In the last two months of 2024, the provinces benefited from an increase in automatic transfers of co-participation and by special laws. This is because some taxes that are distributed increased due to to the fiscal package approved by Congress last year.

New private estimates would indicate that Those improvements, of 2.4% real in November and 1.4% in December, would have been just a summer. And it is that, since 2025, the “extra” effects of some tax collection measures end taken last year, at the same time that there will be no more COUNTRY Tax. It is estimated that the The drop in income at the national level will be 1.84% of GDP, of which 0.42 points will affect the provinces. In percentage terms, 77% of the fall will be borne by the Nation and 23% will be borne by the provinces.

iaraf-tax-2025.png

According to the calculations of the Argentine Institute of Fiscal Analysis (IARAF), The decrease in collection in 2025 will occur due to the elimination of the COUNTRY taxdue to the changes in the tax on Personal Propertydue to the possible drop in income generated by the bleach and for the changes of the exemption from payment of VAT at the time of entry of merchandise through Customs.

Part of the income that arises from national collection end up in subnational governments, due to the existence of co-participation. The IARAF considers the reduction of resources for this year to be “practically confirmed”. Of the four elements mentioned, only one is not shared with the provinces. It is the PAIS Tax, the rest is affected by co-participation.

The problem is then in cHow the national government plans to compensate the drop in revenue generated by the measures adopted last year.

The IARAF report says that “plans to compensate for this drop by increasing the collection of five other taxes, specifically of Profits, Export Duties, Tax on Liquid Fuels, Contributions and Contributions to Social Security and Import Duties.

Of them, yesOnly Income Tax is co-participable, that is, it is automatically collected.. The C Taxfuels has a specific allocation of 10% for the provinceswhose amount is not important in the general estate. The consumption VAT could compensate somewhat, but the government in turn extended the exception regime for VAT collections on the importation of essential goods, including food, throughout 2025. This generates loss of income for ARCA.

2024 Total Automatic Transfers

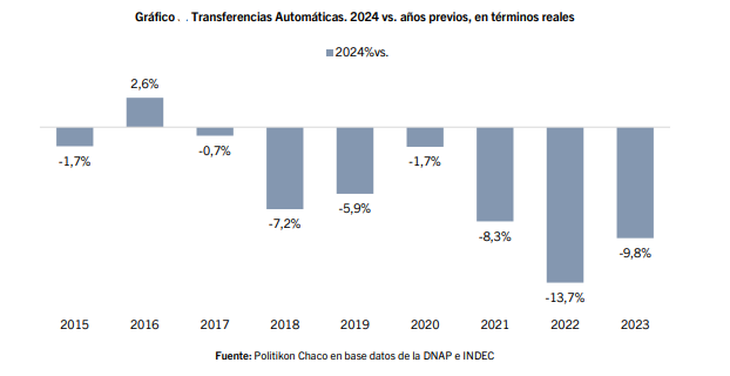

During the year 2024, lAutomatic transfers to provinces and CABA totaled $42.1 billion. Regarding 2023, they show a 9.8% drop in real terms, indicates a report of Politikon Chaco.

provinces.png

Seen by component, resources from Federal Co-Participation fell 8.8%, those derived from Laws and Special Regimes lost 20.8% and from Fiscal Consensus Compensation lost 26.4%.

If the result of this 2024 is analyzed compared to the last decade, It was the second worst year for automatic shipments. Not only was it 9.8% below 2023, but also falls against all years since 2015, with the sole exception of 2016 (compared to that year, shipments in 2024 grow 2.6%).

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.