How the 5 largest mining companies in the world fared in 2024

The Brazilian mining company Okay was the worst performer, with its market capitalization falling 44.9% to $37.7 billion, dropping it out of the top 10. It is the worst performance in the ranking so far this year.

Okay briefly surpassed $100 billion in value in 2022. Now, the market capitalization of the Rio de Janeiro-based giant has dropped to $37.7 billion and the counter has fallen out of the top 10 position, displaced by the emerging Indonesia Amman Mineral.

On the contrary, the British Anglo American was the only one of these giants that ended the year on a positive trajectory, adding $5.5 billion, or 18.1%, to its value. Anglo American is no longer one of the top 10 companies, but it has the distinction of being the only one of the old guard that ended 2024 in positive territory.

It is debatable how much of that assessment is due to the lingering effects of the Australian’s approach. BHPbut long-term investors will still bear the shock of January 2016, when Anglo market capitalizationfell below 5 billion dollars after nearly suffocating under a pile of debt.

With the exception of Glencorewhich markets but does not extract the raw materials to manufacture steelthe mineral iron It has been the source of income for the big five, as China’s huge infrastructure investment absorbed more than 80% of seaborne cargo and prices hovered around $200 per ton.

In 2011, the iron ore It sold at some of the highest margins mining has ever enjoyed. With two-thirds of pre-tax profits coming from iron ore that year, BHP recorded a windfall of $24 billion in 2011, Vale reaped $23 billion, Rio Tinto earned $15 billion and Anglo earned $11 billion.

According to The Northern MinerToday, iron ore prices are back in double digits and a looming supply surge, coupled with China’s prolonged construction malaise, offer little hope of a return to boom days.

image.png

Ranking of the mining companies that grew the most and those that fell the most in 2024.

Copper – for now – is not the new oil

Copper was supposed to play the role of iron ore for the Top 5 in the future and in the first half of 2024 that idea began to look plausible, the specialized site estimated.

Copper on the Comex reached a historic intraday high of almost $5.20 per pound or $11,500 per ton. In a 24-hour period, trading volumes amounted to 100 billion dollars (twice the Dow’s daily average) and the benchmark metal attracted investors far beyond the mining sector.

“Amid the frenzy, the forecasts became increasingly extravagant, and one of the most sober forecasts was for a 50% rise from the all-time high”the publication stressed, adding that it was not long before the pressure grew stronger and, by the end of the year, copper had barely made a profit. It turns out that copper is not the new oilthe media warned.

Now that the agreement with Anglowhich involved a significant copper investment is stalled, and BHP is taking a turn towards organic growth, with an investment of up to 10,000 million dollars alone in Escondida, the mine copper largest in the world. In Argentina, BHP acquired the Filo del Sol (“FDS”) and Josemaría projects from the Lundin family and created the new Vicuña label.

The transaction included the joint purchase of Edge of the Sun for approximately US$4.1 billion Canadians, some US$3,000 million, while the entry to Josemaría involved a disbursement of US$690 million. BHP and Lundin Mining They will each have 50% of both projects. But in addition, the company authorities were designated joint Vicuña.

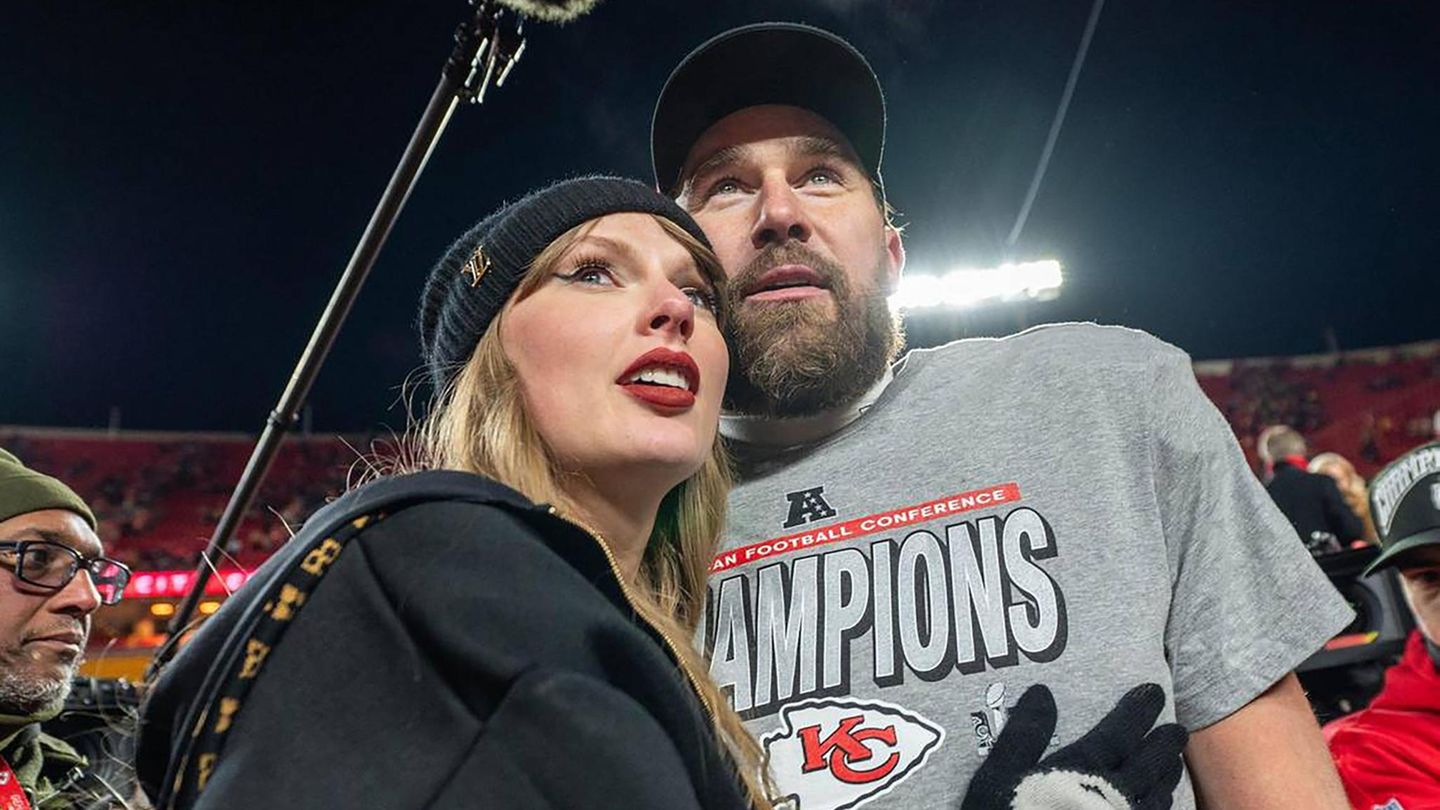

image.png

What were the most valued mining products in 2024.

Rio Tinto benefited from BHP was working hard on its Melbourne neighbor’s 30% stake in Hiddenwhile his project Copper Resolution in Arizona does not obtain sufficient permissions. The long battle to expand Oyu Tolgoi in Mongolia also seems to have reached a stalemate, but the trend of Rio Tinto towards diversification and its inclination towards opportunistic investments remain intact.

Rio Tintoone of only two miners with a valuation of more than $100 billion (and just barely), spent US$6.7 billion to expand its lithium business in 2024, which involved the acquisition of Arcadiumwith the Catamarca Phoenix project included, one of the three that are currently in production in Argentina, with more than 30 years of experience and in moderate expansion.

For its part, Glencore finally got a part of Teck Resources last year, but while it is very profitable at the moment, coal is not exactly the future of mining, he noted The Northern Miner.

At a time when geopolitics and global trade are entering increasingly dangerous territories, Glencore You might find that your marketing business is starting to generate income. The Swiss company, which has been trading for decades in commodities trading waters that few are willing to tread, might also want to avoid the effect The Bambas.

How the gold and silver miners fared

The value of precious metals and royalty companies rose a modest $18.4 billion or 7.2% in 2024, compared to a 27% rise for gold and 22% for silver.

The relative weakness of gold stocks against the price of gold is a perennial problem for the industry.a, exemplified by the two main producers in the world, the American Newmont and the Canadian barrickwhich lost ground in 2024.

In addition to unmet goals and rising production costs at both companies, Barrick has halted activity at its Loulo-Gounkoto mine in Mali, in a dispute with the West African country’s military rulers.

While barrick goes into copper (the maximum forecast for 2024 is 210 kt) and Newmont cuts its portfolio, another mining company Agnico Eagle continues to acquire assets large and small. In dollar terms, the Canadian Agnico is the best-performing stock in the Top 50, adding $12.6 billion in value in 2024 (versus $9.3 billion for China’s Zijin and $8.8 billion Vedanta of India) and enters the top 10 for the first time.

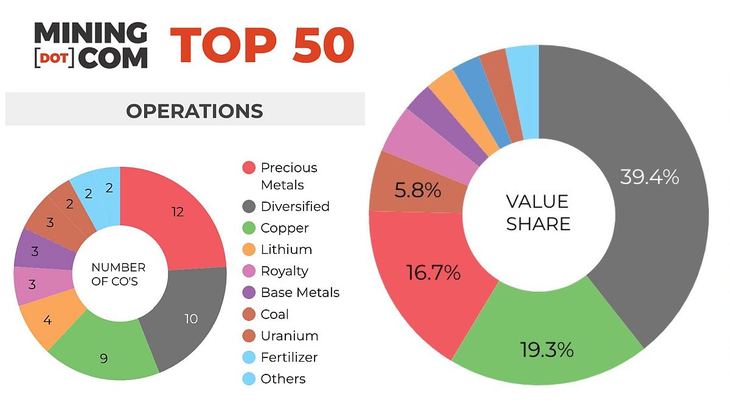

image.png

The countries with the best mining performance in 2024.

If it were not for the limited trading of shares of the Russian Polyuswhich significantly underperformed its peers on an ounce-for-ounce basis (the Moscow-based company’s 2024 target is 2.8 million ounces), the sector’s position in the rankings would also be better.

The position and annual performance of the south african Goldfields They were also affected by the exaggerated movements of their stocks and the South African rand on the day the snapshot was taken. The Johannesburg-based company is in full swing in the first weeks of 2024, up 14% to a valuation of $13.3 billion.

Alamos Gold of Toronto joined the top 50 for the first time in the third quarter of last year and with a more than 50% increase in value in 2024, it now appears firmly ensconced in the top 50 with a valuation of $8.1 billion at end of the quarter.

The newcomer of the second quarter, Pan American Silver (after its absorption of Yamana Gold)also be a permanent addition.

Uzbekistan is preparing an IPO for Navoi Mining and Metallurgy Combinatthe world’s fourth largest gold mining company and a major uranium producer in 2025. NMMC It debuted a $1 billion bond offering in September, marking the first issuance in the global debt market by a gold mining company since June 2023.

Navoi should easily join the ranks of the top 50 gold producers thanks to ownership of the world’s largest gold mine, Muruntau, and annual production of 2.9 million ounces with grades and mining costs per ounce that are the envy of the sector.

The recent and dramatic 126,000 drop in combined market value of the 50 largest mining companies in the world, represents a drop of 9%, particularly pronounced in the last quarter of 2024.

However, despite the recession, traditional mining champions remain an important force in the global economy. And although the fall was abrupt, At the same time, these leading companies advanced with great business opportunities, acquisitions and mergers in various projects around the world, a trend that will continue in 2025.

2024 ranking of the 50 largest mining companies in the world

image.png

The TOP 50 ranking of mining companies excludes unlisted and state-owned companies due to a lack of information, as admitted by the authors of the study. Giants like Codelco (Chile), Navoi Mining (Uzbekistan), Eurochem and several companies from China are not there.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.