image.png

“The official strategy is to finance the current account deficit with capital inflows. The increase in loans in foreign currency to the private sector enabled by the success of money laundering is a reflection of this dynamic, as is the issuance of negotiable obligations in foreign currency,” stated a recent report by the consulting firm PxQby Emmanuel Álvarez Agis. The thing is that these credits are settled in the official market (thus, companies then have access to the wholesale dollar to repay their debts) and give the BCRA margin to buy foreign currency.

The dollars of bleach They provide the ceiling so that this bet can continue and the juicy profits in hard currency that the “carry trade” (with rates in pesos that exceed the rate of devaluation) give the incentive for more players to continue entering. The risk is that the flow will at some point reverseeither because expectations about exchange rate stability change or due to some external or political shock. The Government aims to protect the scheme through external debt: credits from multilateral organizations, such as the IDB and the World Bank, added to the negotiation of a repo with international banks and a new agreement with the IMF.

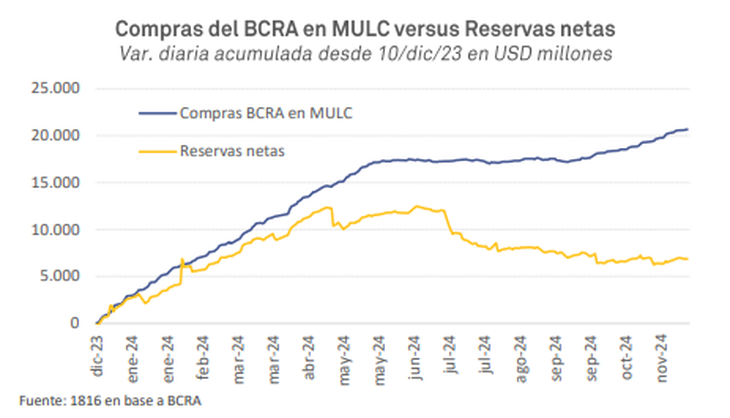

The thing is that, despite the bridge that Luis Caputo and Santiago Bausili achieved with this scheme, BCRA net reserves remain in very negative territory. The consultant 1816 indicated that The purchases of more than US$3,000 million that the Central made in the last two months did not result in an improvement in its net international holdingswho “barely moved.” “The reasons are several: US$820 million were paid to the IMF, US$750 to other international organizations, Bopreal maturities of US$540 million were paid and US$1,056 million corresponding to the payments were transferred to the Bank of New York. interest on Global bonds for January 2025,” he explained.

image.png

Dollar, real, commodities and yellow lights

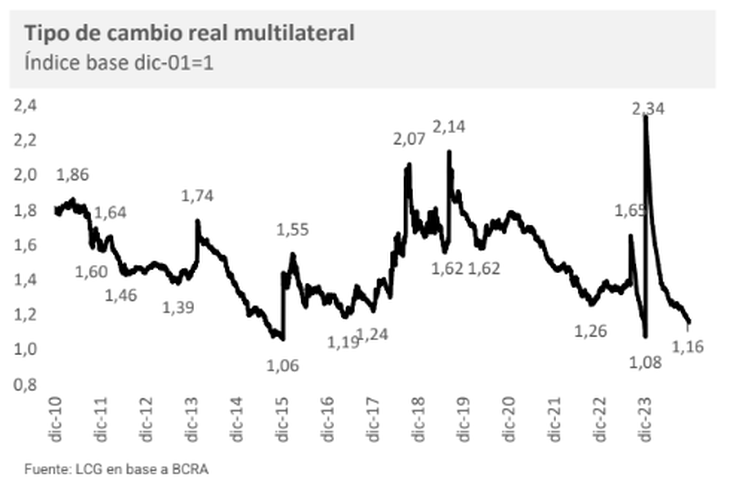

Caputo’s scheme, which in itself tends to accentuate the red of the current account due to exchange rate appreciation, adds pressure factors, which do not escape the eyes of city analysts. Fundamentally, the devaluation of the realthe currency of Argentina’s first trading partner and the main destination for tourists who will go on vacation outside the country in the coming months.

Brazil’s currency depreciated 3.5% in the last week and the dollar exceeded 6 reais for the first time. In two months it devalued more than 10%highlighted the Banco Provincia report. Likewise, the Chilean peso lost 8.8% in the last two months. “Although the region’s good GDP growth numbers have been mitigating the impact of the loss of competitiveness on our exports, the relative increase in the price of the Argentine peso is relevant”the report warned.

“This accentuates the dynamic of the official dollar’s backwardness, which, measured in real terms, is barely 7% above the levels prior to the December devaluation in the multilateral real exchange rate index, but already 2% below if we consider the real bilateral exchange rate with Brazilour main commercial partner,” said the consulting firm LCG.

This feeds back into concerns about the outflow of foreign currency and the impact on the national tourism sector (vacationing on the Argentine Atlantic coast is already more expensive than doing so in Rio de Janeiro) and in the manufacturing industry. Brazil is the main destination for exports of manufacturing products (now more expensive), the import of goods from the other side of the border is becoming cheaper and there are sectors, such as the automotive and auto parts, closely linked to the neighboring country. In addition, the Government adds more and more steps in its import opening plan.

Regarding the expenses of Argentines abroad, the consulting firm Epyca He estimated that they will imply a drain of more than US$3,000 million. This Friday the BCRA provided important information in its October Exchange Balance report: despite the fact that the dollar card is by far the most expensive on the market (today it exceeds the MEP by more than $500), Only 50% of payments for card expenses in dollars are paid with our own currencies of consumers and, therefore, the other half is demanded from the Central. A relevant point in the face of the nominal lowering of the card dollar as a result of the elimination of the COUNTRY Tax at the end of December.

image.png

Bapro drew attention to another problem for the flow of currency to Argentina: the international prices of raw materials. He pointed out that the price of soybean oilwhich represents 40% of shipments abroad of primary products and manufactures of agricultural origin, fell 1.1% in the week and accumulated a loss of 8.1% since the beginning of the month. “Although the rest of the commodities had better performances, “The weighted average of our export prices contracted 0.8% in the last week and fell 6.5% in the month”he warned.

The big question is whether this trend on a global scale will strengthen in 2025. The tariff increases that Donald Trump promises open the door to the possibility of an even greater strengthening of the dollar. If realized, this could increase downward pressures on commodity prices and reduce the inflow of agrodollars to Argentina.

Discussions on next steps loom

Meanwhile, the economic debate begins to move toward next steps. When will the blend dollar disappear? With an exchange rate appreciation like the current one, the expectation is imposed that the Government will loosen the regime that allowed it to intervene indirectly on the exchange gap with 20% of exports, although at the cost of resigning a large sum of foreign currency to the coffers of the BCRA (almost US$4,000 million during the third quarter, according to Banco Provincia).

“Once the blend is eliminated, the Central Bank must decide whether to validate a higher gap -ceteris paribus- or stop outsourcing the intervention, resuming its sales in the parallel market”stated the Bapro report. A higher gap could undock devaluation expectations and discourage participants from entering the “carry trade,” which is one of the pillars of the Caputo plan to sustain the flow of currency.

In addition, The Government advances day by day in measures that deregulate or make imports cheaper of goods to the detriment of local production: for example, in December the expanded quota of US$3,000 for the courier begins to apply (the first US$400, free of tariffs and fees), on the 22nd of this month the COUNTRY Tax, among others.

This could encourage a “importing fervor”he warned LCG. And he argued: “One thing is a welcome trade opening with a balanced dollar, and another is with an exchange rate delay”. “Both an almost paranoid protection and an impulsive and unbridled opening (and with a cheap dollar) do not usually lead us to a successful outcome,” he added.

The other point, of course, is the “timing” of the opening of the trapwhich Caputo indicated would be during 2025, although he clarified that he needs an injection of reserves to be able to face it.

A report of the SBS Group He highlighted that the compression of the exchange gap is an encouraging sign towards that end, although he clarified: “It is no less true that peso stocks are relevant and that, although they are lower than the maximums of 2017, would put pressure on the exchange rate if controls were removedtherefore, although we are in favor of removing the stocks since we consider that this would have more benefits than costs in the medium-long term, given the priority objective of disinflation there would be exchange pressure given these stocks (monetary supply plus titles in pesos of the Treasury).

That sense, LCG He also raised objections: “With reserves still negative, removing all restrictions may still be risky. Today, in this euphoria, they appear to be non-operational restrictions, but they could be in case the mood of liquid asset investors changes. The stocks certainly affect investment decisions; but raising it does not necessarily stimulate those latent investments. They would only do so if this lifting of the stocks is considered permanent, something that is unlikely to happen when dollar stocks are negative and flows are increasingly less positive.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.