The issuance of Negotiable obligations (ON) by large companies experienced notable growth during 2024, surpassing any of the four years in the management of Cambiemos (2015-2019).

Between January and October 2024, The gross issuance of ONs reached US$7,619 million. In comparison, the amounts recorded In 2016 and 2017 they were US$4,125 and US$4,209 million (total of US$8,334 million in those two years)respectively, evidencing a significant expansion. This is highlighted by a recent report prepared by CIFRA.

Sectoral distribution of NO emissions

Of the total issued in 2024, the 74.6% corresponded to companies in the energy sector, while the remaining 25.4% It was distributed among the following sectors:

More companies issuing ONs

One of the most notable changes was the increase in the number of companies that participated in the issuance of negotiable obligations. In 2024, a total of 89 companies issued this type of securities, well above the average of 29 companies observed between 2016 and 2023.

Despite the increase in the number of issuers, the 90% of emissions It was concentrated in a small group of companies, among which the following stand out:

- YPF

- Telecom

- Pan American Energy

- Pampa Energy

- TGS

- Mediterranean Generation

- Edenor

- Galicia Bank

- Vista Energy

- Tecpetrol

- Comafi Bank

- Aluar

- IRSA

- General Fuel Company

This increase not only reflects greater activity in the capital markets, but also the prominence of large players, especially in strategic sectors such as energy and telecommunications.

on1.png

Company profitability

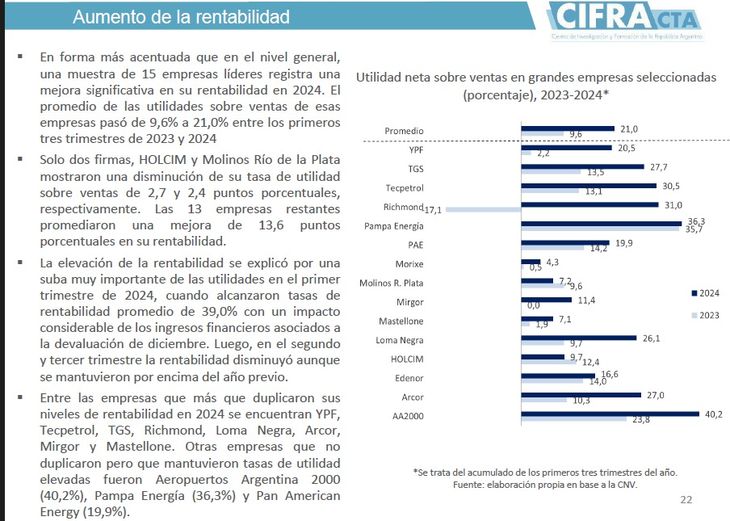

Another point that the report highlights is linked to the increase in the profitability of companies. The CIFRA survey highlights that 15 leading companies register a significant improvement in their profitability in 2024. The average profits on sales of these companies went from 9.6 to 21.0 between the first three quarters of 2023 and 2024.

Only two firms, HOLCIM and Molinos Río de la Plata showed a decrease in their profit rate on sales of 2.7 and 2.4 percentage points, respectively. The remaining 13 companies averaged a 13.6 percentage point improvement in profitability.

“The increase in profitability was explained by a very significant increase in profits in the first quarter of 2024 when they reached average profitability rates of 39 0 with a considerable impact on financial income associated with the December devaluation. Then in the second and third quarter, profitability decreased although they remained above the previous year,” explained CIFRA.

Among the companies that more than YPF, Tecpetrol, TGS, Richmond, Loma Negra, Arcor, Mirgor and Mastellone have doubled their profitability levels in 2024. Other companies that did not double but maintained high profit rates were Aeropuertos Argentina 2000, Pampa Energía and Pan American Energy.

WhatsApp Image 2024-12-23 at 11.30.00 AM.jpeg

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.