While the government reinforces its Exchange anchor policythe effects of appreciation They are noticed in different economic variables. The clearest is the Tourism boom abroadstimulated by the relative increase in Argentina with respect to the other countries. A fact is enough to illustrate it: January ended with an absolute record of dollar expenses by credit card.

The information provided by the statistical forms of the Central Bank (BCRA) show that January 31 (last data available) The dollar loan stock for consumption made with credit cards reached US $ 864 million, the highest level in history.

image.png

The value almost triples the level of January 2024 (month in which he averaged US $ 267 million), shortly after the megadevaluation of the beginning of the mandate of Javier Milei, and It exceeds the previous historical peak, registered during the Government of Mauricio Macri. February 2, 2018had touched the US $ 838 million. It was another context of strong exchange appreciation and occurred weeks before the run was unleashed that began the crisis of the mandate of Cambiemos.

Appreciation and expenditure abroad

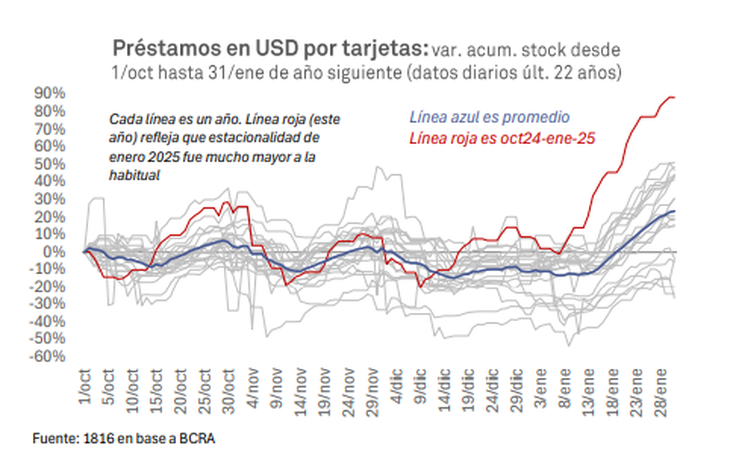

While consumption in dollars with credit cards usually grow at this time of year, the Consultant 1816 He stressed that this time the expansion reflects “A much stronger seasonality than common”. In that sense, he showed that between October 1, 2024 and January 31, 2025 the stock of this type of financing had an increase of almost 90% (mainly concentrated in the last month), while the average of the average of the Last 22 years marks an increase of less than 30%.

image.png

Thus, he concluded that “The departure of currency by tourism would have grown impressive in the first month of the year”. There are still no official data of January to account for that, but everything indicates that it was and that this happened after several months of red expansion in the tourist exchange balance.

There is another factor that could be promoting dollar consumption with credit cards: the flexibility of conditions (with tax reduction) to Purchases of goods abroad through the Small Shipping System (Courier)which can be done through digital platforms.

“The data on consumption in foreign currency with credit card are a very relevant indicator of expenditure abroad (tourism, assets, courier, etc.) and They reflect the level of appreciation of the real exchange rate. It could be evidence of a ‘switch’ tourist spending from local destinations to international and greater preference to consume imported goods and services instead of the premises, due to the change in relative prices, ”said former BCRA -president Jorge Carrera In your X account.

In addition, we must consider that this year they charged strong impulse other payment alternatives abroad. This is the case of Pix in Brazilone of the destinations most chosen by the Argentines, which is operated by virtual wallets used by Stablecoins. These consumptions They do not enter card statistics with cards In foreign currency.

Another fact that accounts for the strong impact of the exchange rate is that This expenses abroad does not occur at a time of salary boom. On the contrary, it occurs after a complicated year for the purchasing power of income measured in pesos. And while the exchange anchor led to a rebound of the Salaries measured in dollars, consultant 1816 stressed that it is “far from records.”

image.png

Pressure on reservations and gap

In his last exchange balance, The BCRA said that 60% of the expenses with an abroad are canceled with their own dollars of consumers, which are largely acquired via purchases of the dollar MEP. This implies that the remaining 40% are raised with weights and that, therefore, they leave the net international reserves.

Anyway, the operation is not harmless for the macroeconomic scheme that the government tries to sustain. In the first case, MEP’s demand to pay those consumption abroad presses on the gap exchange and strength to the BCRA to intervene to keep it at bay. For example, only in the first half of January, the entity allocated US $ 619 million to contain financial dollars. In the second case, When paid with pesos, they directly imply a reservations.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.