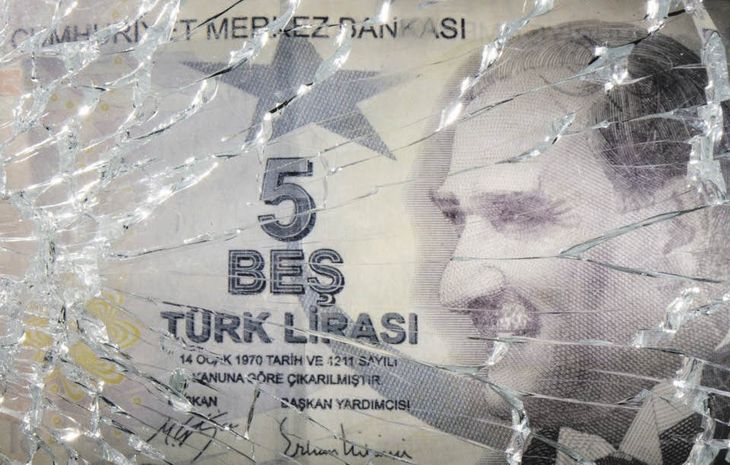

The bonds and actions of the country fall strongly in the midst of doubts about the rule of law, given the arrest of Erdogan’s main opposition leader. In this way, the titles register their worst daily performance since the end of 2023.

The Turkish Lira reached 12.7% this Wednesdayreaching a historical minimum of 42 units per dollar, although it then moderated the fall and retreces 4%. Turbulence extends to bonds and actions, which also suffer strong losses, after the arrest of President Tayyip Erdogan’s president.

The content you want to access is exclusive to subscribers.

The opposition described the measure against Ekrem Imamoglu, mayor of Istanbul, of “coup attempt”, and seems to culminate an aggressive legal repression of several months against opposition figures throughout the country, which has been convicted as a politicized attempt to silence dissent. Imamoglu was expected to be appointed presidential candidate of the main opposition formation within a few days.

Pag17_op.jpeg

The opposition described the measure against Ekrem Imamoglu, mayor of Istanbul, of “coup attempt”

The arrest of Erdogan’s main opponent, hit the markets

The Turkish lyre was quoted at 38.90 units per dollar, erasing some losses of the historical minimum touched previously, but even toYes, having had its greatest fall since July 2023. The previous decline to 42 units marked one of the largest intra -intra -absolute movements of the lyre of those that are recorded.

International government bonds of Türkiye They were also pressured and the longest -term maturities suffered the most pronounced falls. Those of expiration at 2045 subtracted 1.6 cents, to 85,117 cents.

“Bonds and currencies are under pressure in Türkiye this morning, after a possible presidential candidate, the mayor of Istanbul, was arrested,” said Fontisek Taborsky, of ING. The Minister of Finance, Mehmet Simsek, said they are doing everything necessary to guarantee the proper functioning of the markets, without giving more details.

The shares also collapsed, which reflects the concern of investors for the rule of law. Turkish first class values lost almost 6%, registering their worst daily performance since the end of 2023.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.