The portfolio driven by Pablo Quirno will make available to investors Four Expiration instruments in 2025: Two Lecaps (at a fixed rate), with expiration date in August and September, respectively, a Boncap (fixed rate) to October and a bonce (indexed by inflation) also to October. In the tender last week the deadlines were shorter (there were May, June and July).

It will be the last tender of the month, in which the treasure faces Mistrifications for $ 7.5 billioncorresponding to the S28A5 LECAP and the TC25 bonce. It is estimated that a Little more than 70% of the amount corresponds to private holders.

From the SBS group They ratify that today, the Treasury will tender 5 papers fixed rate in pesos: S15G5, S12S5, T17O5, T30E6 and T17E7); Two zero coupon bonce (Tzxo5 and Tzxm7) and the Dollar Linked D16E6.

“They face this time Murcities for about $ 7.45 billion, mainly concentrated in the LECAP S28A5. It is the first tender since January 15 in which the most short Ars Fixed Rate paper offered exceeds 100 days (at that time they offered the S31L5 to 195 days as shorter paper), “says the broker.

From Balanz, Lucas Buscaglia, indicates that the treasure will seek to extend maturity taking advantage of the lower rates context after the rally last week and greater clarity about the economic program.

“Ars7,5bn expire, mainly from the S28A5. In line with the objectives of the IMF report, short -term LECAPS will not be offered and aimed at greater duration and lower indexation. The recent publication of the BCRA balance showed profits by Ars19.4bn, of which ars11,7bn will be transferred to the treasure, raising the deposits to the deposits to the deposits to the deposits to the deposits to the deposits to Ars15.6bn.

What the market analyzes

In a scenario where the market begins to anticipate a regime of lower inflation, but with still latent risks around 2026, the City maintains a positive look on bonds adjusted by CER. The title TZXM7with expiration in March 2027, it is emerging as an outstanding option: it is expected that it is cut around CER + 10%which is equivalent to capturing near a monthly inflation point in real terms. With a real positive rate close to 1% per year, this bonus already begins to compete in returns with the global, especially if the country risk continues to descend and the rates of the sovereigns in dollars are compressed.

Within three -year bonds, they find complementary opportunities. He Tzxo5 presents one Breakeven inflation attractively lowwhich makes it an efficient commitment to those who believe that the disinflationary process will continue its course without shocks. On the other hand, the bonds TZXM6 and TX26 They offer the possibility of capturing an eventual inflationary acceleration after the legislative elections of 2025, a risk that should not be ruled out in a political cycle still uncertain.

In this context, the CER curve not only offers refuge to pricing surprises, but also vehicles to capture tactical value based on the different policy and macroeconomy scenarios. For an investor seeking exposure in pesos with real coverage.

The flexibility of the exchange rate removed attractive to the dollar Linked

In the previous placement, Economics awarded about $ 5 billion, which allowed to refinance 75% of the maturities. The market did not show appetite for the Linked dollar bonds after the release of the exchange rate For human people that govern since April 14.

Tender.png

In the market they argue that, from the new exchange scheme, Rolling the debt is more difficult since investors now have Easy access to the official change marketso the weights are no longer so captive.

“It is indisputable that Both the fixed rate and inflation -related strategies continue to be the main winners after the implementation of the new scheme exchange In this sense, since April 11, both segments accumulate Tax returns of up to 20%“Portfolio said Personal investments in a report this week.

The strategy, according to the most listened consultant of the City

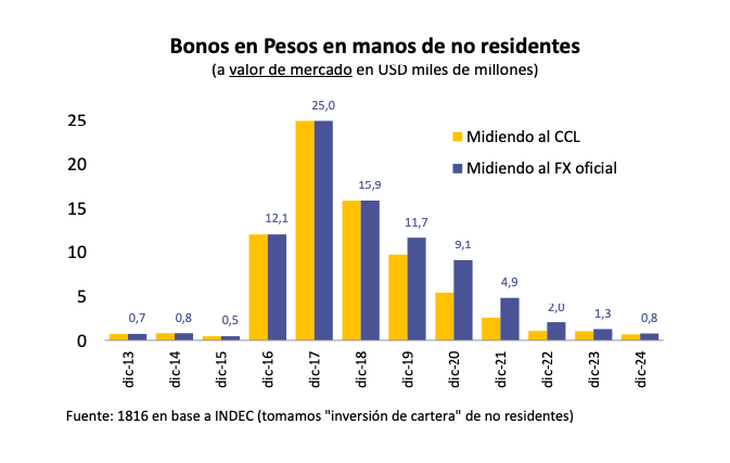

This Thursday, 1816’s report indicates that the third phase of the Government’s economic program started with a dream debut. The partial lifting of the stocks brought immediate results on the key fronts: a compression of the cash with liquidation (CCL), an improvement in sovereign bonds and a rebound in variable income assets was observed.

But the most relevant, stand out, is that the world accompanies. During the first 16 months of Milei management, Argentine assets moved in the same direction as international markets, both in “Risk On” contexts and “Risk off”. From the announcement of the “Liberation Day” on April 2, this synchrony deepened. The United States conciliatory position on commercial matters and the explicit support of the Secretary of the Treasury, Scott Besent – who even suggested a possible direct line through the Exchange Stabilization Fund (ESF) – played in favor of Argentina.

1816.png

At the local level, the Ministry of Economy took advantage of the recent compression of the fixed rate curve to offer greater term titles in today’s tender. However, since 1816 they warn that extending Duration does not seem a clear commitment in this context. The Government seeks to take the official exchange rate to the band’s floor, and if the market does not accompany itself, the Central Bank has already shown to harden monetary policy. Strong up at Overnight rates could mark the way, even without emitting more weights, by placing Bopreal.

The question now is whether the transitory improvement in liquidity – product of the injection of $ 1.6 billion in the past tender and the loss of lace – will encourage investors to take more risk in long titles, or if the preference for shorter lecaps will be maintained.

With the consolidation of the new exchange scheme and high frequency inflation that points to a monthly average of only 1.7% between May and October, the market begins to discount a new scenario. However, caution persists.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.