This was reflected in the last Financial Inclusion Report Posted by Central Bank of the Argentine Republic (BCRA). Among the main points, it is highlighted that access to bank accounts and payment reached record levels: already 69% of the adult population has accounts in financial entities and payment service providers.

In addition, the number of people with accounts in foreign currency It rose from 44% to 51%, driven by new regulations that allow transaction in dollars through debit, QR and automatic debit cards.

The activity was also consolidated: 28.8 million holders They made movements in their accounts in the last quarter of the year, representing the 77.5% of the total holder.

It should be noted that in a context where the use of foreign currency began to be promoted for all types of transactions, the number of people with a foreign currency reached 18.9 million in December 2024, more than half (51%) of the adult population.

Screen capture 2025-04-27 104151.png

Increased accounts in dollars

Last year, the BCRA provided greater benefits to the opening of accounts for adolescents. December 2024, adolescent minors with account They represented 67.6% of the total adolescents. This value was explained mainly by the exclusive possession of payment accounts (38.3%). If those who operate through digital banks are included, the percentage amounts to 45%. This indicates that almost half of these holders opt for a completely digital environment, reducing the relevance of face -to -face operations. “On the other hand, the activity rate of adolescents was close to 80% in the fourth quarter of 2024”.

Cash continues to lose ground

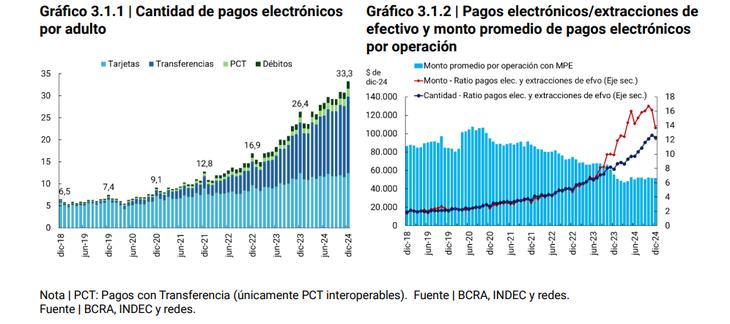

One of the most prominent changes was the deepening of the Electronic paymentswhich grew 45% compared to 2023. Each adult made on average More than 28 electronic payments per monthreducing the dependence of cash. In supermarkets, cash fell from 29% to 18% of total sales, while in appliances barely represented 12%.

Screen capture 2025-04-27 104454.png

Growth of electronic payments

“The decrease in the participation of cash and the increase in electronic payments in the sales of supermarkets and appliances also mark the progress of digitalization. Although only information about payment modalities in terms of amount and not quantity are available, the fall in the percentage of the cash on the total sales in supermarkets is notable, from 29% in 2022 to 18% in 2024. In contrast. With credit cards they advanced 7 pp, “said the BCRA report.

Common money and saving funds booming

Savings also showed a transformation. The Common Money Funds (FCD) They consolidated as the main instrument to preserve value and operate immediately: 22.4 million accounts They already have a balance in FCD. In addition, dollar deposits gained prominence, partly for the regularization regime. In December 2024, 31.2% of savings and investment balances corresponded to deposits in foreign currency.

According to the report, “The FCD in pesos were one of the two instruments that promoted the flows of People savings during the year 2024. This happened under a scenario where FCD’s real interest rates were close to zero, similar to that of fixed deadlines at 30 days. “

At the same time, it emphasizes that although the nominal yield of the main savings and investment products continued to decrease as a result of the fall in the monetary policy rate of 40% in June from 2024 to 32% in December, “the highest slowdown in the price level produced improvements in real interest rates in all savings and investment instruments.” Finally, it was stressed that the balances in foreign currency in bank accounts, largely explained by the implementation of the regularization regime, was another instrument that motorized savings, reaching a participation (31.2%) that exceeded those of the rest of savings and investment products.

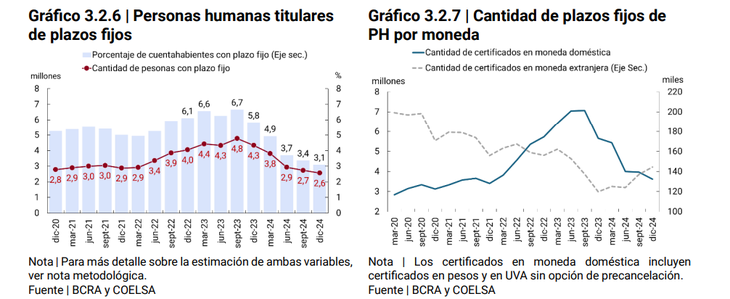

What happened to the fixed deadlines for 2024

In 2024, the number of fixed deadline holders collapsed in half: they went from 4.3 to 2.6 million within a year. In this way, the percentage of holders with a fixed term was 3.1%, with an interannual drop of 2.8 pp on the other hand, the balances in fixed deadlines presented a slight recovery with respect to the first half of the year, with a semiannual increase of 7.1%. Increase was partly driven by fixed deadlines in foreign currency, which presented a growth of 16.7% in the last 6 months of 2024. The amount of fixed deadlines in foreign pH currency was 145 thousand, with an year -on -year growth of 20.7%.

Screen capture 2025-04-27 10485.png

More access to credit, although from low levels

Credit to human persons expanded: 18.4 million individuals They had some financing to December, covering 50% of the adult population. They joined 1.3 million new debtors in the second semester of 2024. There was also a real increase in the balances of those who already had credit.

As for mortgage loans, some 10 thousand people They agreed to housing credits for 2024, almost tripling the figure of the previous year.

However, as of December 2024, the balance of human persons (pH) in savings and investment and credit products in relation to GDP showed values close to 8.6% and 5.4%, respectively, when economies with similar levels of participation of pH in products reach significantly higher values.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.