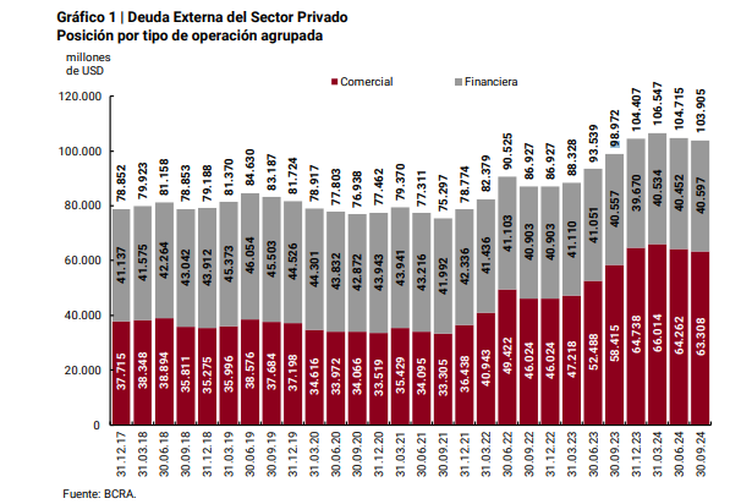

Import debt remained the most relevant, according to a BCRA report. It happened despite the fact that in 2024 there were cancellations and some normalization.

In the third quarter of 2024 the commercial external debt of the private sector fell to US $954 million Regarding the previous three months. While it was lower than that of the three previous quarter, the stock showed a significant ascent with respect to the same period of 2023 and In historical terms it remained very high.

The content you want to access is exclusive to subscribers.

According to a report published Thursday by the Central Bank (BCRA), the recoil of the liabilities of companies for foreign trade operations was explained by the Net cancellation of debt for imports of goods for US $ 1,201 million. In parallel, exports debt had a decrease of US $ 299 million.

From the BCRA, the normalization in import payments highlighted

“It is worth mentioning that this decrease in debt occurred in Context of regularization of the situation of the indebtedness of importers through commercial and exchange regulations Established for these flows since December, “said the BCRA.

On the other hand, they highlighted the placements of the BOPREALES“bonds offered in order to grant a solution as ordered, transparent, indiscriminate, effective and possible in the face Customs registration or service actually provided until December 12, 2023 “.

Between January and September 2024, a Cancellation of debt for imports of about US $ 3,000 million by using these instruments, additional to other cancellations without access to the change market, estimated at $ 7.4 billion.

image.png

Even so, from the monetary authority they reflected that, as of September 30 last year, The debt due to external purchases of goods was the most relevant with a level of US $ 44,112 million. Adding the export debt, the liability climbed to about US $ 49,854 million, while adding to the services, about US $ 63,308 million were reached.

In interannual terms the debt for imports and exports exhibited an increase of US $ 4,893 million. This jump is the Reflection of the accumulated in the last quarter of 2023in an electoral context that led the former government of the front of all to postpone payments to take care of the few reserves, a situation that Javier Milei’s management held in his first months; In December, only 17% of imports actually made in that month were paid.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.