Wall Street He issued his verdict on the scandal related to the Cryptocurrency $ Libra. Investors, by focusing more on the economy than in political noise, ignored the erratic statements of Javier Mileiwho recommended a scam. The great New York banks, such as Bank of America (Bofa), Goldman Sachs and now JP Morganprioritized fiscal discipline and dismissed the controversy, as they supported the work done so far by libertarian management.

And it should be remembered that the country was involved in a Wave of political and financial uncertainty After an unusual episode starring Milei, who shared information about a “memecoin” in his social networks and whose price experienced a vertiginous rise to collapse just hours later, which generated a strong stir in the markets and shook public opinion.

The president’s announcement about the cryptocurrency triggered accusations of Handling and fraudAlthough Milei dismissed such accusations, and stressed that the “high volatility transaction” had been assumed mostly by foreign investors. This fact put under the scrutiny both the Argentine authorities and the Americans, who initiated investigations to clarify possible legal responsibilities derived from the promotion and dissemination of the “Shitcoin” through social networks of the head of state.

$ LIBRA: Impact on financial markets

The episode not only exacerbated political noise, but also influenced the perception of market risk. However, for JP Morgan, There was no political cost, Or even impact on the image of Milei, because in its latest report on Argentina it emphasizes that: “Certainly, the sensitivity of risk premiums at Milei’s approval rate is very high, so market volatility is a typical result of this type of event. “

“However, its level of approval has crossed more challenging situations. Its high support, which had fallen slightly before the episode of the Memecoinfrom 60% in January to 57%, they seem solid enough to avoid changes in its economic policy scheme, whose cornerstone is fiscal discipline, “says the Wall Street bank.

And he adds that: “In a context of political restructuring, the Government managed to obtain majorities in Congress and suspended the primary elections, which could strengthen its maneuvering ability to current challenges.”

JP Morgan 2.png

The events of the week seem to support this vision. For the financial giant, the fact that the Central Bank (BCRA) bought U $ 386 million In the course of the week (until Thursday) it is an indicator that the $ LIBRA scandal did not disrupt the bases of the economic plan.

Although he acknowledges that the cousins of the dollar nominated bonds increased, with the Spread Embi in 38 basic pointsand the gap between the official dollar and the parallel expanded to approximately the 15%.

In addition, the JP Morgan It emphasizes that the turbulence arising from the week will accelerate the negotiation of a new agreement and program with the International Monetary Fund (IMF).

Fiscal Perspectives and Economic Performance: Bank evaluation

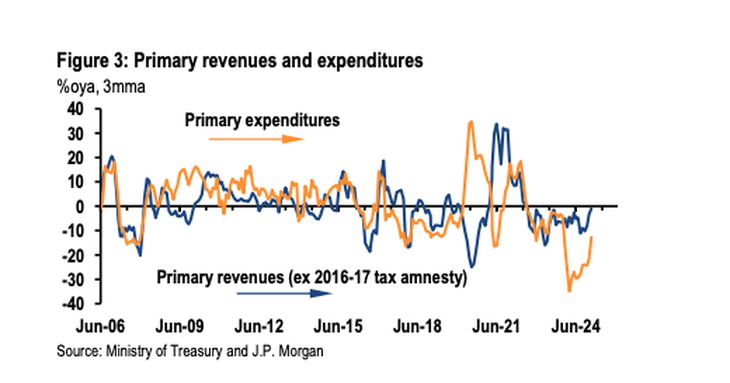

As is Goldman SachsJP Morgan stands out “The solidity in fiscal matters“which is reflected in the recent economic indicators. And applaud that:” The commitment to fiscal discipline remains firm. In January, the primary balance registered an equivalent surplus Au $ s2.3 billion (0.3% of GDP), which configured the first time from 2011 that two consecutive primary tax surpluses are achieved in January.

“However, the monthly surplus was a bit less than last year, in approximately 0.05% of GDP. For its part, the total tax balance also showed a surplus of the 0.07% of GDPcompared to a deficit of the 0.09% of GDP In the same period of the previous year, “the bank marks.

JP Morgan 1.png

“As we have pointed out, to maintain a balanced budget, fiscal consolidation should be based on increasing income, since there is less margin to adjust the expense. In fact, the elimination of the country tax In December, together with the absence of earning tax advances this year, it could imply a lower collection of approximately 2% of GDP. However, we hope that economic reactivation compensates for these losses, “the report warns.

“Tax elimination and the new indexation formula for retirement limit the set of adjustment in spending, so the increase in income becomes crucial to maintain budget balance, especially in an electoral year,” he warns.

Towards a new agreement with the IMF

The bank considers that the turbulence generated by the scam with $ Libra promoted from the X of the Argentine president, It could accelerate the negotiation of a new agreement and program with the IMF. Although the political and economic scenario presents challenges, “the commitment to fiscal discipline and economic reactivation are fundamental pillars in the government’s strategy”, which is seen with good eyes by the organism that leads Kristalina Georgieva.

In this way, JP Morgan joins other Wall Street giants to make it clear that despite the uncertainty generated by the episode of fraud and market volatility, “macroeconomic signals and commitment to fiscal discipline suggest a constructive base scenario “by the financial giant.

While research on the incident and negotiations with the IMF continue, the government of Milei and its economic strategy seem to win the support of Wall Street. Despite the magnitude of the scandal, in which a president recommends an unfounded “shitcoin” to finance the national SME ecosystem, the heavyweights of the investment bank chose to overlook this fact, and focus their attention on the appeal of the Economic policies of the president.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.