He Wholesale dollar closed the last business day of the week with a price of $ 1,126 For purchase and $ 1,135 For sale, which represented a daily drop of $ 65. Despite this punctual decline, in the weekly accumulated the currency rose $ 52.50. In the retail segment, the exchange rate in the National Bank drilled the threshold of the $ 1,200, in which he configured The third day of operations under the flotation regime Between bands. While it is soon to determine which instruments paid better in this new context, the market already has A clear winner, At least in the short term.

Already with the new changing scheme in progress, the S&P Merval measured in dollars He recovered part of the land he gave in the first quarter (approximately 30%) and climbed a 10.3%driven by the drop in cash with Liqui (CCL), which retreated 5.2%. However, in pesos, the index of Argentine bags and markets (Byma) lost 3.1%, and closed the week with a daily decline of 4.7%, at 2,177,974.91 points. Even so, in its dollar version, it rose 0.6% and stood at 1,850 units.

The Bonds in dollars They recovered enthusiasm, especially those with a long stretch like the Global 2035 (GD35) and the Global 2041 (GD41), which came up to 9.6% in New York. Although with the exchange rate in full recoil, many investors chose to position themselves in instruments in pesos. The LECAP showed rises of up to 3.4%, the Boncap climbed up to 5.6%and dual bonds with a fixed rate and tamar adjustment rose up to 3.5%.

The Financial Assets Week

Thus, as explained Matías Waitzelpartner of At investmentsin dialogue with Scope, The first week of the new exchange band regime brought a forceful message by the market: “Trust begins to recover”And it is that in just three wheels, both the bonds and the Argentine actions reacted strongly, accompanied by a more favorable international context.

For the financial advisor Pablo Das Neves “In statements to this media,” the week that closed Wednesday “was atypical for the market” and warns that “Do not be guided by the first impressions”, Since prices begin to adjust and agents to incorporate this new market phase.

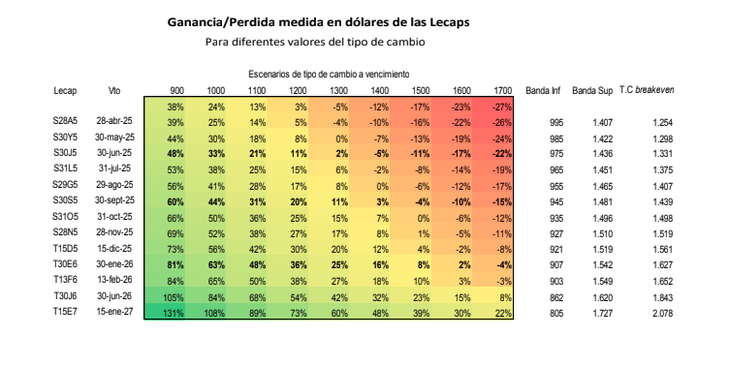

Lecaps quantum.png

Source: Quantum Finance.

For its part, Diego Martínez Burzacocountry manager of INVIUanalyze the international plane and compare it with the premises. It happens that international actions, in particular those linked to global commerce, due to the escalation in the commercial war promoted by Donald Trump. This international tension directly affected a “ASSET”Very operated by the Argentines, so they were amplified losses in pesos.

The winners and losers of the first week without stocks

For Waitzel The great winners were the global bonds. Strictly speaking, those with a long stretch such as GD35 and GD41, which came up to 9.6% in New York. He explains that the compression of rates was so marked that the entire curve closed below the 12% return rate (IRR), “Something unthinkable weeks ago”

For the strategist, the market read positively the combination of Macro order, external financing and the elimination of the Blend dollar.

In the national “equity” segment, Waitzel confirms that the variable income also joined the party. “The actions of YPF and Pampa led the renewed interest in the energy sector, while the banks – as Supervielle (SLE) and Grupo Financiero Galicia (Ggal) capitalized the expectation of credit recovery and a more stable economy. And it is that in a framework of lower intervention and gradual disarmament of the stocks, investors begin to rotate to more risky assets With solid foundations.

Das Neves coincides with that look and slides that despite the “Risk off”Global, the Argentine ADRs closed with profits, as is the case of Edenor, YPF and Supervielle. For the expert, “The surprise was seenthat despite the international prices of crude oil, he invested in the purchase of the Petronas subsidiary and its action shot 11%, ” Oil & Gas Argentine, he says.

“In the local square, the S&P Merval gave lost measures in pesos, But measured in dollars had important profits Given the fall of almost 6% that had the MEP dollar, ”adds Das Neves.

Martínez Burzaco concludes that Argentine actions showed a solid rebound, driven by the appreciation of the peso against the dollar, particularly in the cash. He analyzes that the sovereign bonds also rose strongly, and finished consolidating the good moment of local assets.

In contrast, The big losers of the short week were the yieldswhich led the losses affected both by the fall of the implicit exchange rate and by the global recoil of actions linked to trade, in the midst of new commercial tensions driven by Trump.

The new era champion of the market

For Martínez Burzaco the great winners were, “definitely”, investments in pesos. In particular, the CER, LECAP and BANCAP bondsthese latest instruments of greater term to fixed rate.

“This behavior is explained, in the first place, by the credibility anchor generated by the new exchange regime. The support of the reserves of the Central Bank and the arrival of loans, which widely exceeded the initial expectations, provided a strong power of intervention and support,” warns the Inviu strategist.

For analysts, the next “DEALS“They come from the side of”Carry Trade “. Because in the current exchange scheme, the exchange rate is likely to remain close to the band average in the short term, favored by the positive seasonality of agricultural exports liquidation and the flexibility of the missing controls.

Quantum.png

Source: Quantum Finance.

Das Neves concludes that The pressure from the Casa Rosada to the field to liquidate as soon as possible will push the exchange rate to the lower band. Although he warns that while these circumstances are seasonal, In the short term it facilitates the cheap dollar. In that sense, “the best titles for this type of Trade are the Tx26 and the lyrics of June and July”, As the interest rate is expected to remain at high levels, with bullish bias, until a new slowdown of inflation is confirmed.

So, The first week without stocks made it clear that the market is willing to validate the new exchange rate regimeat least at this initial stage. With a financial exchange rate in recoil, a significant compression in the rates of global bonds and a rotation towards assets in pesos, investors marked their preferences: lower official intervention, solid foundations and expectations of macro stability.

While the global environment imposed certain limits –especially for the yields-, local yields showed encouraging signs. The great challenge, now, will be to sustain this incipient confidence with fiscal consistency, disinflation and a credible monetary standardization. The market has already given its verdict: The vote of trust is, but it is not unconditional.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.