The support of international organizations to the Argentine government was overwhelming, since the agreed financing amounts give it a considerable “mattress” of dollars to defend the new exchange scheme, and relieves the load on the capital account. Neverthelessfrom next year, the maturities of the debt become very bulkywhich will force the Central Bank (BCRA) to accumulate reservations in a sustained way, and Argentina to return to the international market to “roll” liabilities.

The economic team of Luis Caputo recently closed a new according to the International Monetary Fund (IMF) for US $ 20,000 millionof which US $ 15,000 million will be disbursed at 2025. This figure will be added US $ 6.1 billion of other YU $ 2,000 million organizations of a repo with banks.

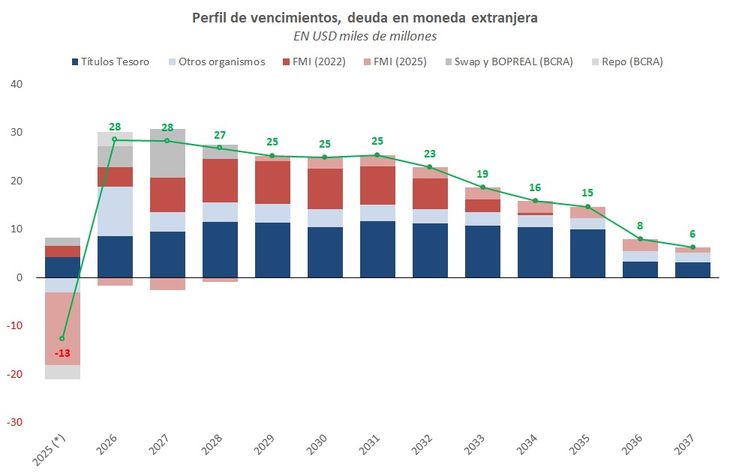

Thus, The national public sector account went from having an expected deficit to a surplus of US $ 12.6 billionfor which The panorama for this year in matters of maturities was already clear. Nevertheless, The forward perspectives are much more challenging.

The new agreement with the IMF includes four and a half years of grace, in which payments should not be made. However, until then If obligations corresponding to the calendar set in the renegotiation of 2022 will runheaded by the Minister of Economy at that time, Martín Guzmán.

image.png

According to a survey carried out by the Economic Studies Management of the Province Bank, based on data from the Ministry of Finance, Between 2026 and 2028 Net expicrations in foreign currency, adding those obligations with organisms, private bondholders and by the SWAP, give a Annual average of US $ 28,000 million. This amount is equivalent to the current stock of gross reserves, except lace for dollar deposits.

Exitations profile.jpg

Source: Economic Studies Management of the Province Bank.

The maturities of the Guzmán and Caputo agreements

Also, from 2029 The payments of the last two agreements with the IMF begin to overlap. Consequently, for this year the obligations amount to U $ 25,000 millionand remain above the US $ 20,000 million annually until 2032.

From the province they stated that In these years the BCRA will inevitably have to add currencies in its coffers. On the side of the current account, the entity does not see in the short term conditions given to generate sufficient resources, despite the recent increase in the official exchange rate, which corrects just a portion of the accumulated exchange delay in the last year.

Faced with the expectation of a balance of goods pressed by the increase in imports and a deficit of services that is hardly reversed in the short term, The financing expectation is perched on the capital account. In particular, in access to financing with the private sectorbecause international organizations have already contributed their own.

In this regard, the IMF Staff He highlighted in his report the hope that the implementation of the program agreed with Argentina and the early accumulation of reserves translate into the reduction of the country risk and facilitate “a timely access to international capital markets in more favorable (and sustainable) conditions in early 2026 “. For this to happen, in the City they believe that The country risk should be around 450/500 basic points, a value that has not registered since 2018.

Facing the end of the decade, Only Muerta Vaca exports emerge at the moment as the only battle horse capable of providing the necessary dollars to the current account. Last week, YPF representatives predicted that their energy exports could reach US $ 40,000 million annually around 2030, when in 2024 they represented about US $ 10,000 million.

In case of completing, the oil company with state participation is a candidate to become the main export company of the country, displacing the large cereals from the top of the ranking.

Can the BCRA defend the roof of the new exchange band and accumulate “genuine” reserves?

Together with the arrival of the dollar of the agencies, the government of Javier Milei gave a Sudden turn in its monetary policy by changing the “Crawling PEG” of 1% monthly that was leading to an appreciation of the weight with already palpable consequences in the exchange balance of the BCRA. The release of the restrictions for the purchase of dollars of human people was accompanied by a new scheme of flotation bands of the price of the “green ticket”, which initially goes from $ 1,000 to $ 1,400

“The central can use the dollars that entered to defend the highest value of the band In case at some point the exchange rate came there. If the movement is down, it will buy dollars to prevent the floor from drilling. In relation to the band there were differences in communication. On the one hand, both the IMF and the monetary authority indicated that in that range there may be purchases with the objective of fulfilling the reserves or sales goal to reduce volatility. HoweverJavier Milei himself announced through the social network X that the BCRA will not buy dollars inside the band, but only on the floor “explained the consulting firm Econviews in a report.

It should be remembered that the small print of the agreement with the IMF raises a Objective of accumulation of net reserves higher than US $ 9 billion until next December, which does not contemplate the disbursements of organisms. In that sense, consulting firm 1816 stressed that if the BCRA fails to buy currencies, these obligations must be fulfilled with the bulky resources from the agency.

“In our base scenario, in which the exchange rate does not reach the band of the band and there is no immediate access to the voluntary debt market, The BCRA (or, failing that, the treasure), will buy dollars inside the band to accumulate reservations“, forecast.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.