And it is that the Government managed to ensure a first disbursement of 60% of the program agreed with the International Monetary Fund (IMP) —As US $ 12,000 million, according to 1816—, an unusual fact in this type of agreements. To this is added the visit of Scott Besentsecretary of the US Treasury, the renewal of the Swap with China and the flexibility of exchange restrictions, What translates a clear message for global investors.

Aprup of the US to emerging capitals to emerging

For years, faith in the dollar was unquestionable. Although the US represents about 26% of the global internal (GDP), Wall Street concentrates more than a third of global investments in sharesaccording to a report from Goldman Sachs.

“Foreigners owned US $ 33 billion in shares and bonds called dollars at the end of 2024, of which U $ 14.6 billion were indebted and the rest in shares“, He quotes the document that slides that that could have changed last week, since both the dollar and the US Treasury bonds – considerate as a safe refuge par excellence in times of crisis -” became the main victims of a market collapse derived from Trump’s tariffs. “

Goldman.png

Thus, uncertainty adds to other factors, such as high expectations of inflation, increasing debt costs and budgetary restrictions within the internal of that country, so, so, so, so, The search for alternative shelters in volatility times direct capital to emerging markets. Places such as China, India and Brazil appear on the horizon as attractive destinations for these flows, so the question that arises is If with the new agreement with the IMF and the partial lifting of the Argentine Stim, it could capture part of those funds.

Punished bonds, banks and energy: the local “equity” as an opportunity

The lifting of exchange restrictions represents a significant change for Argentine financial markets, with a direct and positive impact About the local equity. This measure not only improves the predictability and trust of investors, but also opens the door to a potential recategorization of Argentina as an emerging market by the main international indices. Such recognition could generate a greater capital entry, Increase liquidity and revalue assets.

The Sunday of the Consultant 1816 He maintains that after 15 months of a mixed and unconventional scheme, Javier Milei’s government begins to turn to a model “mainstream”And aligned with the practices of Emerging countriesS: broader exchange flotation, remumination with weights and abandonment – at least for now – of the idea of dollarization based on a fixed monetary base. And warn: It is a plan of “To all or nothing“:” If it works, macroeconomics could stabilize with fiscal surplus and flexible exchange rate; If it fails, the currency would weaken even more. ”

Matías Waitzelpartner of At investmentsexplains in dialogue with Scope That, the New international and local scenario, could shoot a re-rating of Argentine assets: “The sovereign bonds They operate with very punished parities and the local equity, especially in sectors such as banks and energy, has a significant Upside potential. ”

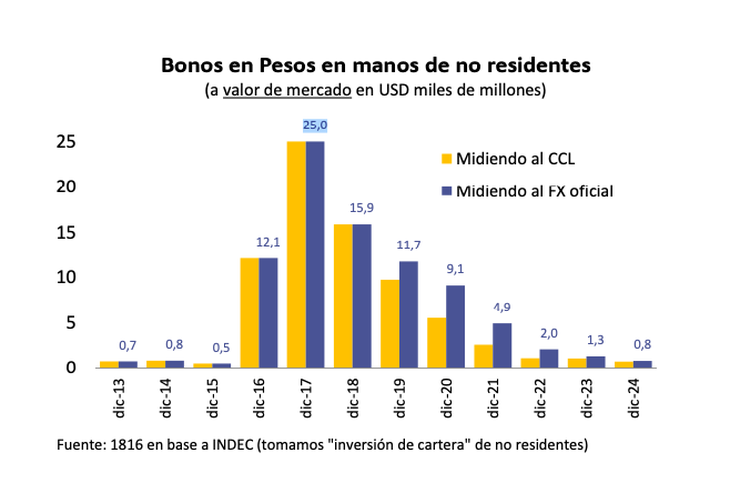

1816 1.Png

He Citi It coincides with that analysis. In a report on Friday, he highlighted the potential of the Argentine financial system, which still exhibits a low credit penetration despite a strong structural demand. “We maintain a purchase recommendation for Galicia (Ggal)”They said from the American bank.

Among the favorites, Waitzel stands out YPFfor its ability to generate box in a standardization environment; Pampa Energywith projections of electrical expansion; and South gas transporterkey to new exports from Vaca Muerta. In the financial sector, Supervielle and Galicia They appear well positioned to capitalize on credit reactivation.

Financial flows vs. Direct foreign investment

Gustavo Neffapartner of Research For Tradersanalyzes in statements to this medium that, the first thing to differentiate is the financial flows of those of foreign direct investment, which involve the filing of productive capital in an economy, in this case Argentina.

Neffa points out that, if the US manages to advance successfully in its commercial strategy and reaches an agreement with China, it could sustain moderate tariffs without the need to eliminate them completely. In that scenario, many US companies would choose to repatriate part of their productive investments and reinvest them in the domestic market, which would cause a net capital flow to the US, instead of an exit to emerging economies.

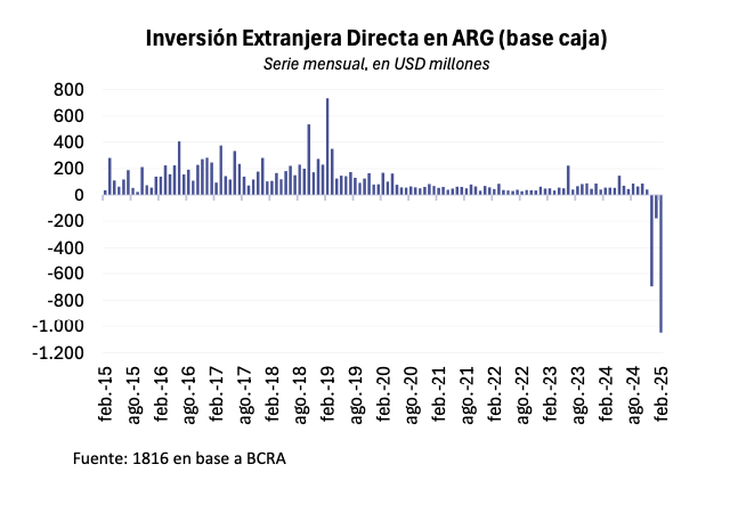

1816 2.Png

On the other hand, he acknowledges that we are witnessing a “Financial War“In full development. China reduces its exposure to US Treasury Bonds, accumulates gold reserves and advances in the disdain of its assets. This trend could trigger a greater dollar depreciation. In addition, other allied countries of Beijing or those outside the block of “friendly countries” promoted by Trump could join this process, which would further exert more pressure on the American treasure titles.

Nephfa is bluntly pointing out that the US debt market is gigantic, with about a third of its titles for winning this year. Meanwhile, China increases its interest rates, which could generate short -term fluctuations in Financial flows. In this context, the possible dollar devaluation would benefit emerging economies By strengthening their coins and increasing commodities prices, which, in particular, would result in Un Significant impulse for export regions such as Latin America.

The golden opportunity for Argentina

For Pablo RepettoResearch Chief in Aurum values, Argentina and Mercosur have a golden opportunity in the current context of commercial tensions between the great powers. “As international trade is affected and the world perhaps enters a recession, the natural resources and productive capacity of Argentina are emerging as an important advantage,” slides the strategist.

“This situation presents an opportunity for Argentina and other Mercosur countries to play a key role in the global economy. In addition, financial flows also become relevant in this context,” Repetto brand.

Neffa concludes that, beyond financial flows, Argentina needs to solve its structural problems to attract direct direct investment. Among the keys to achieve this, the need to reduce inflation, accumulate reservationseliminate – completely- the change control and guarantee a competitive exchange rate. “Legal certainty and continuity of tax reforms are also fundamental to provide confidence to investors,” he says.

In a world where traditional pillars shake and capitals look for new shelters, Argentina emerges with great potential: by taking advantage of the cola of the reconfiguration of the global financial order, the country has a chance – at the same time unique in decades – to reposition itself as a key actor in the emerging universe and attract investment flows.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.