While the local financial scenario It crosses a reconfiguration stage and global uncertainty grows from the growing geopolitical tensions and new commercial obstacles driven by Donald TrumpJavier Milei’s government receives winks from Wall Streetalthough not without nuances: The main investment banks still maintain a cautious vision on the course of the new economic era.

Such is the case of Wells Fargothat this week issued a report that titled: “The great wave of change in Argentina: did it reach its maximum point too soon? ” The document emphasizes that the turn to technocratic and friendly policies with the market under the libertarian presidency is “remarkable” and marks a possible inflection in the country’s recent economic history.

It praises the so -called “shock therapy” implemented by the new government and that gave “encouraging” results in fiscal and monetary matters, to the point that the bank questions if Argentina begins to leave behind “decades of structural imbalances and inappropriate policy decisions to make way to a path of prosperity“

One of the highlights for Wells Fargo is the drastic fiscal adjustment, which qualifies as “Unpublished in recent decades.” And it is that Milei managed to convert a chronic primary deficit into surplus in just one year, with a real reduction of public spending of around 27% in 2024. This fiscal consolidation, added to “End of monetary financing by Banco CentraL “, contributed to a significant inflation deceleration:” From the peak close to 300% at an year -on -year rate of 55% in March 2025, “says the bank.

The firm also highlights the importance of the recent renegotiation with the IMF, which supports the reform agenda and allowed the economic team to “release additional financing from multilateral organizations.” The agreement includes key commitments, such as the lifting of capital controls and exchange unification“Steps that aim to reintegrate Argentina in global financial markets.”

“This time different for Argentina?”

However, Wells Fargo also warns about the risks facing this transformation. The lifting of the exchange controls, although necessary, could generate exchange volatility in a sensitive electoral context. The dollar It could be appreciated in the months prior to legislative elections, which could rekindle inflationary pressures and affect the purchasing power, a determining factor and that could in check the support of citizens to Milei.

Wells Fargo 1.jpeg

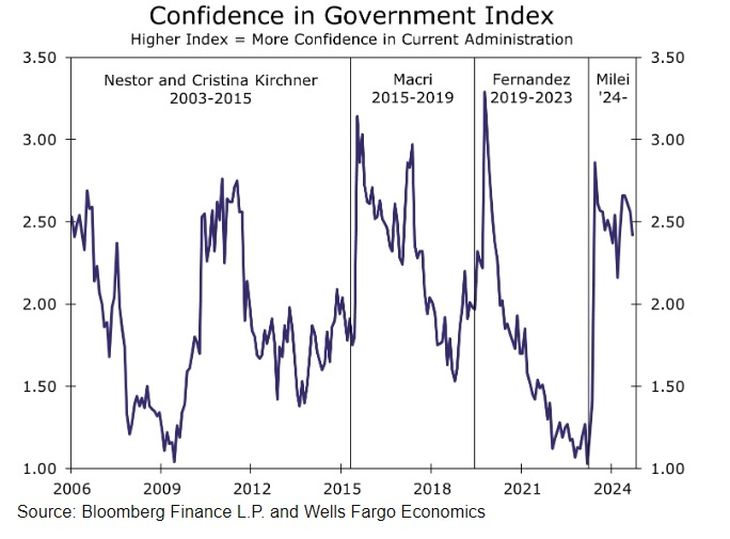

In that frame, Wells Fargo He wonders if this time the road could be different for Argentina. Although it recognizes signs that suggest a break with the past, Wells Fargo ratifies its cautious posture. “The recent history of the country shows that the reformist impulse tends to be diluted over time, particularly if there is a return of the ideas associated with economic populism,” slides the colossus of the bank.

In that sense, it states that the sustainability of reforms It will depend largely on the election result of October. For the bank, The behavior of the exchange rate, the inflation, the poverty rate and the presidential approval rates will be the main indicators to be monitored for that scenario. A setback in the support of Milei could put in check the continuity of the orthodox course and cause a renewed macroeconomic instability.

Wells Fargo.jpeg

The weight seduces Wall Street

Meanwhile, the Bank of America (Bofa) adopts a vision More tactical of the Argentine scenario and take advantage of the instruments in pesos to position themselves with a dual strategy that mixes opportunities for “carry trace” with coverage to exchange risks.

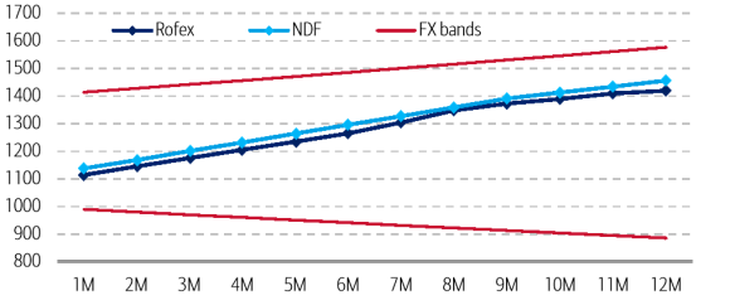

Specifically, Bofa recommends Sell NDF contracts (non -deliverable forwards) three months over the official dollarwhich currently contribute to $ 1,202 Ars/USD, which implies an implicit rate of 39%. Given the exchange band established by the BCRA – with a $ 1,400 roof that will move to $ 1,442 in three months – the maximum loss would be 16.7%while the potential gain reaches 24% if the exchange rate converges to the band’s floor (which would go from $ 1,000 to $ 970).

Bafa Carry.png

Source: Bank of America (Bofa).

Simultaneously, the bank suggests Buy capitalization letters (LECAP) expiration on November 10, 2025 (after the electoral contest)that pay 34.5% annual with monthly capitalization of a coupon of 2.2%. Bofa’s strategy reflects confidence in financial stabilization, but without ignoring latent risks: una inflation acceleration, extension of the external deficit or a global appreciation of the dollar could compromise the profitability of these positions. In addition, they warn that you buy foreign exchange by the BCRA or the Treasury could press the weight.

Thus, while Wells Fargo evaluates whether Argentina is facing a structural breakdown point towards international stability and reintegration, the Bofa, adopts a short -term pragmatic approach, by combining operations with attractive real rates and careful handling of exchange risk. Both visions reflect the renewed market interest in the country, although with diagnoses and strategies that reveal a common conclusion: The Argentine future remains a high -risk betwith incipient signals of change, but also with multiple open fronts.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.