The data comes from a report presented by the Vice President of the BCRA, Vladimir Werning, during a meeting of emerging markets organized by the International Payment Bank.

In the midst of speculation about the amount of New agreement with the International Monetary Fund (IMF)he Central Bank of the Argentine Republic (BCRA) He informed that, since the assumption of Javier Mileihe only managed to retain less than 30% of dollars Acquired in the exchange market, data that demonstrates the difficulty by accumulating more reserves.

The content you want to access is exclusive to subscribers.

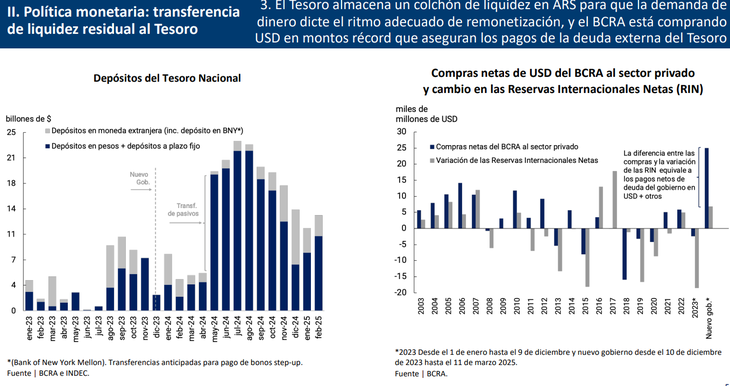

The data comes from a report presented by the vice president of the BCRA, Vladimir Werningduring an emerging market meeting organized by the International Payment Bank (BIS). According to the document, Between December 2023 and mid -March 2025, the monetary authority bought around US $24,000 million, But he could only keepUs $ 6,500 million of that total. One of the causes was for the fulfillment of the debt commitments in dollars it maintains.

Screen capture 2025-03-25 090524.png

According to the document, between December 2023 and mid -March 2025, the monetary authority bought around US $24,000 million

The phenomenon intensified in recent days: the Central Bank sold US $ 1,204 million in the single and free market (MULC) in just over a week. So far in Marchthe entity led by Santiago Bausili accumulates a seller balance of US $ 580 million And, if the negative trend persists, this could become the worst month of Javier Milei’s management in terms of foreign currency acquisition.

As for the gross reserves of the Central Bank, These decreased to US $ 1,462 million during the last week, being at US $ 26,626 million, the lowest level since September 2024. Since January, the total drop amounts to $ S5.079 million.

In search of the US $ 20,000 million of the IMF

This week, The International Monetary Fund will hold an informal meeting between its technical staff And the directors to discuss, in a preliminary way, the scope of the agreement with Argentina, as confirmed by the Bloomberg agency. The same source estimates that the program in question would be around the USD 20,000 million.

It remains to be determined if that figure will include both debt refinancing and the net contribution for cancellation of non -transferable letters. According to IMF market -based market estimates, during the four years that would cover refinancing, the country would face capital maturities for approximately USD 14,000 million.

For its partfrom vector they warned that, although greater clarity on the agreement with the IMF is keydoubts persist about whether a significant disbursement will be sufficient to sustain the transition until the opening of the exchange rate. Besides, In case this measure is imminent, it is also uncertain if the government can maintain the necessary exchange stability to continue with the disinflation process and reach the October elections with a relatively stable economic scenario.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.