The appreciation of the exchange rate, in a context of stocks and low stock of reserves, encouraged a growing deficit of the balance of services In recent months. It was also one of the elements that promoted the Importsalthough here they also influenced the process of deregulation and commercial openness that the Government is carrying out.

Both factors explain the current account deficit suffered by the BCRA, typical of moments of delay in the price of the dollar. To this were added the Debt paymentsand a greater use of currencies to intervene directly in financial dollar contributions.

It is precisely the latter one of the points that the International Monetary Fund (IMF) usually question more of exchange policy. Not only for direct intervention but also by the scheme “Blend”which forces exporters to liquidate 20% of their sales in the CCL.

In the last eight wheels the problem increased since the monetary authority had to sell US $ 1,361 million to sustain its “exchange tab Disarmament of “Carry Trade” strategies. This occurred in the midst of rumors about a possible IMF demand to make exchange adjustments in exchange for sealing a new agreement for debt.

Facing the stage described, since the beginning of January The central has already lost US $ 6,658 million of its reserves.

BCRA.png sales

Source: Economic Studies Management of the Province Bank.

Yields credit in dollars and presses reservations

An analysis of the Economic Studies Management of the Province Bank He explained that the average sales of recent days in the MULC is a bit higher than the average of January-November 2023, and in line with December 2023, before the last devaluation.

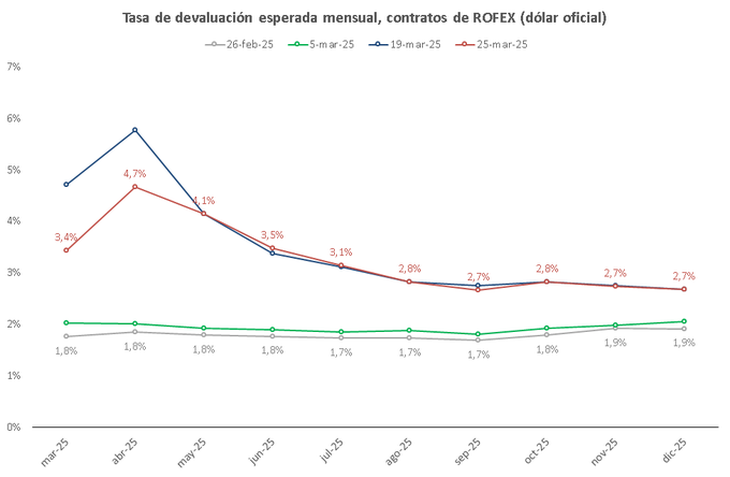

“This deterioration is due to the lowest debt flow of companies in dollars. Financially, A company is indebted in foreign currency if it estimates that it will be cheaper than it in pesos; For that, the interest rate in pesos must exceed the interest rate in dollars + the expected devaluation. As the latter went up, the credit demand fell in currency“They explained.

This was reflected in the contracts of the future dollar; For the next two months the prices agreed in the ROFEX came to throw an expected implicit variation greater than 8%well above the “Crawling Peg” of 1% scheduled by the central.

Crawl.png

Source: Economic Studies Management of the Province Bank.

Facing the future, in the province they ensure that The key is to see if when the tensions pass the demand for creditin a context in which imports of goods and services exceed exports, a dynamic that does not seem to be close to reversing, but the opposite.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.