The market issued its verdict on the president’s management Javier Milei and cryptocurrency $ Pound. Although investors focused on the economy rather than political noise, it was not the president’s defense on the scandal that promoted the rebound of the Argentine assetsbut rather a precise “timing” in which Two Wall Street banks They ratified their commitment and optimistic vision for the local economy.

The same day that the New York Stock Exchange (NYSE) resumed its operations after a long holiday and the reaction of investors was expected to the $ Libra scandal, Goldman Sachs praised the government’s fiscal discipline, while the Bank of America (Bofa) He reaffirmed “his positive feeling” regarding Argentine assets.

In the City, therefore, the operators were surprised by the bouncing of the S&P Merval (+6.1%) And they pointed out in statements to Scope that, “the market perceives that the issue $ libra No It affects common people, on foot. Which is the one that reaps the fruits of an improvement economy. ”

“As Clinton said: It is the economy, stupid! In short, what really commands is the pocket, and even more when the matter is such a sophisticated issue, with implications outside Argentina and in a world as complex as that of the cryptocurrencies”, A renowned operator slipped.

The look of the Wall Street giants

In his X account, the Minister of Economy, Luis Caputoshared a graph of the report of Goldman Sachs: “When economic solids do not change, the eventual noise of the juncture is usually seen by the most experienced as an opportunity. Spoiler: This government will never change the course. ”

That was what the investment bank applauded: “A rapid fiscal adjustment, which leads to a balanced budget, is the cornerstone of the macroeconomic re -quilibrio program that is being implemented in Argentina,” the document records.

Goldman Sachs.jpeg

The agency adds: “In 2024, the Government reached a fiscal surplus of 0.3% of GDP, and by 2025, we hope that President Milei’s firm commitment to fiscal discipline continues,” slides the financial entity that warns that “it will be A greater expenditure control necessary throughout the year to fulfill the objective of fiscal equilibrium. ”

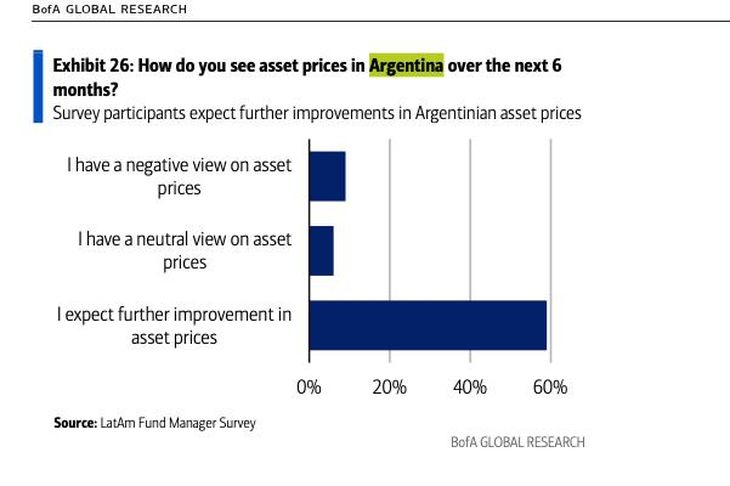

For its part, THE BOFA He published the results of a survey of fund managers. The survey revealed a Alcista feeling For Argentina: “69% expect new improvements in assets prices”, Says the document.

“In our opinion, Argentina brings together the largest number of catalysts in the region: elections, disinflation and reduction of regulatory risks, ”says the financial institution. However, when comparing it with the Andean markets, investors consider that Chile could offer better performance.

The City’s look on market reaction

Juan José VázquezChief of Analysis in Cohen -In statements a Scope– He explains that there was concern about the reaction of the market to the $ LIBRA case, considering the strong flow of international investors with positions in Argentine companies via Adrs and Exchange-Traced Funds (ETFs) exposed to local risk.

And, as Vázquez explains, “the publication of favorable reports, Like the Bofa and Goldman Sachshelped to calm the concerns. ” For the strategist, everything indicates that soon $ libra will be forgotten along with all the events.

Argentina Bofa.jpeg

From Delphos Investment They ratify that 2025 is not a year of “somde”, but that trading has to be the way to activate for investors. This means that throughout this year the broker estimates that No It is advisable to maintain long -term investments, but it is better to take advantage of the short -term purchase and sale opportunities to maximize profits in a more volatile or uncertain market.

The Stock Exchange recommends caution, since A total survey of the exchange rate is not expected before the elections, for which there are eight long months. “We anticipated a scenario of high political volatility on the road to the elections, But we didn’t imagine that it would be the government itself who would trigger it. And, in addition, long earlier than expected and in an unexpected way, “says the firm.

And then, what to invest?

Pablo LazzatiCEO of Insider Financehe comments in dialogue with this medium that, for now, the recommendation is to position himself “mainly in bonars and global within the universe of Argentine assets ”. And in terms of Argentine actions, the expert maintains a position of “Wait and see “since they recently reached maximum and, in addition, the scandal of Libragate It is still in the air and could intensify the downward correction.

“Although this event caused 10% drops in some papers on Monday, we consider its impact It will only be short -term noise and No It will affect the yields of Argentine assets in the long term, ”says Lazzati.

Meanwhile, Vázquez slides that the correction opened “A clear opportunity for fixed income” In variable income, on the other hand, many of the favorable expectations already seem to be reflected in prices, analyzes.

“The actions operate with valuations that assume the resolution of the stocks, the reservation situation of the Central Bank and other key factors, which leads me to be more cautious. I prefer to wait better input points, If they are presented, or put together a position in days of low, such as yesterday, ”concludes Vázquez.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.