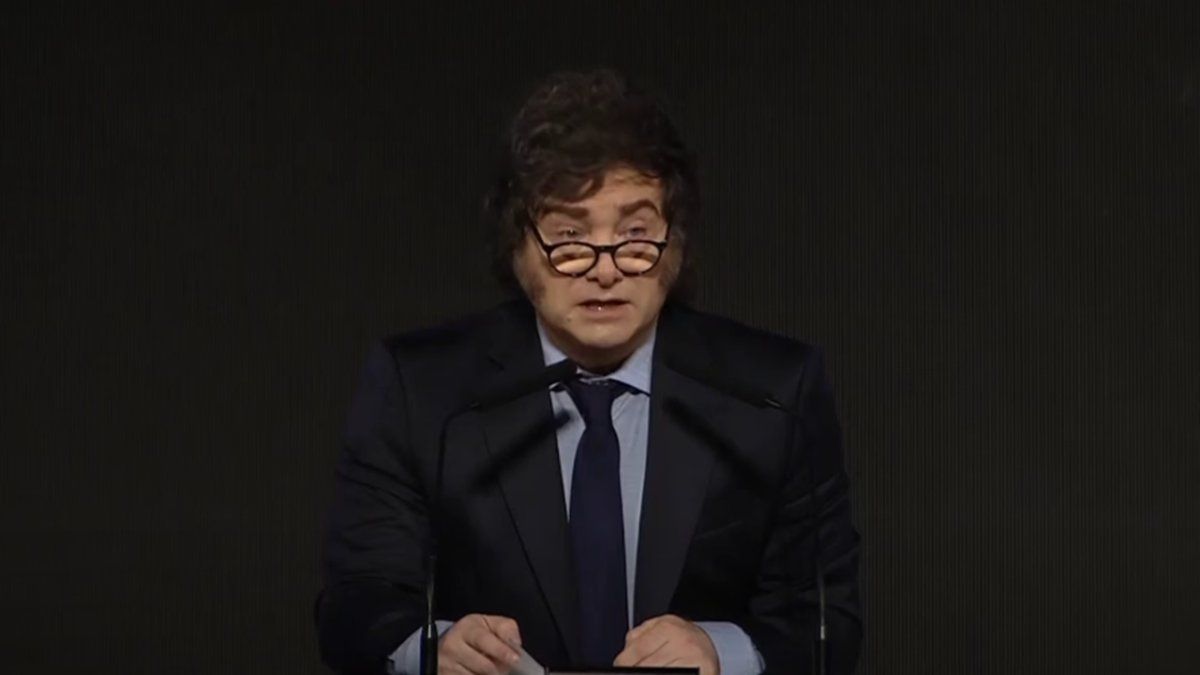

Javier Milei He once again demonstrated against the CBDC (Central Bank Digital Currencies) during a social network event. In a speech focused on highlighting technological progress, the President spoke of the “historical monopoly that is breaking down” in relation to the currency.

“Another historical monopoly that is breaking technology is the currency monopoly. Because the individuals of the world are tired of the domination of taxes by the bureaucrats on duty and are beginning to use means of exchange that are autonomous from the central power, but still reliable, such as cryptocurrencies,” expressed Milei.

“Don’t let the States take charge. Let them stay in the private sector. They have already appropriated the paper money and “They are scamming us with the biggest scam in the history of humanity, which is the central banks,” he stated harshly on Meta Day.

cbdc.jpg

What is a CBDC and why does Milei reject them?

It is worth remembering that during the administration of the minister of economy, Sergio Massa, The possibility of having a digital currency was considered. However, with the arrival of Javier Milei to power, he rejected this proposal.

According to the current president, the plan for a CBDC is lantithesis of the government planwhich is trying to restructure its economy with a possible closure of the Argentine Central Bank (BCRA). Likewise, Milei pointed out that savers prefer to invest their capital in decentralized cryptocurrencies or stablecoins.

What are CBDCs and why are they a hot topic in the cryptocurrency world?

A central bank digital currency (CBDC) is a digital form of money issued by a central bank. Its value is linked to the official currency of the issuing country and legally supported by its regulators. This distinguishes them from other types of cryptocurrencies, like floats or stablecoinswhich are decentralized or maintained by the private sector.

Main characteristics and types of CBDC

- Currency type: CBDCs can be of two types:

- General Purpose Central Bank Digital Currency: This type of CBDC is designed to be used by the general public, as an alternative to cash or bank deposits.

- Wholesale central bank digital currency: This type of CBDC is designed to be used by banks and other financial institutions, as a means of payment or settlement.

- Technology: CBDCs can be issued using a variety of technologies, such as blockchain, existing payments infrastructure, or an entirely new system.

- Access: Access to CBDCs can be limited or universal.

- Restriction: The use of CBDCs may be restricted to certain purposes or activities.

What countries have CBDC?

Brazil is one of the countries that has democratized its financial system, including Drex as a digital version of the real. Other countries, such as China, Russia, the European Union and the Bahamas, are already in advanced stages of implementation.

On the other hand, the International Monetary Fund (IMF) carried out a report to stimulate the creation of digital currencies. As they determined, more than 100 countries are considering adopting the technology, which reveals the strength of this trend on the digital world stage.

“Although several nations have begun to explore or implement these currencies, the challenges in terms of acceptance, trust and effective use are still significant,” the organization noted.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.