The jump in stock deposits in foreign currency derived from bleach of capital, added to the bets on “carry trade”led to a strong growth of bank credit in dollars to the private sector. To the point that, according to data from the Central Bank, By September this type of loans had practically doubled compared to the level they had a year ago. This process was one of the keys that drove the current currency buying streak of the BCRA.

The data comes from Report on Banks of September, which was published this Wednesday by the monetary authority. The document highlights that, in the ninth month of 2024, when the asset regularization process was already registering a strong influx, the real balance of credit in dollars to companies increased 8.5% compared to August.

Compared to September 2023, the growth was 93.3%. That is to say, the stock became almost double that of a year ago. In the granting of this type of financing there was “greater relative dynamism of national private banks and foreign entities,” noted the BCRA report. Almost half of the increase registered during September “was driven by documents and pre-financing for exports,” added the Central.

image.png

The impact of money laundering

The truth is that, when the data for October are known, the year-on-year expansion will accelerate. It happens that the Government extended the first stage of the bleach to enhance the flow of foreign exchange. Finally, section I of the Asset Regularization Regime left a balance of US$20,631 milliononly in cash.

In September alone, “the balance of foreign currency deposits in the private sector grew 62.7% compared to August (equivalent to US$12,177 million), driven by the entry of resources into the financial system within the framework of the Asset Regularization Regime,” highlighted the BCRA. This was what gave rise to the increase in dollar loans.

The other factor that stimulated the taking of loans in foreign currency was the incentive for “carry trade” which generates a rate in pesos that travels well above the rate of devaluation. This drives companies that access this type of financing to borrow in dollars (either through financial credit or pre-financing of exports), liquidate the currencies and start making rates in pesos to, finally, dollarize and make juicy profits in hard currency.

In any case, upon settlement in the official market, loans in dollars contribute to expanding the supply of foreign currency. In this way, together with the issuance of negotiable obligations in foreign currency by companies, they were a key element in the BCRA purchasing cyclewhich has acquired more than US$3.3 billion since mid-September.

Credit in pesos: strong recovery

On the other hand, the loans in local currency They continued with their strong recovery process. “In September the balance of financing in pesos to the private sector grew 6.7% real compared to the previous monthwith increases in all credit segments and groups of financial entities,” highlighted the entity that presides Santiago Bausili in his report.

Thus, in five months, he accumulated a 48.6% increase from end-April levelwhich had marked a historical floor for the credit-GDP ratio. “The real balance of credit to the private sector in pesos presented a positive interannual variation of 5.8%, a situation that has not been verified since mid-2022“added the BCRA.

In September, consumer financing lines in pesos increased 9.4% in real terms, followed by commercial loans (5.7% in real terms) and those with real guarantees (3.4% in real terms).

image.png

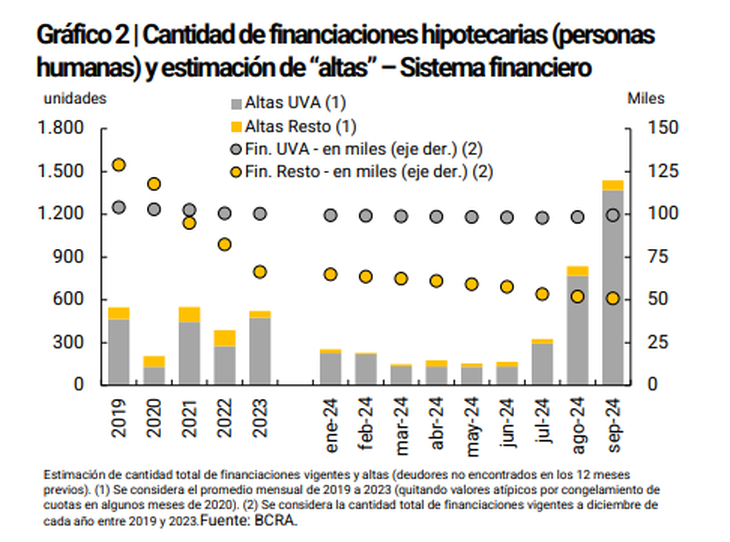

Among the latter, the mortgage loans increased 2.3% in real terms in the month -including capital and adjustment of loans in UVA-. “It is estimated that in September the number of new mortgage debtors (‘registrations’ of human persons) in the financial system amounted to 1,438 (of which 95% were arranged through instruments denominated in UVA),” the Central stated.

“When considering both currencies, in September the real balance of credit to the private sector increased 6.7% between the ends of the month. The balance of credit to companies increased 4.4% in real terms, mainly explained by loans to commerce and primary production. For its part, financing to families grew close to 7% in real terms in September, mainly driven by the performance of consumer lines (personal and cards),” the Report on Banks indicated.

And he concluded: “As a result of the positive dynamics observed in recent months, the real balance of total credit (national and foreign currency) to the private sector accumulated a real year-on-year growth of 12%, reversing the negative year-on-year rates of the last six years. ”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.