Nicolás KohnHead Wealth Management Research in Capital Balanzcomments in dialogue with Scope that, although that slowdown of the US economy – largely – is due to strong import growth (in advance of tariffs) combined with a deceleration of consumption, “It is not a good omen for the beginning of an administration to start with a fall in GDP product of own policies. “For the analyst, to continue on this way, The US would head a recession.

Of promise from market to risk factor

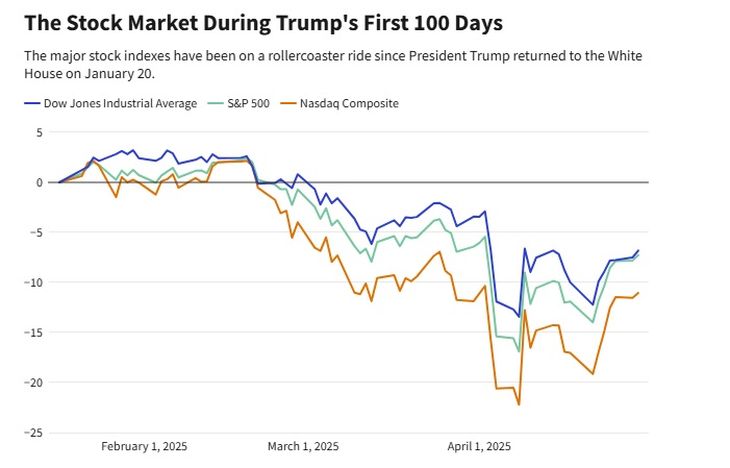

Diego Ilan MéndezTeam Leader of Corporate Credits in Personal investment portfolio (PPI) says in statements to this medium that Trump’s first 100 days were more than turbulent. “Since November, after the electoral victory, the markets anticipated a pro-business agenda: The S&P 500 rose strong Given the expectation of tariffs that would boost the growth of the economy, but also inflation, he says.

However, that narrative fell apart quickly. “After assuming on January 20, Trump climbed the commercial rhetoric and sowed increasing doubts with unpredictable policies. The commercial war intensified, The dollar lost strength, and fears of stagflation and global recession arose, ” Remember Ilan Méndez.

He adds that the turning point was the “Liberation Day“On April 2, when it was revealed that” reciprocal “tariffs responded to arbitrary criteria. What came later was a bloodbath: in just 35 wheels, The S&P 500 fell 19% and He deleted almost a year of profits. All this, in the midst of a growing perception that the global impact of the measures would be deep and negative.

S&P 500.jpg

The storm gave way to calm, and investors breathed again. When Trump announced a 90 -day break for all its commercial partners, Less China (although it maintained the minimum announced for the rest), the market partially recovered its composure and the S&P 500 returned to 5,500 points. “Another incredible issue of the period is that on April 9, when the market was approaching what was the floor of the year, Trump wrote on his social network, which was a good time to buy shares giving a signal, which in retrospect, would have been spectacular to follow. Recall that the Nasdaq and the S&P 500 on two digits recorded that day“Slides the strategist.

For Ilan Méndez, with a more moderate Trump and a more pragmatic approach by the Secretary of the Treasury, Scott Besent, It is possible that the situation is aimed at a positive resolution at the end of the 90 -day pause. “Although there are still uncertainties and potential stumbling blocks, the great feared recession seems less likely, and the prospects for leading companies are more optimistic,” concludes the expert.

From the Trump of the past to “Flight to Chaos”

The assets considered historically as a refuge in turbulence times were also victims of the shocks. The 10 -year bond yield dollar It fell 8.6% so far from 2025, which also obeys a weakening of its symbolic condition as a global safe asset.

The president’s aggressive statements towards Jerome Powell and the permanent change of course in economic policy filled international investors on the relative attraction of US assets. In this regard, Juan José VázquezChief of Analysis in Cohen financial allieshe explains that, thanks to Trump’s policies, the market is witnessing the first “Flight to Quality “in which investors did not seek refuge in the dollar, or in the treasure bonds. In fact, not only international holders avoid treasuries: mainly, it is local investors who They come off the titles“, he says.

This is due to the perception of an unsustainable fiscal dynamic, with a high deficit that persists and an increasing risk of recession for the second semester. To this is added the pressure exercised by the interests of the debt on tax revenues, which already exceed 15%. Together, it is a worrying and complex dynamic.

S&P 500 1.jpg

It happens that Trump’s protectionist turn, framed in measures such as the imposition of a universal tariff of 10% to imports and threats of unprecedented rate reprisals, not only reconfigured expectations on global trade, but also that altered the perception of risk in all assets.

The most punished in the first 100 days

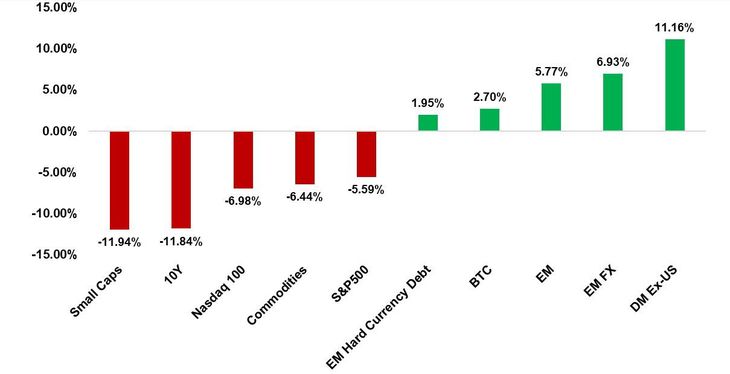

For its part, Gustavo Neffa, partner of Research for Traders, He comments that since the assumption of Trump in January 2025, the financial markets behaved divergently. “The 10 -year Treasury Small Caps and Treasury Bonds were the most punished assetswith falls greater than 11%, which reflects a strong risk aversion in segments sensitive to economic and monetary conditions, “says the strategist.

Neffa adds that Nasdaq 100 and the S&P 500 also retreated, although with more moderate losses. In contrast, emerging market assets expose remarkable performance: “Both currencies, as the variable income and the hard currency debt of these countries, record significant increases“

Trump.jpeg winners and losers

Particularly, Neph emphasizes that the actions of developed countries, not including the US, lead the profits, with increases greater than 11%. “This pattern suggests that, after the change of administration, Investors rotate to international and diversified assets, possibly in response to new commercial policies or prosecutors promoted by the White House, “he says.

Kohn, from Balanz, adds to what is expressed by Neffa that, in addition, the dynamics of the dollar and, above all, of the long -term treasure bond rates indicate that investors They no longer see US assets as a value refuge. This phenomenon is “worrying given the combination of high fiscal deficit and a high debt/GDP ratio,” he says.

As analyzed, since 2022, the market demands a greater prize for maintaining long-term treasure bonds, something not seen since 2014-2015. Trump’s initial policies could deepen these concerns, in particular if they increase the risk of a recession.

Gold: The great winner

The great winner of chaos is the gold. With a rise greater than 20% so far this year and record prices above U $ 3,500 per ouncethe metal is reaffirmed as the barometer par excellence of financial fear.

In this context, the Trump administration faces a double challenge: Advance with its ambitious agenda without deepening institutional polarizationand recover the market confidence that, although it supported this political project at the polls, now faces its consequences, very different from campaign promises. In a scenario dominated by uncertainty, it seems that the true test for investors just begins.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.