European stock markets lead the ranking of stock markets that most rose in 2025, which caused many investors to put their eye on this market.

The European bags They head the ranking of the stock markets that more rose so far this 2025, which meant recategorization by different qualifiers towards “Overpone”. This happens within the framework of the Commercial War that the president of the United States began, Donald Trumpimposing tariffs on its main business partners. Thus, the fears of recession were revived, increases in inflation projections and possibly a longer cycle of high interest rates by the Federal Reserve (Fed).

The content you want to access is exclusive to subscribers.

If the ETF (quoted funds) Of the main bags of the world, it can be concluded that, among the first five that rose the most so far from 2025, four are European selective. In this way, Poland It rose 28.7%, followed by Austria, with 23.3%. Behind them, it appears Germany, with 21.3%; China, with 20.6%, and finally, Spain, With 19.2%. As against the main rates of Wall Street They have suffered cuts: only in February, the Nasdaq 6.2%collapsed, while the Dow Jones lost 3.1%, and the S&P 500, 1.9%.

Within that framework, the HSBC Bank He updated European actions from the “infraper” to “raised” rating. In parallel, he cut the qualification of US actions of “over -deprived” to “neutral”. “It is important to emphasize that we are not becoming negative regarding the actions of the United States, although we tactically believe that There are better opportunities in other places for now“said Alastair Pinder, head of emerging markets and Global Variable rental of HSBC.

The firm argues that the new coalition of Germany will achieve the approval of the “Bundestag” for its tax stimulus measures, it will contribute it to “Maintain the impulse of European actions and see an extension of performance, particularly among German values related to the domestic market.” “Also leave the door open to other countries to follow the same wake. A good way to express it would be the Mdax in front of the Dax and long defense actions, “the report added.

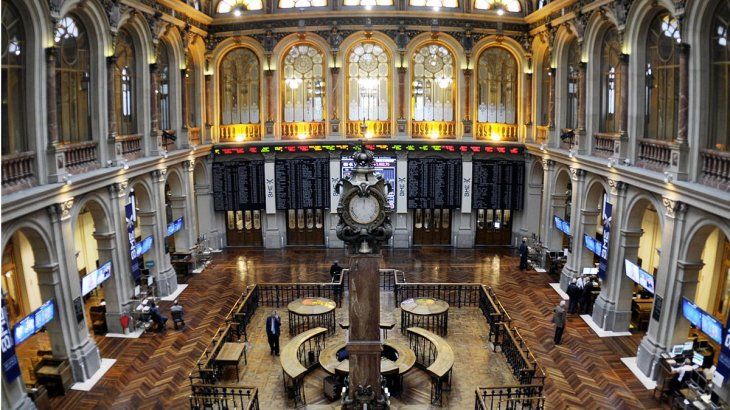

European Bags Madrid Ibex

Photo: Madrid

How to buy European shares from Argentina?

“From the local market, with contribution in pesos and dollars, European shares can only be purchased through Yields (Certificates of the actions). They have a conversion ratio. And, through mandate operations, they can operate abroad (also Europe, actions that coticate in regulated markets with CNV agreement), but it is only for qualified investors, “he told Scope, Emilse Córdobadirector in Bursatile.

Gustavo Neffapartner and director of Research For Traderson the other hand, he described as an “interesting” option, the Ieur (Ishares Core Msci Europe ETF). It is a ETF yield which was launched in January by the National Securities Commission (CNV). This index consists of European high, medium and low capitalization companies. Experts argue that this ETF is key if an investment strategy is taken into account by geographic diversification.

But you can also invest, through specific companies that have Yields. Some cases are, Unilever (United Kingdom/Netherlands), multinational consumer goods, especially in hygiene and food products, SAP (Germany), multinational that develops business software and technological solutions, Adidas (Germany), globally known sports brand and Astrazeneca (United Kingdom), Pharmaceutical Company, to name a few cases.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.