Another Monday, another turbulence in global markets. A week ago it was the “Deepseek Dive”, this time is the “Trump’s Tumble Tumble“. Traders are surprised that a president who said he would put tariffs on the countries with which the United States has notable commercial deficits, have put tariffs to some of those countries.

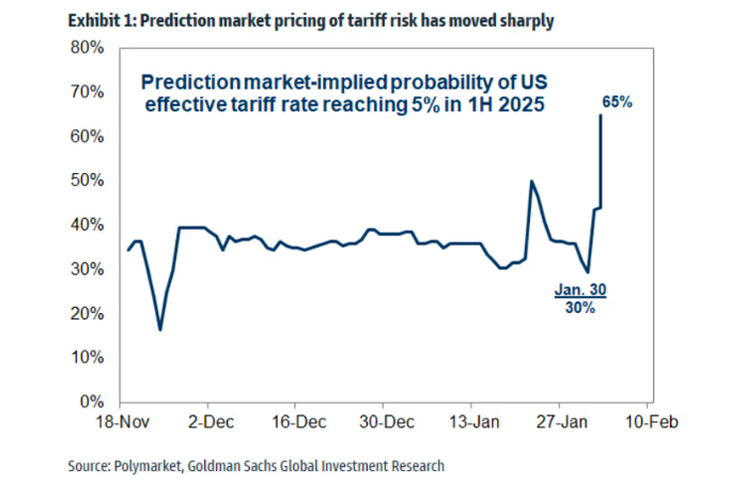

After Canada, Mexico and Chinathe uEuropean nion could be the following. The graphic after Goldman Sachs shows how prediction markets, at the end of last week, did not take the threat of tariffs very seriously.

And in a note published on Sunday, Goldman’s strategists, led by David Kostin, They have exhibited the implications for the share market of the last Trump movement. One way in which the actions could be pressed is that the big tariffs represent a downward risk for estimates of profits and performance expectations of the S&P 500, according to Goldman.

“If companies decide to absorb the highest costs of the inputs, then the profit margins would be pressed. If the companies transfer the highest costs to their final customers, then the sales volumes could be affected,” says the bank of Wall Street.

Goldman Sachs’s gaze

They estimate that each increase of 5 percentage points in the US tariffs would cut the profits per share of S&P 500 in approximately 1-2%. “As a result, if they are maintained, the tariffs announced this weekend would reduce our profit forecasts per share of the S&P 500 by approximately 2-3%, without taking into account the additional impact of an tightening of financial conditions or an effect greater than expected of political uncertainty about corporate or consumer behavior, “says Goldman.

GS.PNG

(We must point out that bank economists still think that tariffs to Mexico and Canada will be temporary). Another way in which the shares could be pressed is that the anxiety of investors could affect the valuation multiples of the shares. The graph below shows the increase in the uncertainty index on economic policy, reaching a value greater than 99% of the last 40 years, according to Goldman.

“The historical relationship between political uncertainty and the risk of actions of the S&P 500 suggests that the recent increase in uncertainty should reduce the P/E multiple to 12 months from the S&P 500 by approximately 3%, maintaining everything else constant,” Goldman says. Remember, the P/E multiple of the future of the S&P 500 is currently approximately 22, well above its historical average, which is in the high ones. The effect of the highest costs of indebtedness due to concerns on inflation could have a more nuanced impact on actions, however.

Yes, the most sensitive part of the monetary policy of the short -term yield curve could increase, but long -term yields could be repressed by concerns about the damage caused by tariffs in the prospects for economic growth. In addition, if the dollar rises together with the yields of the short -term treasure bonds, its impact on the aggregate profits of the S&P 500 could be limited, according to Goldman.

S&P 500 companies obtain 28% of their income outside the US, but less than 1% of their income explicitly come from Mexico and Canada. “Our upward profits model suggests that, keeping everything else, a 10% increase in the USD weighted by trade would reduce profits per share of the S&P 500 by approximately 2%,” says Goldman.

Even so, in general, the tariff plan is not good news for actions. “Combining these modeled profits of profits by action and assessment, it suggests a short -term drop of approximately 5% in the fair value of the S&P 500 if the market values the sustained implementation of the newly announced tariffs,” says Goldman.

GS 1.Png

If investors believe that tariffs are a short -term movement towards a negotiated agreement, the damage would be lower. But the actions could further fall if traders see that the most recent ads indicate a greater probability of an additional escalation. The strategists said that high expectations of economic growth and profits underline the potential risk of the actions if investors are forced to reassess the fundamental perspectives.

What is being commented on General Motors (GM) and Ford Motor (F) dropped by 6.5% and 4.2%, respectively, in the market prior to opening because investors fear that tariffs affect sales in sales in USA and complicate cross -border supply chains.

The US economic data planned for Monday includes the final PMI index of January manufacturing of the S&P, published at 9:45 am, Eastern time, followed at 10:00 am for the construction expense of December and the survey January ISM manufacturing. NXP Semiconductor (NXPI) and Palantir Technologies (PLT) could be the main results of the market after the market on Monday.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.