He Argentine financial systemdriven in recent years by the advancement and technological transformation of fintech in various segments of the industry, requires a regulatory framework that guarantees innovation, promotes competition, fosters interoperability between different actors and, at the same time, provides security for depositors.

This conclusion was reached by a report prepared by the Tax Affairs Center (led by the former undersecretary of Tax Policies, Roberto Arias, along with Marcos Finn and María Sol Pasqualini), which, at the same time, considers that there is no need to promote a “fintech law”, given that the sector does not face regulatory asymmetries of great relevance. However, despite complying with “reasonable standards”, sometimes financial regulation in Argentina is “excessive and inefficient”, the document warns “Innovation and Regulation in the Financial System.”

The analysis indicates that the Central Bank (BCRA) and other regulatory bodies have sufficient powers to adapt existing regulations and regulate fintech companies that participate in the financial system. In this sense, the importance of deepen specific regulations to guarantee interoperability, promote contestable markets, protect users against technological and financial risks, and that “entry and exit barriers do not compromise the offer” of the services provided by fintech.

Exponential growth in payment methods

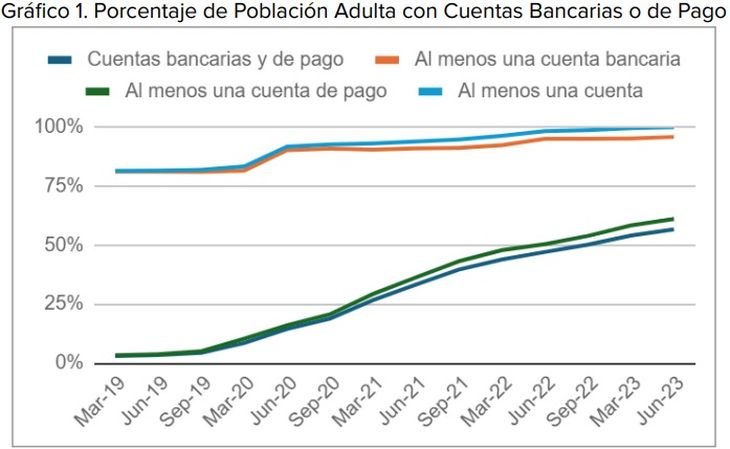

The impact of fintech on financial inclusion is reflected in compelling figures. According to data from the Central Bank, in June 2018 only 3.7% of the population used digital wallets. By June 2023, that proportion had reached 61.1%. Furthermore, the payment accounts (CVU) They went from representing 24% of the financial system in 2018 to 40% in 2023, while traditional bank accounts (CBU) remained practically stable.

four 8 law fintech.jpg

“The progress in the use of digital payment methods such as QR and virtual wallets shows the adaptability of the Argentine financial system, but also demonstrates the need for a more modern and flexible regulatory framework that allows these achievements to be consolidated,” the report states.

graph 1 fintech report.jpg

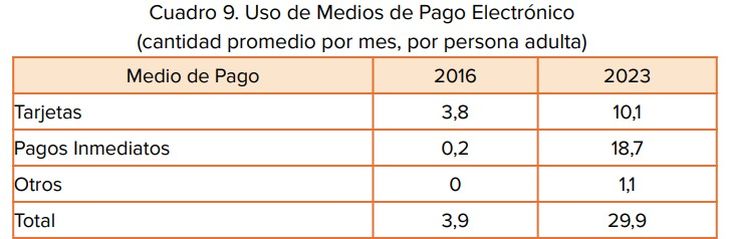

Another notable fact is the change in financial consumption habits: while in 2016 Argentines used debit or credit cards on average 4 times per month, in 2023 that figure rose to 10.1. On the other hand, Immediate electronic payments increased from 0.2 to 18.7 monthly transactions per adult in the same period.

table 9 fintech report.jpg

Regulatory challenges: towards a more competitive system

The report identifies several key points that should be a priority for fintech regulation in the country:

- Interoperability: Promote open systems that facilitate collaboration between banks, fintech and other actors through the use of APIs and shared standards. According to the report, “interoperability is crucial to ensure that financial markets are contestable and do not create barriers to entry or exit.”

- Technological neutrality: Design transversal regulations that do not discriminate based on the technology used. “Regulation should apply the same to any entity, whether it uses blockchain, cloud computing or artificial intelligence,” the document explains.

- “Regulatory sandboxes”: Implement controlled test environments to experiment with new business models. “The creation of a space for regulatory experimentation will allow innovation without compromising consumer protection or financial stability,” the report highlights.

Fintech and financing for the private sector

One aspect in which fintech is beginning to gain prominence is access to credit and financing, especially for historically underserved sectors. Although fintech They do not carry out financial intermediation between savings and investment, which exempts them from prudential regulations applied to banks, their ability to offer fast and accessible financing alternatives makes them a relevant player.

“Fintech does not require prudential regulation, since it does not have a significant impact on monetary policy or financial stability. Its main function is to improve competition in the financial system”, details the report, while recommending strengthen aspects such as deposit insurance coverage for funds in virtual payment accounts.

The potential of open banking

Another key issue on the regulatory agenda is the development of a framework for “open finance” or open banking. This model allows users to securely share their financial information with third parties to access better services. However, progress in this area has been limited in Argentina.

“Open banking has the potential to foster innovation, competition and the development of new financial services, but it requires a collaborative framework between the public and private sectors,” explains the report. In addition, it points out that it is necessary to deepen the technical standards linked to security and interoperability between banks and fintech.

A path aligned with international standards

The report also highlights the importance of Argentina closely following the recommendations of global organizations such as the Bank for International Settlements (BIS) and the International Monetary Fund (IMF). “The regulation of cryptoassets, for example, must be coordinated internationally to avoid regulatory arbitrage that could destabilize the financial system”he points out.

Finally, the analysis concludes that Argentina It has a unique opportunity to position itself as a regional reference in fintech regulation. “Adapting the regulatory framework to the best international practices will not only guarantee internal stability, but also facilitate integration into the global financial system,” he concludes.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.