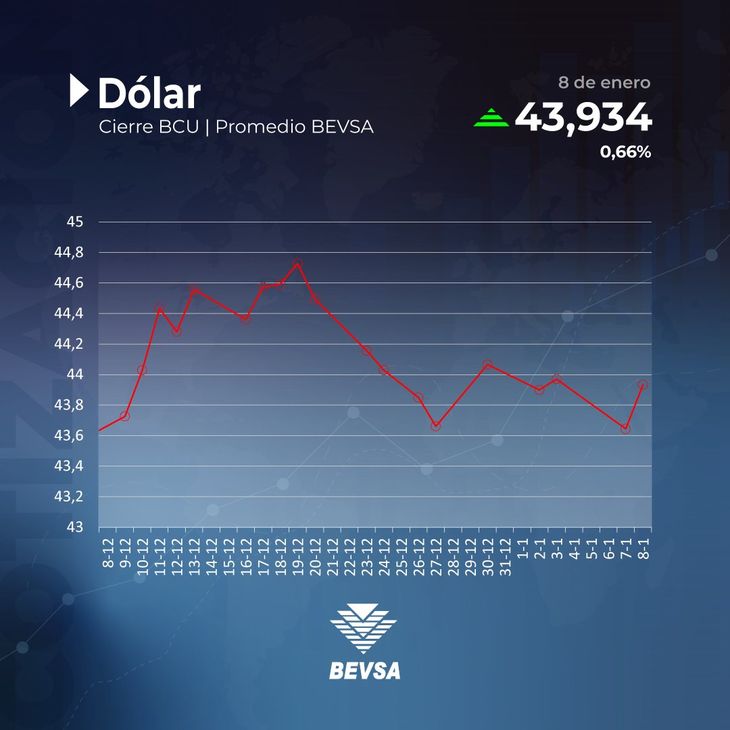

The US currency rose 0.66% this Tuesday and accumulates a monthly and annual decline of 0.30%.

He dollar increased 0.66% compared to Tuesday and closed at 43,934 pesos in the interbank price of the Central Bank of Uruguay (BCU), thus recovering almost completely from its previous fall and being close to returning to the 44 peso range.

The content you want to access is exclusive to subscribers.

The US currency now accumulates a monthly and annual decline of 0.30% in 2025, since its price was 0.13 pesos below that registered at the end of 2024.

On the reference board of the Republic Bank (BROU), he dollar Retail ticket was offered at 42.70 pesos for purchase and 45.10 pesos for sale. For its part, the preferential value of eBROU dollar It was at 43.20 pesos for purchase and at 44.60 pesos for sale.

The closing price in the Uruguayan Electronic Stock Exchange (Bevsa) was 43,870 pesos, while the maximum price was 44,000 pesos, and the minimum was 43,860 pesos. A total of 56 transactions were carried out, with a transaction amount of more than 28.8 million dollars.

BV.jpg

The crypto Tether (USDT), 1 to 1 parity with the dollarwas quoted today at an average of 47.36 pesos for online purchases with a bank account or card, and from 46.22 pesos to 48.60 pesos in the Binance peer-to-peer (P2P) market.

The interbank throughout the previous days

2024:

- December 27 — 43,661

- December 30 — 44,066

2025:

- January 2 — 43,900

- January 3 — 43,970

- January 7 — 43,644

US bonds hit 8-month high

The global dollar rose this Wednesday for the second consecutive session, as the yields of the US bonds continued their recent advance, following a report that the president-elect Donald Trump was contemplating the use of emergency measures to allow a new tariff program.

The benchmark bond yield of American treasure 10-year forecast reached 4.73%, its highest level since April 25, after CNN reported that Trump is considering declaring a national economic emergency to provide a legal basis for a series of universal tariffs on allies and adversaries, as reported by Reuters.

Investors hope Trump’s policies such as deregulation and tax cuts will boost economic growth, but there are concerns that this, along with yet-to-be-confirmed tariff actions, could cause inflation to reaccelerate.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.