Commercial debt accelerated its growth in October. He impact of the “carry trade” incentive on the decisions of importing and exporting companies caused this type of private sector liability to have its largest increase since May.

A report of the CP consulting broke down the exchange balance data published days ago by the Central Bank and pointed out that During October, commercial debt increased by US$862 million “amid the rise of ‘carry trade’ strategies.” This was the biggest increase in five months.

Precisely the bets on getting on the financial bicycle in search of the juicy dollar profitsgenerated by the scheme Javier Milei and Luis Caputocaused both importers and exporters to increase their commercial liabilities.

“Both the debt borrowing from importers (US$182 million), agro-industrial exporters (US$274 million) and other exporters (US$405 million) presented positive balances,” highlighted the report from the consulting firm directed by Pablo Moldovan and Federico Pastrana. .

image.png

Because? The financial cycle consists of getting rid of holdings in foreign currency to place them in an instrument in pesos that provides an interest rate higher than the rate of devaluation set by the Milei and Caputo exchange table, and then dollarizing again to ensure the profit.

Thus, in addition to financial debt with local banks or through the capital market, Companies that participate in foreign trade also modify their behavior to join the “carry”: The scheme encourages exporters to pre-finance and settle early, and importers to delay payment for their purchases abroad.

Both the commercial debt and the flow contributed by bank loans in foreign currency and the issuance of negotiable obligations, leveraged in the currencies that entered into laundering, allowed more than offset the jump in the current account deficit Au$1,581 million in October.

It is that during that month services showed their largest deficit of 2024 (US$744 million) and the red in this account is expected to grow strongly during the summer, given the expected boom in foreign tourism. Although the card dollar is by far the most expensive on the market, the BCRA estimated that 50% of Argentines’ expenses abroad come from reserves (the other half is settled with travelers’ own dollars, arising from savings previous or purchased in the MEP).

“Carry trade”, dollars and reserves

Given the continuity of the bullish “carry” cycle during the past month, “The BCRA accumulated purchases for US$1,628 millionwell above its historical seasonality and closing the second best November since 2003,” highlighted the CP report.

“Since mid-September, the BCRA has accumulated a buying streak that totals more than US$3.7 billion. The contributions of bank credit in dollars, negotiable obligations, changes in the banks’ positions and greater settlements than expected from agro-exporters explain the results,” the study added.

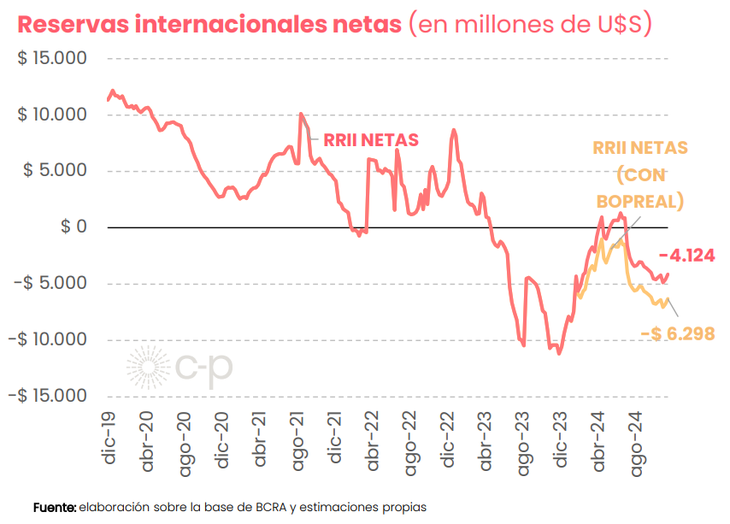

However, the BCRA is unable to capitalize that large purchasing balance in its coffers: “Net reserves grew US$260 million between the end of November and the end of October, after the fall in October (US$598 million),” CP calculated. The reason was foreign debt payments.

image.png

Other analyses, such as that of Portfolio Personal Inversiones (PPI), deduct from the net reserves the dollars that the Treasury bought from the Central Bank to guarantee the payment of capital amortization to bondholders and that is why they calculate that they had a decline of US$ s1,185 million.

Official signals and exchange intervention

In this framework, Caputo is betting on extending the currency bridge that he achieved with money laundering and the private debt boom in dollars to join the cycle. That’s why, The Government reinforced the signals that it will maintain carry trade incentives. On the one hand, Milei announced weeks ago that If inflation maintains its trend will slow down the pace of “crawling peg” from 2% to 1% monthly.

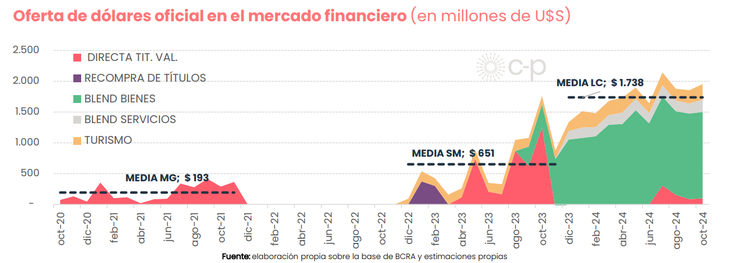

Another sign was that, despite the compression of the exchange gap, The BCRA continued to intervene directly on financial dollars during October. According to official data, CP estimates that the entity poured US$100 million into the bond market throughout the month. But direct intervention, of course, was not the only one.

CP summarized it like this: “In October, the channeling of official dollars to the gap totaled US$1,953 million, as a result of the mix of goods (US$1,403 million), the mix of services (US$201 million) and direct intervention (US$100 million), which is maintained despite the positive dynamics of money laundering. Thus, the average Caputo management remains at more than US$1.7 billion” per month. It should be remembered that, for the blend dollar, 20% of exports are settled in the CCL market.

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.