In a report released on Thursday, Fitch said the exchange reforms and the new program with the IMF open a “clearer scenario” To strengthen the reserves of the Central Bank and eventually recover access to international credit markets. Currently, the qualification of the Argentine debt is only three steps above the selective default.

The qualifier also positively valued the fiscal adjustment implemented by the current administration, which allowed to close 2023 with a primary surplus of 1.8% of GDP, and stressed that this policy helped eliminate direct monetary assistance from the Central Bank to the Treasury.

Fitch evaluation

However, Fitch warned that some tools used by the government to contain inflation – like the slow pace of depreciation of the official exchange rate, capital controls and financial repression mechanisms – although they were effective in an initial stage, also caused an appreciation of the weight above their equilibrium value.

In that context, the report indicates that the accumulation of international reserves It was modest for 2024, but that in the first months of 2025 began to observe net currency exits, partly as a result of the disarmament of “Carry Trade” strategies. According to Fitch, in March, gross reserves fell au $ 24,000 million, while the nets – disseminating the Swap with China, lace and repurchase agreements – remained around US $ 7,000 million, without large variations since the beginning of the mandate of Milei.

Despite the persistent challenges, Fitch considers that the government has better conditions to manage the economic transition than in previous episodes, which could be key to a future improvement in its credit note.

What does the City say?

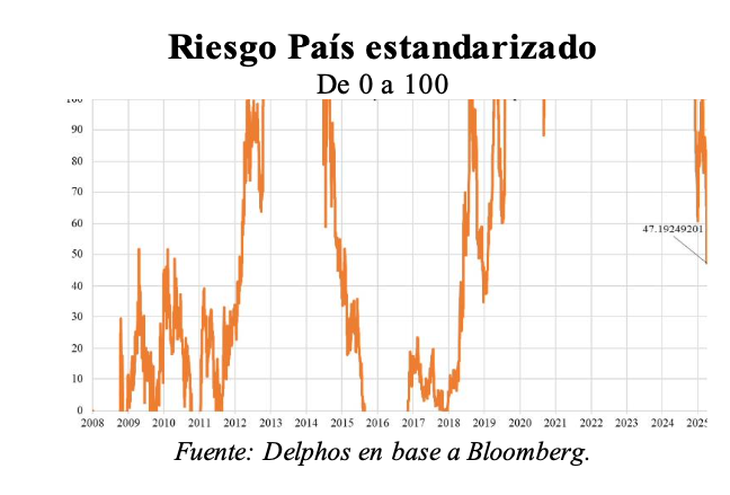

The last report of Delphos Investment He points out that, when the country risk has been standardized at levels of 50 – as currently occurs – it can be affirmed that there is a relative improvement, although not absolute, compared to the January values, when the SPRADA came to drill the 570 basic points. “Currently, the EMBI is located around 750, which reflects a relative deterioration against the global credit universe,” says the document.

When comparing the main macroeconomic variables of Argentina with those of other emerging countries of similar qualification – such as Pakistan (CCC+), and Angola, Senegal, Nigeria and Egypt (all with rating b -) – in terms of fiscal results, economic growth and current account, Argentina stands out bluntly.

The only variable in which Argentina was lagging regard To its comparable was the level of gross reserves, a relationship that is reversed with the recent disbursements announced. In this sense, Delphos considers that the last piece of the puzzle could have been completed: BCRA recapitalization. “This advance could be translated into an upward review of the Credit Qualification of the Argentine Sovereign Debt, currently in CCC,” he says.

And it is that Pakistan, our closest comparable, registered a rise in its credit rating by the CCC+ A B- Fitch Agency. According to the qualifier, the improvement is explained by macroeconomic progressin line with the commitments assumed by the country within the framework of the program with the IMF.

Delphos 2.png

Source: Delphos Investment.

Regarding fiscal consolidation and monetary policy, Pakistan exhibited significant advances: It is projected that the fiscal surplus doubles by 2025, reaching 2% of GDP, while a contractive monetary position would contribute to strengthening international reserves. However, these still remain at low levels (US $ 12,750 million), which continues to restrict access to external financing. Therefore, the bulky maturities that must face in the coming years (approximately US $ 30,000 million until 2027) positions them in a fragile situation.

While Argentina’s fiscal situation presents certain similarities –With a new primary surplus goal of 1.6% of the PBI-, the central difference lies in the approach adopted to reach it. While Pakistan based its adjustment on tax increases, the Argentine economic team prioritized the reduction of spending with a lower tax burden. In addition to this, the projected growth of Pakistan for the year 2025 is 3%, compared to 5.5% estimated for the Argentine economy.

“From this perspective, Argentina is in a relatively more favorable situation than Pakistan, which still faces a challenging combination of low level of reserves, commercial deficit and a demanding schedule of maturities in the short term. Under this line, an improvement in the credit rating of Argentina seems to be, more than a possibility, a matter of time, considering the fiscal and monetary position comparatively more solid that exhibits in front of countries like Pakistan,” warns the report.

Delphos 1.png

Source: Delphos Investment.

Nevertheless, The partial exchange restrictions that still persist under the current system are an impediment to materialize this improvement in the qualification. To do this, the BCRA announced that a new series of Bopreal will be issued to a period of three years for an amount of up to US $ 3,000 million, with the aim of ordering the stock payments of commercial debts, dividends and commercial debt services retained.

While the formal change by the qualifying agencies could take, The markets already began to anticipate this improvement during the week. However, and despite the fact that Argentina exhibits more solid macroeconomic metrics, a disconnection between these foundations and the perception of market risk persists, which is reflected in that Argentine bonds continue to yield above their peers.

Even so, there is room for additional country risk compression, especially as convergence towards comparable curves is consolidated. In this sense, the next reasonable objectives would be Nigeria and Pakistan, both with B- qualification and sensibly lower yields.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.