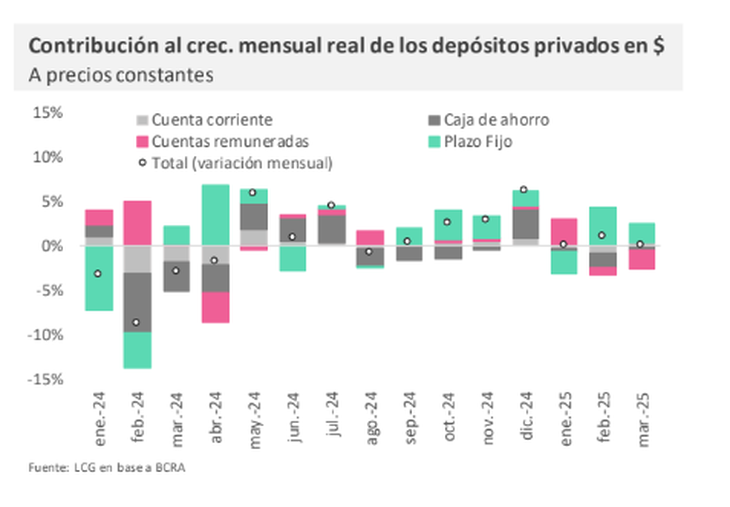

Amid the exchange tension, the fixed deadlines rose although a moderation of the placements was noticed in the middle of last month. Meanwhile, the FCIs were the most affected.

Volatility in the exchange market impacted fully on Common investment funds (FCI), who suffered a drop of 18% in March, according to a private report. This setback almost completely compensated the growth of fixed deadlines, subtracting 2.2 percentage points from the Added growth of the financial system.

The content you want to access is exclusive to subscribers.

Although fixed deadlines showed a monthly increase of real monthly 5.2%, analysts warn that this growth was mainly concentrated in the first half of the month. From mid -March, With the resurgence of exchange tensions, the demand for this instrument began to moderate.

According to a LCG reportduring the first two weeks of the month the term deposits increased by $ 690,000 million, promoted by a greater search for yields in pesos in the face of a context of relative stability. However, as of March 14, the placements grew only $ 330,000 million, reflecting the change of financial climate.

In parallel, the deposits in sight (current accounts and savings banks) registered their third consecutive monthly fall, with a real decline of 0.2%. However, in interannual terms, 3.6% are maintained above the levels of March last year.

Top, from LCG they warn that the growing uncertainty regarding exchange policy, in a negotiation context with the IMF, could affect the placations in pesos. “The disarmament of local currency positions is still limited, but instability persists and devaluation expectations They are maintained above the rates in pesos, a reactivation of savings in national currency is not expected ”concludes the report.

Screen capture 2025-04-06 143435.png

The placements in pesos, in the sight after the exchange tension

Fixed term at 30 days: How much does each bank pay?

For its fixed term deposits at 30 days, Banks offer rates that reach up to 31% per year, with almost 10 entities registering yields above the level set by the BCRA.

Next, bank by bank, with rates from highest to lowest:

- REBA: 31% annual

- Banco Mariva: 30.75% (30.15% not customers)

- BANK: 30%

- VOII BANK: 30%

- CMF Bank: 30%

- BICA BANCO: 30%

- Bibank: 30%

- Macro Bank: 29.5%

- MERIDIAN BANK: 29.5%

- Bank of Corrientes: 29%

- Regional Credit Financial Company: 29%

- Banco Galicia: 29%

- CREDICOOP BANK: 28%

- Nation Bank: 28.5%

- Galicia more: 28.5%

- Province Bank: 27%

- Mortgage bank: 27% (30.5% for no customers)

- Chubut Bank: 27%

- Tierra del Fuego Bank: 27%

- Julio Bank: 26.5%

- ICBC: 26.5%

- COMAFI BANK: 26.5%

- BBVA Bank: 26.25%

- Dino Bank: 26%

- City Bank: 25%

- Banco del Sol: 25%

- Santander: 25%

- Bank MAS SALES: 23.5%

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.