The possession of Banks of Fiscal Liquidity Letters (LEFI), the monetary regulation instrument that replaced the liquidity letters (Leliqs), was located at the beginning of April in the lowest level since its entry into force. According to experts, this would obey Central bank measure announced in December but that began to govern this month, related to the Bank lace.

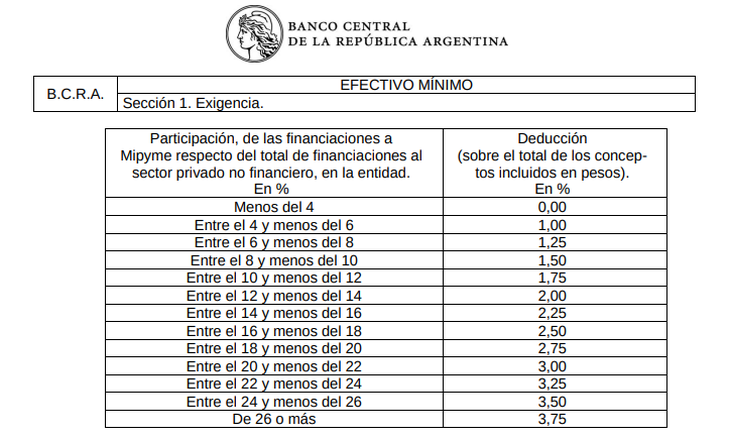

This is the Resolution A-8159 of the Central Bank that established a change in the way of calculating the lace -The minimum cash immobilized by the entities- for loans to MSMEs. This modification would have caused a drop of about $ 5 billion of the positions of Lefi’s financial entities.

Lefis.png

The circular of Central Bank signed in December last year states that as of April 2025 the deduction percentages are reduced by half of financing to the private sector with respect to the total loans of the entity’s portfolio.

In the event that a Bank has between 4% and 6% of your loan portfolio to the non -financial private sector composed of financing to MSMEs, then since the first day of this month you have to immobilize 1% on the total credits in pesos.

According to the economist Federico Machado, of the Open Economy consultant, this produced a “strong disarmament of Lefi in the first days of April, drilling for the first time the $ 6 billion floor”. At the end of March the banks had about $ 11 billion and in April they stayed with a little less than $ 6 billion. The economist points out that The money migrated to the lace.

“The banks were having yields with the Lefi, but with the lace. If they are having lower performance, it is expected to be transferred to the fixed term rates, ”Machado told the scope.

lace.png

That implies that Fixed term deposits could render less, although marginally. In fact, according to Machado, it is likely that the banks “have already been adequate.”

As he says last The First Capital Group report, financing to the private sector amounted last month to $ 64.6 billion, which implied a growth in a year of $ 44.6 billion, that is, 221% nominal of increase, which gives a real growth of 108%.

According to the Central Bank communication, MSME financing include “instrumented through the purchase of electronic credit invoices Accepted by companies, as well as the tenure of funds subject to the special regime for the constitution of common SME investment funds ”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.