In Half the $ Libra scandala new report on the crypto industry He revealed the key role that Argentina plays in the ecosystem, both regional and global. The country is consolidated as a reference point, not only for the number of users, but also for the rise of the exchanges they find in their market a favorable terrain to grow. Something that the president also identified Javier Milei by promoting the operation investigated by justice.

And it is that in a challenging economic context and in full digital transformation, Argentina emerges as the main reference in the adoption of cryptocurrencies In Latin America. According to the document data, the country holds sustained growth in transaction volume, active users and regulatory development, which marks a paradigmatic change in the dynamics of the regional crypto ecosystem.

As can be seen from the report “Crypto 2024 industry“That she elaborated LemonDuring that year, Argentina received US $ 91,100 million in cryptoactive, which represents a 6.7% increase compared to 2023. “Bitcoin surpassed the stablecoins As an investment option due to exchange stability and lower inflation compared to 2023, ”says the document.

From Stablecoins A Bitcoin

And it is that the change in tendency is clear and is part of, according to the Exchange, in a relative recovery scenario: “Annual inflation descended to 118% –In a record of the 211% In 2023– and the volatility of the dollar was reduced, which allowed investors to diversify their strategies, ”he analyzes.

Historically, the high devaluation of the weight promoted the preference for Stablecoins as a value refuge. However, in 2024 there was a decisive turn and Bitcoin It became the most desired instrument above these stable currencies. It should be remembered that cryptocurrency experienced an increase in 122% Throughout the last year and reached a record value of US $100,000 In December.

“This trend was reflected in the user’s behavior: on the exchange platform there was a growth of the 126% In the purchase volume of Bitcoin, in contrast to a modest 44.4% In the purchase of Stablecoins ”, marks the report.

Lemon 2.png

Source: “Crypto 2024 industry.”

In addition, the composition of the holdings guarded in said Exchange evidenced the preference for Bitcoin, which represented the 36% of the total, while the stablecoins and the Argentine weights constituted the 27% and the 18% respectively.

Market dynamism is confirmed with use data that “four out of ten users that open an app crypto in Latin America do so from Argentina, and the country concentrates the 39% of active sessions in mobile applications of the sector ”. This despite representing only the 7.3% of the regional population.

Platforms that mark the rhythm in Latin America

The document found that the crypto sector in Argentina is structured around two giants in the market: Binance and Lemon. And it is that between these two platforms they concentrate the 64.2% of the active sessions, with the first at the head with a 34.2% And the second with a 30%.

It happens that the National Exchange holds more than 3.3 million historical discharges and in a transaction record that exceeded US $ 2,000 million in the last quarter of last year, which places it in the highest dimensions of the national crypto industry.

In addition, the integration of blockchain infrastructure with the traditional financial system is another milestone. According to the document, Argentine companies develop more and more solutions that allow:

- Open virtual accounts in dollars or euros.

- Receive international deposits accredited in Stablecoins (such as USDC).

- Use international visa cards to operate with cryptoactives abroad.

- Make payments in pesos in Brazil through the PX payment system.

“These innovations not only facilitate capital mobility, but also position the country as a financial integration laboratory in the digital age,” the Exchange analyzes in its report.

Lemon 3.png

Source: “Crypto 2024 industry.”

Argentina in the regional context

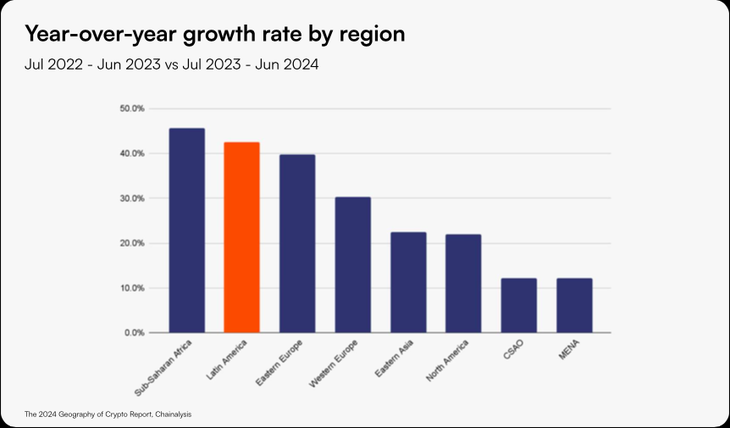

The report on the state of the crypto industry in Latin America highlights that the region registered a 42% increase in the volume of cryptocurrencies received in 2024, which translates into transactions for more than US $ 415 billion.

Among the leading countries are: Argentina, Brazil, Mexico and Venezuelathat are distinguished by their particular dynamics. For example, while the South American giant is committed to institutional adoption and speculative trading, the Aztec country is consolidated as a crypto remittance market and more towards the Caribbean, the stablecoins are used as a refuge in the face of high inflation.

“In contrast, Argentina evolved from a system dominated by the stablcoins – it is involved in Venezuela in 2023 – towards a preference marked by Bitcoin, driven by greater exchange stability and a reduction in inflation,” says the study.

Thus, with 22% of the total volume of cryptoactives in the region and an outstanding worldwide position – at the fourth place in the amount of active users of mobile wallets – “Argentina reaffirms as the true crypto epicenter of Latin America,” says the Exchange.

A digital and financial transformation model

When asked about the impact of the $ LIBRA case on the operation of the Exchange, from Lemon they pointed out in statements to Scope That, memecoins can be an entrance door to the crypto ecosystem, particularly those that seek to build communities.

Lemon cash.png

Source: “Crypto 2024 industry.”

However, they explain that if their risks do not communicate clearly, “they can affect trust and slow down mass adoption,” which is counterproductive for industry and ecosystem.

However, in an attempt to see the good side of Milei’s adventure, they slide that “this scenario marks a maturation point in the market, since users begin to operate with greater caution, by prioritizing transparency and the foundations of projects on speculation.”

On the performance of Argentina in the crypto ecosystem, the report concludes that it is the result of the convergence of multiple factors: “the need for protection against economic instability, the search for investment alternatives and a commitment determined by technological innovation.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.