The last report of Consultant 1816 warns that, even with the entry of multilateral organisms, the Central Bank and the Treasury must Buy dollars in the market or issue debt to achieve the demanding quarterly goal that sets the International Monetary Fund (IMF) on reservations.

In the midst of the debate for the lifting of the stocks and the crossed signals on the exchange intervention, a new report by the “most listened to the City” advises that the government must accumulate more than more than U $ S5,000 million in less than two months to comply with the demanding goal of net reserves set by the Bank of last instance for the second quarter of the year. The figure contemplates the positive effect of the disbursements of multilateral organisms, such as the entry of US $ 1,500 million from the World Bankbut still the scenario looks challenging.

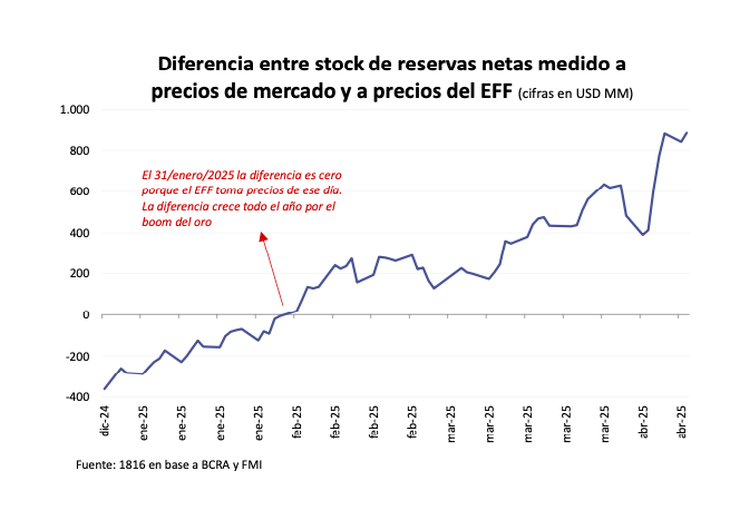

The consultant, directed by El Economista Marcos Skladnik and Joaquín Cerezohe remarked that the IMF demands from the country to reach U $ S -2.7 billion in net reservations for June 13which implies improving in US $ 6,700 million Regarding the last data available. In addition, towards the end of the year the goal amounts to US $ 1,800 millionwhich will require additional accumulation of US $ 11,200 million.

Although the background allows to compute the multilateral turns within the calculation of net reserves, the margin is limited, says the document. June’s goal admits a top of U $ 3,061 million in disbursements until that dateof which only US $ 265 million They entered the first quarter, according to data from the Ministry of Economy. Thus, the remaining flow that could be counted is U $ 2,796 million.

“The key is in the Mulc”

The rest must come from purchases in the Single and Free Market (Mulc) or debt emissions. But the president himself Javier Milei and officials of the economic team ratify that the Central Bank will only intervene on the floor of the exchange bandwhich limits its ability to action if the dollar remains above that level.

1816 reservations.png

Among the alternatives that the consultant considers to achieve the goal are:

-

BCRA purchases on the band’s floor (Máxima’s scenario)

-

Interventions within the band, today discarded by the Executive

-

Treasury purchases using the fiscal surplus, without issuing pesos

-

New debt placements, both in dollars and pesos subscribed in foreign currency

What’s coming: greater pressure

On the other hand, between now and on June 13 more than US $ 1,600 million in commitments to the IMF and other organisms, in addition to U $ 450 million In Bapreal payments, which will further press the BCRA accounts.

Another key point is the eventual repo by U $ 2,000 million that the government negotiates with international banks. However, the IMF already warned that only U $ S500 million of that amount can join the computation of net reserves, given that the first US $ 1,500 million are discounted Like new liabilities.

1816.png

Looking ahead to the second semester, the panorama does not improve: in the first days of July, the treasure must face maturity by More than US $ 4,000 million in global and bonars bonds, without certainty even about the possibility of an effective rollover.

As for monetary policy, Consultant 1816 It highlights the tension between the need to buy currencies and the official commitment not to expand the monetary base within the flotation band. Although the April 11 statement replaced the monetary base goal with a transactional M2 goal, the official message insists that the Amount of money is fixed while the dollar remains inside the band.

The final warning of the consultant is clear: with a Fall commercial surplus (U $ S761 million in the first quarter of 2025 vs. U $ S4.401 million a year earlier) and self -imposed restrictions on exchange intervention, compliance with the goals agreed with the IMF will depend critically on the Agricultural capacity to liquidate exports and from the government’s disposition to Use all the margins available to add reservations.

A report of Province Bankensures that to meet the reservation goal with current account surplus, that is, market purchases, The central should add US $ 130 million per day in the next two months. “To dimension, in January and February, it averaged purchases for US $ 75 million,” he explains. A more than demanding amount.

Pro.jpeg Bank

“How many dollars should the BCRA buy in each quarter to meet the goals agreed with the IMF, assuming that multilateral organisms disburse the maximum allowed by the goal? If financing is reopened in the market beyond the repo, these funds could complement purchases, thus reducing the net needs of the BCRA,” they point out from the bank.

So, to meet the goals, the BCRA should accumulate just over US $ 4,000 million in net reserves until June 13, Do not lose more than US $ 100 million between that date and September 30and add other US $ 4,500 million until the end of the year.

“This last section coincides with the payment of coupons and amortizations of global and bonares bonuses planned for the July 9for a total of U $ 4,500 millionwhich would imply having to repurchase that amount in the market, ”says the bank.

In total, net reserves should increase in US $ 10,000 million during the rest of 2025figure that amounts to US $ 15,000 million if debt commitments are considered. “It should be clarified that these amounts They do not include IMF disbursementsnor the First US $ 4,000 million that turn other multilateral organismsnor the US $ 1,500 million market financing mentioned on page 99 of the agreement ”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.