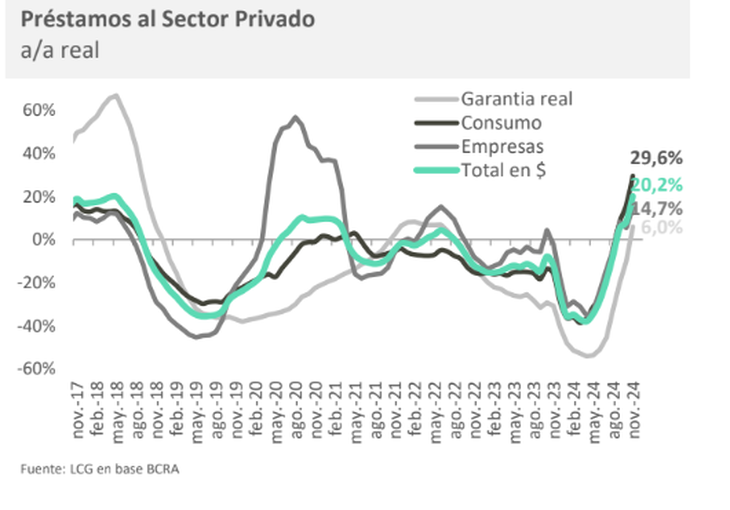

This is a strong recovery, which also includes loans in dollars and with collateral, according to a survey by the consulting firm LCG.

The credit for consumption drives private sector financing. According to the report from the consulting firm LCG, of every $10 of loans that banks granted during November, $6 were to finance purchases of goods or services.

The content you want to access is exclusive to subscribers.

In the study of Labor, Capital & Growth (LCG) It is highlighted that last month credit to the private sector grew 20% in interannual terms. “Loans in pesos have been growing for seven months in real terms. 59% of the total growth in November was explained by the increase in consumer loans,” the report highlights.

According to the analysis, This component grew by 9.2% real monthly, highlighting an increase in personal loans of 10% year-on-year, and an 8.4% monthly improvement in credit cards. “In year-on-year terms, total consumer loans expanded by 29.6% in real terms,” it was highlighted.

creditosprivadoslcg.png

Financing for companies

On the other hand, the financing to companies grew by 2.5% real monthly, with documents growing at 3.1% real monthly, and advances at 2.6%. Compared to last year, loans to companies grew by 14.7% in real terms.

A 14% of the general growth was explained by the increase in collateral loans (12.4% monthly), with growth in both mortgage loans (22.2% monthly) and pledges (8.1% monthly).

“The relevant fact is that “These loans recorded a positive year-on-year variation of 6% for the first time since August 2022,” assures LCG.

The study indicates that “even with the growth of recent months, it is worth highlighting that The stock of loans in pesos is still only 59% of the 2018 stock although it is 10 points higher than November 2023.”

On the other hand, according to LCG, the loans In dollars they have been growing for eleven months: with an increase of 11% in November (67% accumulated). In that sense, the report recalls “the obligation to liquidate these loans in the MULC that increased the supply of dollars in the official market, favoring the BCRA’s purchasing position in recent months.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.