Bank of America (BofA) He once again set his sights on Argentine assets. On this occasion he updated the recommendation for YPF “of Neutral to Buy” and introduced a new target price (PO) of US$55/ADR (from US$31/ADR), which represents a potential increase of approximately 40% compared to the current price.

This measure of the giant of Wall Street It comes after at the beginning of November he pointed out that “Argentina is the country with the most catalysts in the region: due to disinflation, the possible agreement with the International Monetary Fund (IMF) and the reduction of regulatory risks”, for which he returned to overweight it. This confirms the positive vision of the future performance of the Argentine economy, and that the BofA expects good returns for domestic assets.

In a document titled “It’s not too late to join the YPF party,” the bank recalls that the stock has had a strong rise since the beginning of the year, a movement that, in its opinion, “can be largely explained by the reduction in Argentina’s country risk, which fell from 2,000 basis points in January to approximately 750 at the end of November, its lowest level since 2019.”

The institution analyzes that this led to the actions of YPF will increase close to 125% in the accumulated year. Meanwhile, YPF’s microeconomic story “advances,” with the divestment of conventional assets and the integrated LNG project, which BofA estimates will continue to support the stock.

And the state oil company has already signed the sale of more than 25 blocks (out of a total of 50) of conventional assets. Therefore, the divestment of these areas is highly beneficial, “as it will allow YPF to focus on Vaca Muerta, which offers significantly higher returns,” analyzes the bank.

The local view on YPF

From Adcap Financial Group In December they ratified their focus on Argentine hydrocarbon stocks due to better results in the balance sheets of the third quarter of the year. They stand out Vista Energy (buy, target price, US$84/ADR), YPF (buy, target price US$41/ADR) and Pampa Energía.

BofA.jpg

“The rally in YPF shares reflects positive results and greater confidence in its growth strategy. In addition, the improvement in the outlook for country risk benefits the expectations for all companies in the sector,” said the broker in line with the BofA.

About a possible agreement with the IMF and the Milei Government

The bank once again applauds the work done by Javier Milei’s government. It indicates that YPF shares are going through this rebound “mainly due to the reduction of Argentina’s country risk after the austerity measures implemented since the beginning of the year”, as well as due to improving the regulatory framework for oil and gas companies.

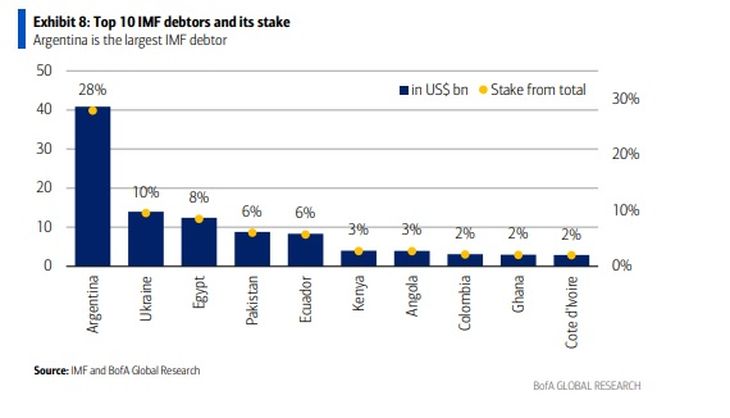

And he maintains that the victory of donald trump in the US elections it further reduced country risk, “with the expectation that this could accelerate a potential agreement between Argentina and the International Monetary Fund (IMF) to obtain fresh financing and advance the agenda of eliminating capital controls” .

BofA1.jpg

And he adds: “Although negotiations with the IMF were delayed this year (Argentina does not complete the current program), markets expect that the change of leadership in the US will favor the talks. It is worth noting that Trump supported Argentina previously, when a loan of US$56 billion in 2018 under the presidency of Mauricio Macri,” the document analyzes.

The analysis recalls that this context would allow the Government to lift the restrictions and that this affects “the ability of oil and gas operators to import drilling equipment and related equipment.” Therefore, it expects “a gradual lifting of controls starting in the second quarter and a more rapid elimination of controls after the 2025 legislative elections.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.