The S&P 500 index reached a record of 6,144 points on February 19, but since then it went back 9.5%, with more space to fall, according to the projections of several weight entities.

Morgan Stanley and Jpmorgan, two weight banks on Wall Street, They forecast that S&P 500 index could experience a drop of up to two digits In the worst scenarios.

The content you want to access is exclusive to subscribers.

The S&P 500 reached a record of 6,144 points on February 19, But since then it fell 9.5%, with more space to fall, according to the projections of several Wall Street firms. Michael Wilson, Investment Director of Morgan Stanley for the USA, He estimates that the index could fall to 5,500 points over the course of this semester.

This loss, which is considered moderate from the current levels after the strong fall of Monday, It is attributed to the fears of a possible recession. Wilson warns that markets are going through a volatile path, due to the concern for the impact of tariffs on business benefits. In addition, it suggests that investors should prepare for a drop of up to 20% due to the possibility of a recession.

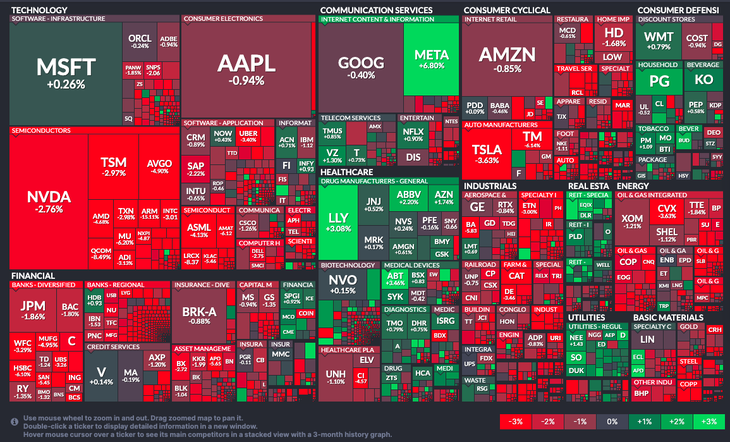

Wall Street.png

The markets operated with strong volatility from the assumption of Donald Trump

The bags could suffer a hard impact this year due to US commercial policy

The optimism that emerged on Wall Street after Donald Trump’s victory In the presidential elections it disappeared. Its erratic economic policies have generated distrust among investors. According to Dubravko Lakos-Brujas, responsible for Variable Income in JPMorgan, It will be difficult to foresee the possible negative effects of policies due to the lack of clarity on the moment, scope and depth of the changes. His team now considers that it is more likely that the S&P 500 does not reach 6,500 points for December, providing that the index could range between 5,200 and 6,500 points. In this scenario, JPMorgan estimates that the variability of the S&P 500 could reach up to 20% by the end of the year.

Lori Calvasina, head of investments for US Variable Income of Royal Bank of Canada, also sees a cautious panorama. Its model projects stagnant business benefits and flat interest ratessuggesting that the S&P 500 could close at 5,775 points in December. In Europe, Deutsche Bank expects the index to go back to 5,300 points, a level that was already observed during the 2018-2019 trade war.

Experts agree that investors who They bet on the S&P 500 long -term must be prepared for high volatility along the way. John Bartleman, CEO of Tradestation, points out that such activity has not been observed since the beginning of the Covid-19 Pandemia.

He Volatility index, Vix, which measures the expectations of future movements of the S&P 500, It shot 26% last week, a level that was not seen since the 2020-2022 period during the pandemic. Although volatility has led to market sales, analysts point out that these falls have been more ordered compared to other pronounced falls, such as in August.

Doubts about the short and medium term persist, Especially considering that the S&P 500 has closed positively in seven of the last ten years and has risen more than 100% in the last five years.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.