The 10 most important currencies in the world registered falls of more than 10% against the dollar. What is the analysts’ expectation for 2025.

He dollar is heading to have his best year in almost a decadedriven by the economic strength of the United States, which reduced expectations of cuts in interest rates. Additionally, President-elect Donald Trump’s threats to impose heavy tariffs contributed to this rally.

The content you want to access is exclusive to subscribers.

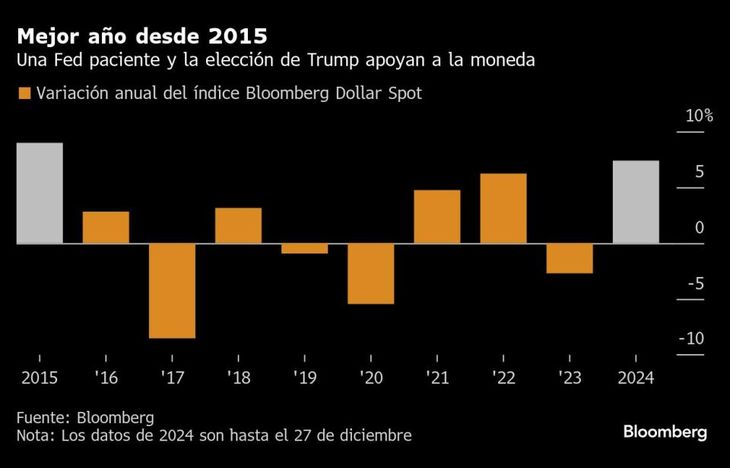

According to the Bloomberg Dollar Spot index, an increase of more than 7% was recorded in 2024, the largest since 2015. All currencies of developed countries weakened against the dollar, except Argentina, as other central banks were forced to intervene. to support their local economies.

According to Skylar Montgomery Koning, currency strategist at Barclays, “the main factor supporting the US dollar this year was the robustness of the economy.” This led the Federal Reserve to follow a cycle of moderate cuts, keeping interest rates in the US above other countries, which sustained the historically high valuation of the dollar.

The dollar index hit its highest level in more than two years this month following the Fed’s rate cuts, although the Fed made clear that monetary easing would be slower. Although Wall Street expects the dollar to continue strengthening in 2025, Global economic growth is expected to improve towards the end of the year, which could benefit other currencies and slow the rise of the dollar.

858a5147d2c7db25162be54cf0670c13 (1).jpeg

The dollar has its best year since 2015, according to an index prepared by Bloomberg

The 10 most important currencies in the world fell more than 10% against the dollar

Through December 27, 2024, the yen, Norwegian krone and New Zealand dollar have shown the worst performance within the Group of 10, recording falls of more than 10% against the dollar. The euro, for its part, lost around 5.5%, trading near US$1.04, and more and more strategists are warning about the risk of the common currency reaching parity with the dollar next year. Speculative investors increased their bullish bets on the dollar since before the US elections, accumulating some US$28.2 billion in contracts related to a future appreciation of the currency, the highest figure since May.

According to a Goldman Sachs report, led by Kamakshya Trivedi, “The current strength of the dollar is aligned with economic data. We do not believe markets have fully incorporated our tariff expectations, and risks to our projections remain to the upside over the medium term. This is especially relevant if more positive sentiment leads to longer-lasting economic growth in the US. despite additional protectionist measures.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.