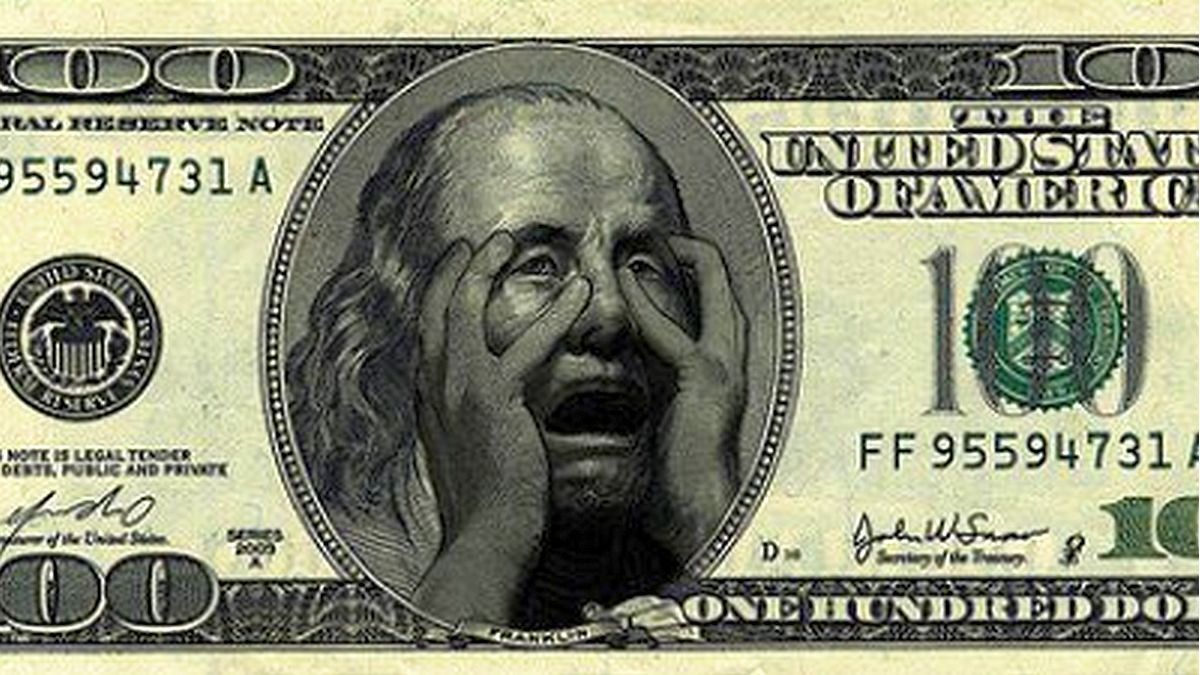

The current climbing of Vix underlines the magnitude of the fear that reigns in global markets.

Fear seized markets bluntly. This Monday, the VIX index –known as the “index of fear” by measuring implicit volatility In the S&P 500 options-it reached extreme levels, standing at 46.98 points after touching a maximum of 60, a level that was not seen from the most convulsive of the Covid-19 pandemic in 2020.

The content you want to access is exclusive to subscribers.

At certain intradic moments, some reports indicate that the Vix He even touched the 60 points, which suggests a financial panic environment similar to that registered in previous crises, such as 2008 or during uncertainty peaks in 2020

This increase reflects a strong rebound in risk aversion by investors, who have chosen to take refuge in low -risk assets after significant falls of significant falls. The collapse of the S&P 500 – which has dropped 10.5% in just two sessions, losing more than 5.4 billion dollars in stock market capitalization– It has generated a global uncertainty environment, extending the pressure to European and Asian markets, where decreases greater than 6% have been recorded in the main indices ,.

The VX, developed by CBOE Global Markets, acts as a fear thermometer on Wall Street. When investors expect sudden movements in the market, the demand for options to cover increases, raising the VIX to levels that, by exceeding 30, already indicate a high volatility; However, by exceeding the 50, an alert signal for the investment community is entered.

Another key indicator appears

At the same time, the Fear & Greed Index of CNN has fallen to the 4 points, located in the “Extreme Fear” area, which reinforces the perception of generalized pessimism in the markets. Experts from various sources, including reuters and analysts in TradingView and Barron’s, agree that these volatility levels reflect a high degree of uncertainty, where many investors resort to coverage strategies in the face of the possibility of sudden and prolonged declines movements.

NYSE.JPG ACTION BAG MARKETS

While investors prepare for possible additional falls and continue to evaluate coverage strategies, the key will be detected if these extreme levels represent an opportunity.

Some analysts warn that, although historically similar peaks have been followed by “fool rallies” – overflower rebounds in the middle of a bearish environment – caution remains the best strategy in the face of a possible extension of panic in the market.

While investors prepare for possible additional falls and continue to evaluate coverage strategies, the key will be detected if these extreme levels represent an opportunity to enter the market or if, on the contrary, they presage sustained volatility that could prolong the recession. The looks focus on the next economic data and on any adjustment signal in monetary policy that can calm or intensify this climate of uncertainty.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.