To date, Zimbabwe has still not managed to reincorporate its local currency into the formal economy.

Although the closest stories that come to mind when we think about economic crises and national financial adversities, we often think of cases of Latin America that are similar to our same problems, or that we can appreciate first-hand the results they left behind.

The content you want to access is exclusive to subscribers.

However, this is not just a case of our continent. In Africamore than a decade ago, one of the most important countries in the south carried out a dollarization to seek economic stability and stop the inflation that was eating into the local economy. However, the experiment did not turn out as expected, and Zimbabwe had to change course.

currency zimbabwe.webp

What was dollarization like in Zimbabwe and why it didn’t work

Zimbabwe adopted the US dollar as its official currency in 2009 due to uncontrolled hyperinflation that reached catastrophic levels, with monthly inflation rates exceeding 11,200,000% the previous year. The population suffered a severe shortage of basic goods. The country led by Robert Mugabe At that time it decided to abandon its local currency, the Zimbabwean dollar, and adopt the US dollar to stabilize the economy.

Initially, dollarization achieved drastically reduce inflation and stabilize the economy. In 2010, inflation fell to just 3.2% and remained at low levels for several years, and the country’s GDP showed an average annual growth of 7.4% during the first years of the new measure. However, the lack of growth in infrastructure and economic reforms ended up leading the plan to failure.

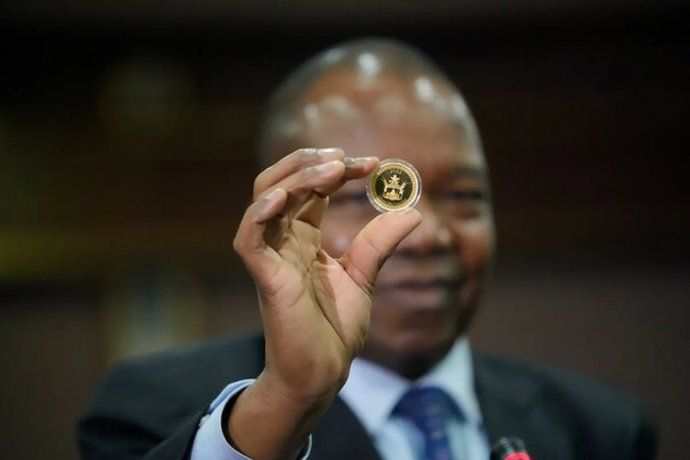

Dollarization meant that Zimbabwe lost the ability to print your own currencywhich limited the government’s ability to finance public spending and manage the economy flexibly. The lack of physical banknotes also led to the introduction of “bonus bills” in 2016, which failed to resolve the economic problems.

Furthermore, the lack of transparency and the mismanagement of public resources drove away foreign direct investment and hindered the development of the private sector.

Currently, foreign currencies such as the south african randthe Botswana pula, the euro, the pound sterling, the Australian dollar, and the United States dollar are widely used in almost all transactions in Zimbabwe. The government insists that the Zimbabwe dollar should only be reintroduced when improve prospects within the economy in its industrial apparatus.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.