The central axes of the economic debate are the future of the exchange scheme and the new indebtedness with the International Monetary Fund to which the government seeks to hug as a lifeguard. But, in parallel, some City tables followed the fall that starred in debt titles in pesos During the last wheels and reinforced the alerts on bullish pressures for interest rateswhich result in a higher financing cost for treasure.

This Monday, the Ministry of Economy will make the call for a New debt tender in pesos, which will take place on Wednesday. At the auction, it will face the expiration of a LECAP for about $ 4.6 billion. This operation will be given in a context of growing pressures on interest rates, which already In the last placements led to the Secretariat of Finance to shorten the issuance deadlines and to validate returns higher than those of the secondary market.

Debt in pesos: changes in the curve

In the short week you just finished, Treasury titles in local currency operated in lowas had happened on the previous wheels. On Thursday, in fact, there was an important Sel-Off of the Boncap (fixed rate bonds that are part of the long section of the curve). The exception was Friday: there was a rebound that allowed to cushion the weekly red.

Thus, according to calculations of the SBS groupthe week closed with a slight 0.2% rebound in the short section, a 0.2% decrease in the middle section and a Strong 1.8% drop in the long sectioncompared to the previous Friday. The setbacks are added to the weak performance of the previous weeks and promotes interest rates in the secondary market.

“The fixed rate titles continued to correct this week with falls accumulated in the long section around 2% and already operate with rates greater than 2.4% TEM (effective monthly rate). The short titles were also lazy, located in the topic of 2.65%, ”said IEB in a report sent to your customers.

The report compared the current yields of the public debt curve at a fixed fee with which it had two and three weeks ago: the rise is considerable. In the short section, most LECAP operated on Friday with TEMs of between 2.6% and 2.7%; February 21 were below 2.4% and February 14 below 2.3%. In the long section there are also increases in the rates of about two tenths.

image.png

Inflation, phase 2 and pressure on rates

The Consultant 1816 analyzed pressures on yields and government financing, and considered that they respond to a combination of three factors.

On the one hand, he indicated that the data of high frequency inflation “They anticipate a variation of the February CPI not very different from January, which I could postpone the next Central Rate cut “. In fact, several consultants estimated that last month closed with a rebound in general inflation. Indec will announce this Friday the official data.

Secondly, 1816 recalled that, In the last tender of debt in February pesos, the team of Luis Caputo validated rates above 2.5% Tem.

And finally, he reiterated that The continuity of the broad monetary base limit (BMA), which is fixed at $ 47.7 billion since July 2024, compresses system liquidity. “As long as there is no temporary horizon in which the central will make monetary policy again through the interest rate, the risk that interest rates will become endogenous (as the monetary base approaches the bma’s limit) will persist and that, therefore, therefore, The real rate is tendentially pressured up “he warned.

IEB It coincided in the diagnosis and added the exchange factor: “This correction is triggered with high frequency data that show a rebound or stagnation of inflation in February and similar measurements in the first week of March. Besides, There could be a disarmament of positions in pesos product of the rise of the financial exchange rates that eroded the dollar returns of those who were making ‘Carry’. Finally, the liquidity situation that, being adjusted, with the limit of the wide monetary base at $ 47.5 billion, generates expectations that real rates can go above causing the market to move forward to this situation and the longest titles correct accordingly. ”

In that sense, last week the BCRA went out to intervene strongly with the sale of reserves to contain the rebound of financial dollars and there was a strong rebound of the expectations of devaluation implicit in the future dollar market, especially for the post -election period. The City does not seem to buy the idea that the agreement with the IMF, which the government claims to have almost fastened, will come without considerable turn in exchange policy.

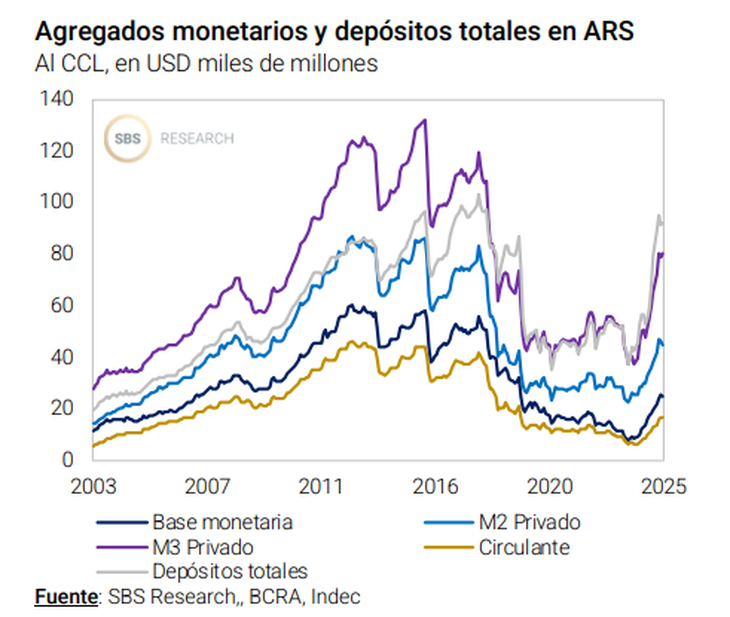

Caputo said that the agreement with the bottom and exit of the stocks will not imply a cimbronazo for the dollar because “there are no pesos”since the broad monetary base is much lower than the historical average and the new indebtedness will emphasize the hole of negative net reserves. But in the market they look at other numbers and believe that the pressure on interest rates in pesos operates against that possibility.

A report of SBS group raised: “It is very importantpressing on the imbalance between the weight stock and the stock of dollars, which we see how the main lock thinking about the exit of the stocks ”, together with the missing currency.

And he added: “For this reason, it is key to continue with the reduction of the financial cost of the instruments issued by the Treasury, since It is necessary to limit as much as possible the rate of growth of the debt stock in pesos so that this will press as little as possible when leaving the stocks, and the impact on the exchange rate is lower. Therefore, we repeat that in context of phase 2 of monetary policy, a liquidity in pesos of the system shown ‘Tight’ presses on short market rates and prevents reducing that financial cost of issuing short papers, as happened in the last tenders. ”

image.png

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.