After the sharp slowdown in inflation, INDEC explained the reasons why the CPI does not reflect increases in personal consumption and launched an interactive tool to measure the increase in household prices.

Given the sharp slowdown in inflation, which leads many consumers to wonder why the Consumer Price Index (CPI) does not reflect the increases in personal consumption, the National Institute of Statistics and Censuses (INDEC) He explained, through a thread in X, the reasons why differences occur between official data and those perceived by the public. In addition, it made available a tool for each consumer to measure their own basket.

The content you want to access is exclusive to subscribers.

“‘Why doesn’t the consumer price index reflect the price increases of my consumption?’, we often hear”noted the Institute in a thread x (exTwitter) and explained that “the CPI is used as a synonym for what it costs to live, but family expenses can vary over time.”

In this sense, the organization requires that the cost of living contains “subjective elements” the adaptation of each consumer’s personal basket of expenses to “satisfy their needs and maintain a certain level of well-being.”

“The CPI measures price variations of a basket of goods and services that are not modified based on subjective decisions. And that considers the consumption expenditure of all households over the course of a year, as revealed through a special survey,” argued the INDEC.

At the same time, they maintained that the cost of living is not calculated because there are no practical possibilities of knowing immediately and permanently the quantities consumed, the prices and the tastes and possibilities of consumers.

“It would be rare for the basket of a private household to coincide with that of the CPI. There are households with different numbers of members, with different ages and consumption characteristics. For example, those who go out to work spend more on transportation; those who rent spend more on rent” , he argued.

Likewise, changes in consumption according to the time of year were highlighted. In winter, greater heating costs are generated in the home, while in summer a greater percentage is spent on travel and recreation.

“Finally, the impact of price variations is not the same in each region. For example, a possible increase in the subway fare only affects the region where that means of transport operates and does not affect the basket of the rest,” they concluded. .

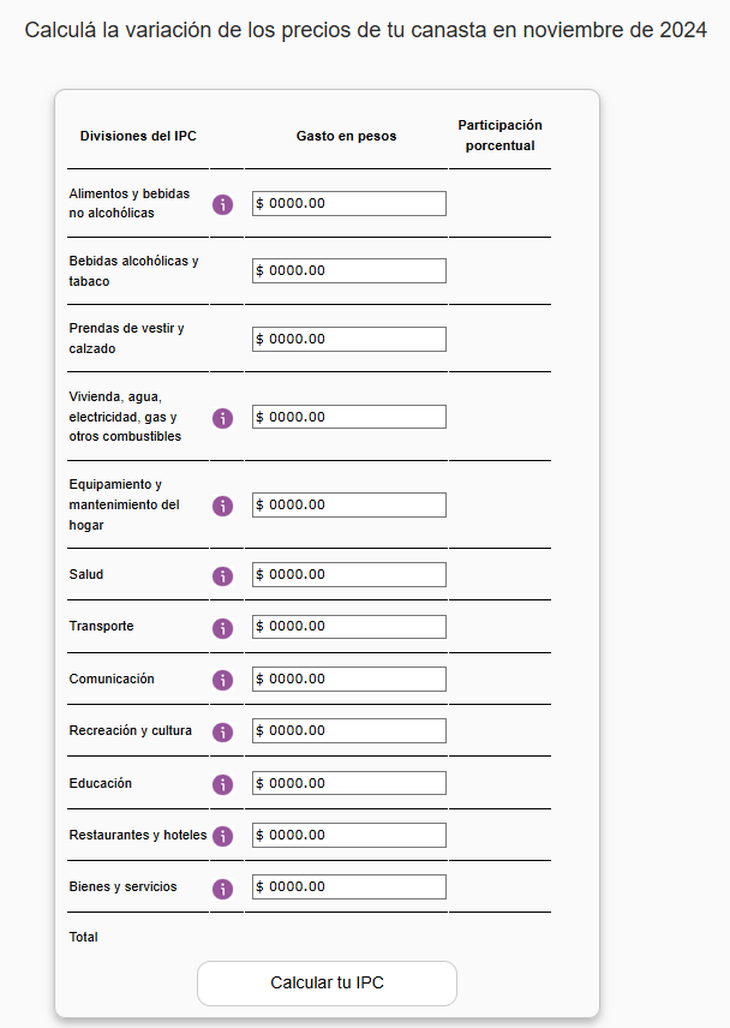

And they put a interactive tool to be able calculate the increase in goods and services consumed by each household based on the prices surveyed by the Institute.

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.