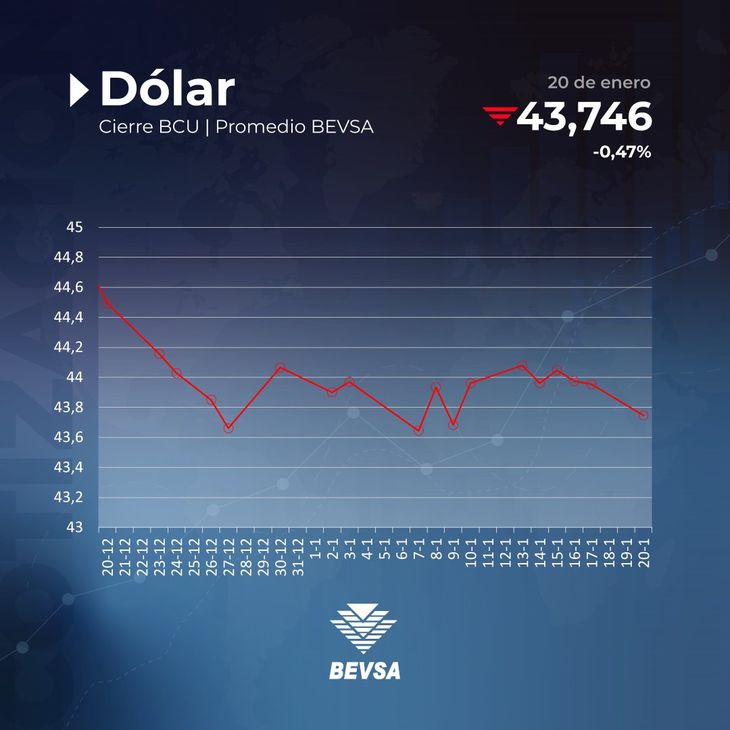

The US currency fell 0.47% and accumulated its third consecutive fall in the $43 range.

He dollar fell 0.47% compared to Friday and closed at 43,746 pesos in the interbank price of the Central Bank of Uruguay (BCU), opening the week downwards in line with the global scenario before the inauguration of donald trump in USAaccumulating its third consecutive fall in the range of 43 pesos.

The content you want to access is exclusive to subscribers.

The US currency now accumulates a monthly (and annual) decline of 0.73% in January, since its price was 0.32 pesos below that registered at the end of 2024.

Despite today’s variation, the financial advisor of Gastón Bengochea Corredor de Bolsa, Francisco Echegoyenpointed to Scope that everything seems to indicate that “the dollar will continue to strengthen” against other currencies globally in the following months, since the Federal Reserve (Fed) “hardly” lower rates in the short term as a result of the rebound in the inflation in USA.

On the reference board of the Republic Bank (BROU), he dollar Retail ticket was offered at 42.60 pesos for purchase and 45.00 pesos for sale. For its part, the preferential value of eBROU dollar It was at 43.10 pesos for purchase and at 44.50 pesos for sale.

The closing price in the Uruguayan Electronic Stock Exchange (Bevsa) was 43,800 pesos, while the maximum price was also 43,800 pesos, and the minimum was 43,700 pesos. A total of 35 transactions were carried out, with a transaction amount of more than 17.5 million dollars.

BV.jpg

The crypto Tether (USDT), 1 to 1 parity with the dollarwas quoted today at an average of 47.64 pesos for online purchases with a bank account or card, and from 46.25 pesos to 48.53 pesos in the Binance peer-to-peer (P2P) market.

The dollar throughout the previous days

- January 13 — 44,079

- January 14 — 43,962

- January 15 — 44,047

- January 16 — 43,975

- January 17 — 43,954

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.