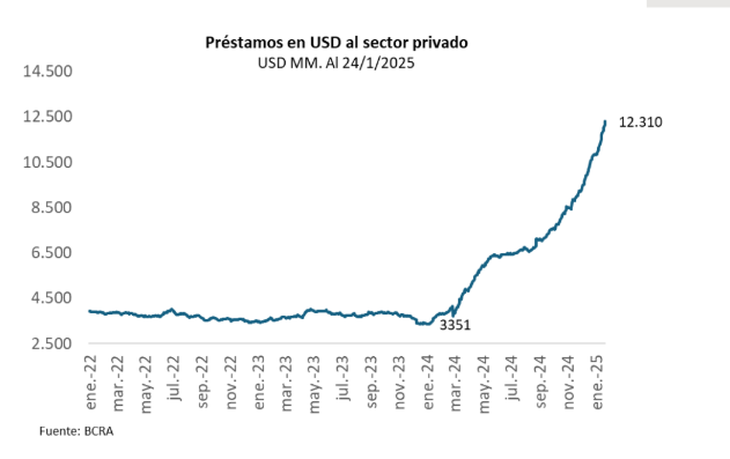

According to a private report based on official BCRA data, loans in dollars came to represent 3.2% of GDP.

The Bank loans in dollars granted to Private sector They reached the US $12,310 millionwhich represented a 267.3% increase compared to 2023. This increase was particularly remarkable as of September last year, driven by the impact of money laundering.

The content you want to access is exclusive to subscribers.

According to an analysis of the Quantum Finance consultantbased on the statistical data of the Central Bankan increase of almost US $ was observed9,000 million Regarding US $3,351 million registered at the beginning of the Presidency of Javier Milei.

This growth in loans is part of a broader trend of improvement in external financing in foreign currency For the corporate sector, which reached US $18.5 billion At the end of January, representing a 3.2% of the Gross Domestic Product (GDP). However, this participation remains relatively low compared to other countries in the region, which suggests that There is room for greater growth in the future.

Screen capture 2025-02-05 100120.png

The growth of dollar loans, according to Quantum Finance, Daniel Marx’s consultant

The report also indicates that the Total bank credit In Argentina (in pesos and dollars) it represents only the 10% of the GDPin front of the 29% in Uruguay, 45% in Peru, 72% in Brazil and 110% in Chili. Despite this low proportion, the Key paper than the capital market He will play in the future, as a more flexible source of financing and willing to consider investments in Argentina.

In a context characterized by greater credit availability and the flexibility of some financial restrictions, the consultant Quantum He stressed that much of the credits granted They were financed with dollars from cash laundering. This phenomenon contributed significantly to the increase in bank loans and the greatest participation in the Primary emissions of the local debt market. As explained, the Best commercial perspectives They favored easier access to companies to International financing.

According to a recent Megaqm report, in the Dollar segment continues to highlight a growth in loans, but worries the drop in deposits. Thus, the possibility of starting to pay fees to generate a balance.

Which sectors benefited from the increase in loans in dollars

According to the data of the Central Bankthe consultant pointed out the economic sectors that benefited the most with the granting of credits in dollars. First, the industry concentrated the 32% Of the total loans, highlighting the Food sector With a 12%followed by the chemical industry With a 7%.

He agricultural sector represented the 24% of loans, with a 13% addressed to Cereals and oilseedsmainly like Export Prefinancing. In addition, the sector of crude oil and natural gas He received the 14%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.